Greenlane Renewables stock could go much higher, Beacon says

Beacon Securities analyst Ahmad Shaath said he’s not worried about the revenue miss in the latest quarter from Greenlane Renewables (Greenlane Renewables Stock Quote, Chart, News TSXV:GRN).

Beacon Securities analyst Ahmad Shaath said he’s not worried about the revenue miss in the latest quarter from Greenlane Renewables (Greenlane Renewables Stock Quote, Chart, News TSXV:GRN).

In an update to clients Wednesday, Shaath reviewed Greenlane’s first quarter results and said investors should take more notice of GRN’s growing sales pipeline.

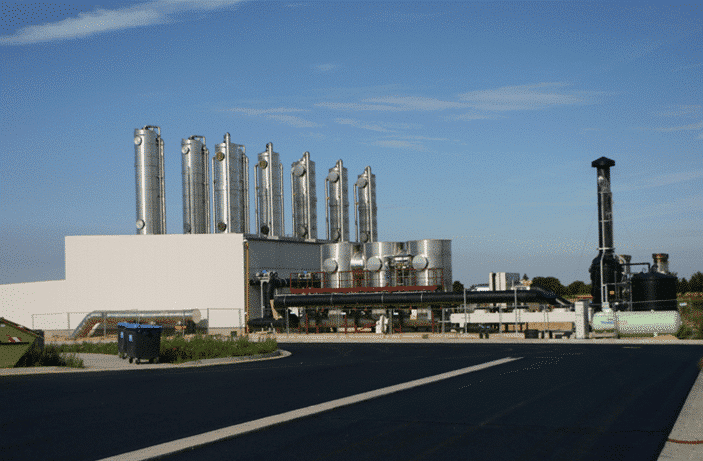

Vancouver-based Greenlane is a provider of biogas upgrading systems for the production of clean, renewable natural gas from organic waste sources including landfills, wastewater treatment plants, dairy farms and food waste.

The company released its Q1 2020 results on Tuesday, showing revenue for the quarter ended March 31, 2020, of $2.9 million and an adjusted EBITDA loss of $0.7 million.

Greenlane ended the quarter with cash and equivalents of $6.7 million compared to $2.3 million at the end of the previous quarter, and finished with a sales order backlog of $22.6 million, up 40 per cent from the previous quarter and reflective of the movement of sales pipeline opportunities into sales contracts, management said.

“Our company and our industry continue to grow despite the backdrop of unprecedented global conditions,” said Brad Douville, President and CEO of Greenlane, in a press release. “We expect revenue will continue to build throughout 2020 as new contract wins move out of our sales order backlog and into the revenue line. In 2020, we are taking a more aggressive strategy to build, own and operate biogas projects and have partnered with SWEN Capital Partners in Europe. This approach will allow the Company to take advantage of project specific return on capital while providing potential customers with a complete turnkey biogas upgrading solution from financing and design to construction and operation,” Douville said.

On the quarter, Greenlane’s top line of $2.9 million was below Shaath’s $.0-million forecast while the EBITDA loss of $0.7 million was equal to the analyst’s forecast. Shaath said the miss on revenue is not a cause of concern to him, since sales will continue to be lumpy as projects proceed at varying paces. Shaath noted EBITDA was stronger due to higher gross margins at 44 per cent versus his estimate at 26 per cent.

“We continue to be positive about GRN’s growth initiatives, driven by two unique partnerships that should result in its valuation expanding as it starts realizing their benefits: 1) The Integrated Biogas Alliance, a unique industry alliance where GRN is cooperating with key partners across the value chain to accelerate its market penetration; and 2) A JV with SWEN Capital on the BOO front that should accelerate

the establishment of a stable, recurring revenue base from sale of RNG and Operation and Maintenance contracts (details here). The imminent expansion of its BOO initiative into North America should be a major catalyst for the stock,” Shaath wrote.

Shaath also relayed management’s update in its comments on the joint venture with SWEN, saying GRN is now proceeding with similar discussions with a partner to focus on the North American market (as opposed to the European market, the focus of the SWEN JV). Management has said these discussions have accelerated significantly over the past month and an announcement is due before the end of quarter two.

With the update, Shaath maintained his “Buy” rating and $1.10 target, which at press time represented a projected 12-month return of 165 per cent.