Shares of Medicenna Therapeutics (Medicenna Therapeutics Stock Quote, Chart, News TSX:MDNA) have skyrocketed over the past few months, but there’s still a lot of upside potential, says Bloom Burton analyst David Martin, who launched coverage of the stock on Tuesday with a “Buy (Speculative risk)” rating and $14.00 target.

Shares of Medicenna Therapeutics (Medicenna Therapeutics Stock Quote, Chart, News TSX:MDNA) have skyrocketed over the past few months, but there’s still a lot of upside potential, says Bloom Burton analyst David Martin, who launched coverage of the stock on Tuesday with a “Buy (Speculative risk)” rating and $14.00 target.

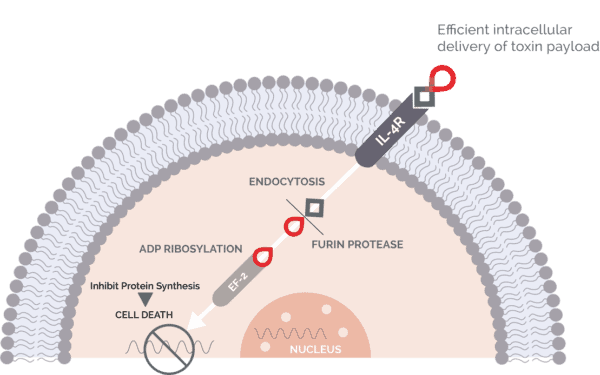

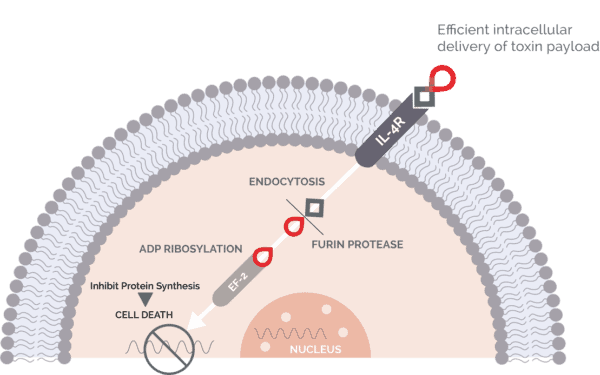

Clinical stage oncology company Medicenna’s lead asset is MDNA55, a locally administered therapy targeting glioblastoma (GBM), the most aggressive form of brain cancer.

Medicenna recently completed a Phase 2B study of 44 patients with recurrent GBM, finding that MDNA55 achieved an objective response rate from baseline of 11 per cent (32 per cent from tumour nadir) and median overall survival of 12.4 months versus 7.7 months for a synthetic control arm, with the delta being wider for patients whose tumours expressed higher levels of the cytokine interleukin-4 (IL-4R), which affects tumour progression.

Medicenna’s share rose from sub-$2.00 territory in December to the mid-$3.00 range by January and has since taken off in the month of May to now above $6.00.

Martin said even with the strong returns, MDNA is undervalued due to its assets.

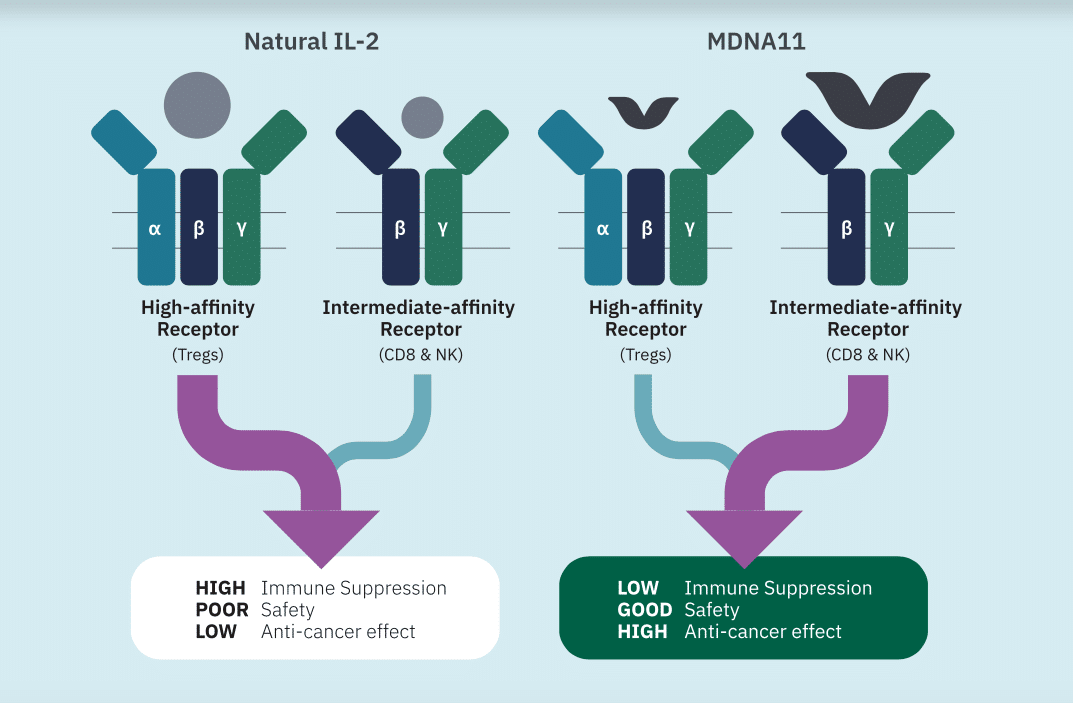

“We believe Medicenna’s biggest value driver is its engineered IL-2 Superkine program, including candidates MDNA19 and MDNA11. The program has demonstrated class leading potency and selectivity, and robust anti-tumour activity in multiple preclinical models, and we believe this is not reflected in Medicenna’s stock price,” Martin wrote.

Medicenna’s pipeline includes MDNA55, on which Medicenna is planning to have an end of Phase 2 meeting with the US FDA (with the package submission date sometime in the first half of 2020); MDNA19 and MDNA11, which are next-generation IL-2 agonists for the treatment of metastatic melanoma (MM) that Medicenna is planning on completing IND-enabling studies by the first quarter 2021 and a potential Phase 1 trial in

mid-2021; and MDNA413 and MDNA132, for both of which the company has yet to finalize a development timeline.

On May 15, Medicenna announced its fiscal 2020 year ended March 31, 2020, results, which featured a net loss of $8.3 million or $0.26 per share.

President and CEO Dr. Fahar Merchant said Medicenna is well-positioned for success in calendar 2020 and 2021, saying, “Fiscal 2020 was a year of considerable accomplishment on all fronts for Medicenna. We had promising non-human primate pre-clinical data with our IL-2 Superkine Platform, solid results from our Phase 2b clinical trial for MDNA55 and successful financings at higher prices than earlier offerings with gross proceeds of over $47 million establishing a solid balance sheet to meet our next set of milestones.”

Martin noted that Medicenna has to date raised $65 million to advance its pipeline, including a $35-million offering which closed in March, while the company’s cash and marketable securities as of the end of March stood at $37.7 million.

“Our base case forecasts and current target price conservatively assume that Medicenna will be required to conduct a phase 3 trial for MDNA55 (cost: $30 MM, potential approval: 2026). The best case scenario would see FDA recommending filing immediately (which would add $7.50/share to our current target price). An intermediate scenario would have FDA recommending the addition of ~40 more patients to the phase 2b data set (which would add $1.80/share to our current target price),” Martin wrote.

The analyst’s sum-of-the-parts valuation puts MDNA19/11 at $9.94 per share (based on risk-adjusted comparable company analysis), MDNA55 at $4.02 per share (based on 6x peak sales. Martin’s $14.00 target represented at press time an implied 12-month return of 139 per cent.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment