Now’s not the time to buy Maxar, National Bank says

National Bank analyst Richard Tse says there’s still too much uncertainty surrounding space tech company Maxar Technologies (Maxar Technologies Stock Quote, Chart, News TSX:MAXR) and thus investors may want to look elsewhere for the time being.

National Bank analyst Richard Tse says there’s still too much uncertainty surrounding space tech company Maxar Technologies (Maxar Technologies Stock Quote, Chart, News TSX:MAXR) and thus investors may want to look elsewhere for the time being.

In an update to clients on Tuesday, Tse retained his “Sector Perform” rating and US$12.00 target for MAXR, which at press time represented a projected 12-month return of four per cent.

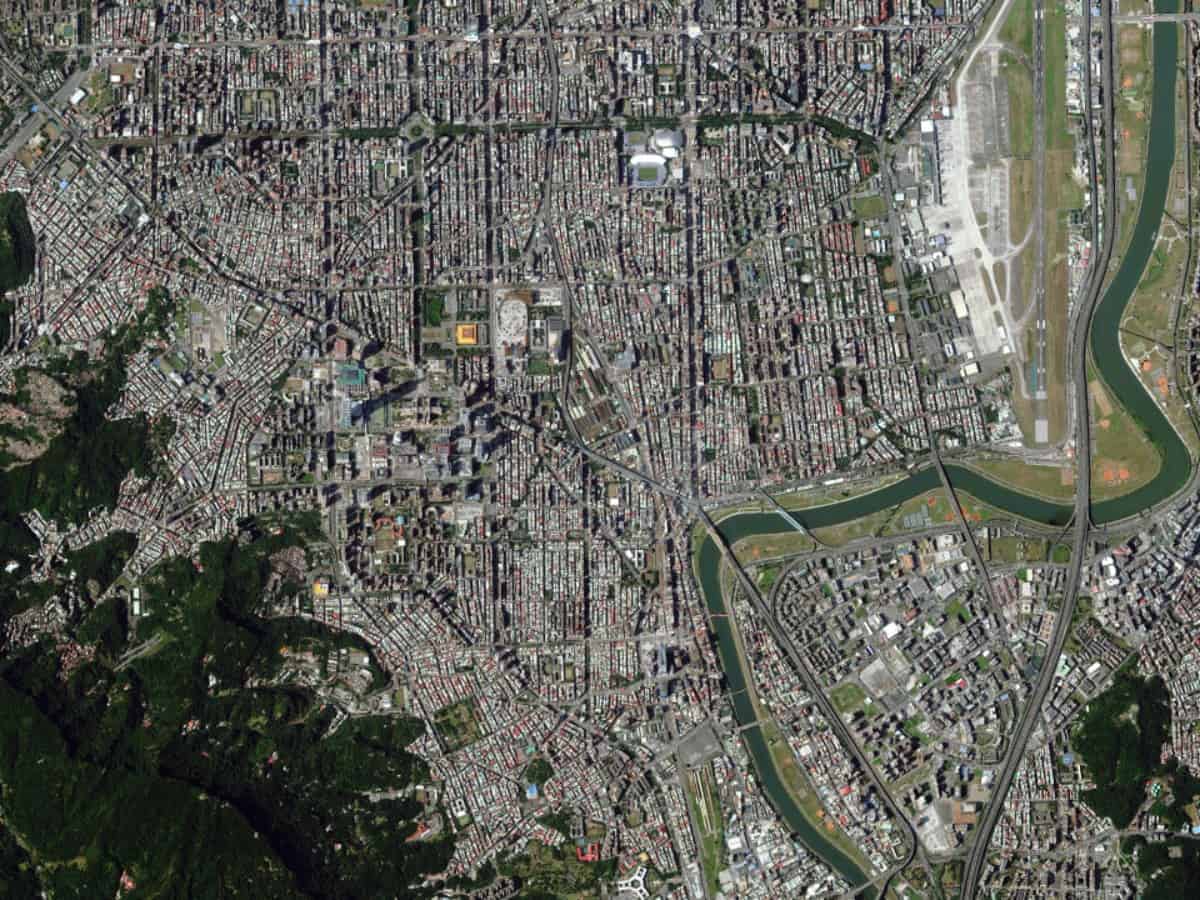

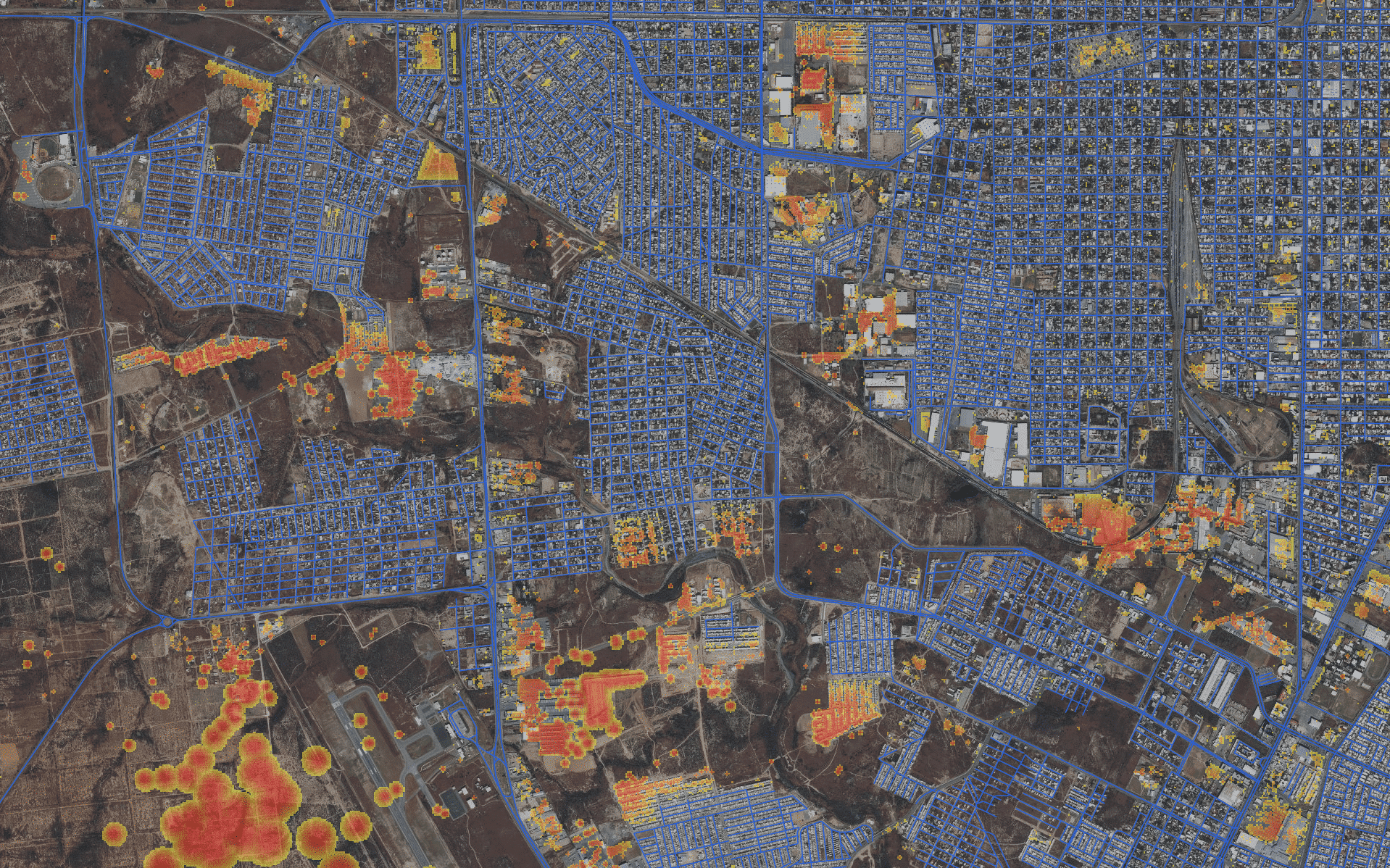

Colorado-based Maxar, which offers ground, air and space-based information solutions to global customers including satellite systems, airborne surveillance and transportation management, released its first quarter 2020 financials on Monday.

The company reported consolidated revenue of $381 million and adjusted EBITDA of $77 million. (All figures in US dollars except where noted otherwise.)

The company has had a turbulent couple of years now including the sale of MDA, its Canadian space segment once known as MacDonald, Dettwiler and Associates, to Canadian investors for $1 billion, announced this past December and closed this past quarter.

With the Q1 release, Maxar also announced a multi-hundred million-dollar contract award to build “multiple 1300-Class communications satellites” for an undisclosed customer.

Maxar CEO Dan Jablonsky said the quarterly results show the progress made on the company’s multi-year strategy to strengthen cash flow and fix the company’s balance sheet and noted that the new satellite contract brings Maxar’s year-to-date bookings to over $700 million.

“This quarter’s results were negatively impacted by an increase in estimated costs to complete programs and scheduling penalties in our Space Infrastructure segment because of the social distancing restrictions put in place across the world to help combat COVID- 19,” wrote CFO Biggs Porter in the press release. “Separately, we discovered a design anomaly on a commercial satellite program in late April prior to shipment. This was during the final stage of our thorough test process and resulted in schedule revisions and cost growth. Our results included negative impacts of $32 million in the quarter related to these items. Excluding these items, our results are in line with expectations.”

On the Q1’s $381 million top line and $77 million in EBITDA, Tse had been forecasting $420 million and $89 million, respectively, although the analyst did point to strength in Maxar’s Earth Intelligence segment, up seven per cent year-over-year, compared to a softer quarter from Space Infrastructure, down 37 per cent year-over-year.

Tse said management’s flat guidance for Maxar’s 2020 combined with a lack of momentum behind profitability and free cash flow at least until 2023 are keeping him from upgrading the name.

“As we look ahead, the recent divestiture of MDA and today’s GEO awards announcement are positive data points for a name that’s needed some relief. That said, given the current backdrop and the uncertainty it creates even beyond the short term, not to mention the short-term impact (supply chain disruption, lowered productivity), we think the stock is fairly valued.”

The analyst is expecting MAXR to generate fiscal 2020 revenue and EBITDA of $1.682 billion and $408 million, respectively, and fiscal 2021 revenue and EBITDA of $1.772 billion and $441 million, respectively.

So far in 2020, MAXR is down 30 per cent.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.