ProntoForms is a buy ahead of quarterly results, says PI Financial

Expect ProntoForms (ProntoForms Stock Quote, Chart, News TSXV:PFM) to feel the pinch of COVID-19 on its business over 2020, says PI Financial analyst David Kwan, who on Monday issued an earnings preview to clients. Kwan kept his “Buy” rating but reduced his target price from C$1.10 to C$0.90 per share, which at press time represented a projected 12-month return of 21.6 per cent.

Expect ProntoForms (ProntoForms Stock Quote, Chart, News TSXV:PFM) to feel the pinch of COVID-19 on its business over 2020, says PI Financial analyst David Kwan, who on Monday issued an earnings preview to clients. Kwan kept his “Buy” rating but reduced his target price from C$1.10 to C$0.90 per share, which at press time represented a projected 12-month return of 21.6 per cent.

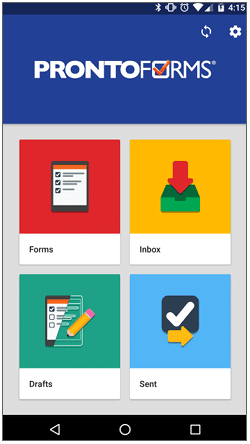

Ottawa-based ProntoForms was having a great start to 2020 before the pandemic hit. The company, which makes mobile workflow solutions for businesses and subscribers to collect and analyze field data in real time on their smartphones and tablets, saw its share price jump as much as 72 per cent between the start of January and early February, based on strong subscription results and bigger accounts from enterprise businesses.

The company released its fourth quarter and year-end results in early March with revenue up 24 per cent to $15.10 million for the year and revenue in the fourth quarter climbing by 23 per cent year-over-year to $4.07 million.

ProntoForms picked up a bunch of big clients in 2019, including major utilities companies in the US and a Canadian energy resources company with more than $100 million in annual revenue, while other customers expanded their business with ProntoForms.

Commenting on the year that was, CEO and founder Alvaro Pombo said macrotrends such as workforce and talent shortages for field technicians and IT along with heightened customer expectations had been driving interest in ProntoForms’ products.

“We are pleased to report that our Annual Recurring Revenue (ARR) base grew 27 per cent year-to-year to reach $15.74 million by December 31, 2019. Our accelerating growth continues to be driven by enterprise expansion; accounts with more than $100K of ARR now represent 36 per cent of our base, up from 26 per cent a year ago,” Pombo said.

And while the company’s prospects are still bright and management has so far said its business hasn’t seen any impact to customer demand stemming from the COVID-19 crisis, Kwan now believes a hit is almost unavoidable, particularly when it comes to subscription renewals.

“Given the extent of the lockdown and the financial impact it has had on businesses, we now assume incremental growth in ARR is likely to be offset by a pickup in churn (which had recently hit record lows) over the next couple of quarters, leading to flattish quarter-over-quarter growth for most of this year, with a modest pickup expected toward the end of this year,” Kwan wrote.

But the analyst said PFM should get a bit of a buffer from cost control measures along with a weaker Canadian dollar, as the company has about 90 per cent of its revenue in the US while 75 per cent of its expenses are in Canadian dollars.

Ahead of ProntoForms’ first quarter 2020 results due on May 7, Kwan has adjusted his 2020 estimates, now calling for $16.3 million in revenue (was $18.9 million) and negative $1.2 million in adjusted EBITDA (was negative $1.4 million).