Buy UGE International for solar exposure, this investor says

Renewable energy was surging before the market fell amid the COVID-19 crisis, but there are still good plays within the space. One would be micro-cap UGE International (UGE International Stock Quote,Chart,News TSXV:UGE), says Robert McWhirter, portfolio manager and president of Selective Asset Management, who likes UGE’s position in the solar energy market.

Renewable energy was surging before the market fell amid the COVID-19 crisis, but there are still good plays within the space. One would be micro-cap UGE International (UGE International Stock Quote,Chart,News TSXV:UGE), says Robert McWhirter, portfolio manager and president of Selective Asset Management, who likes UGE’s position in the solar energy market.

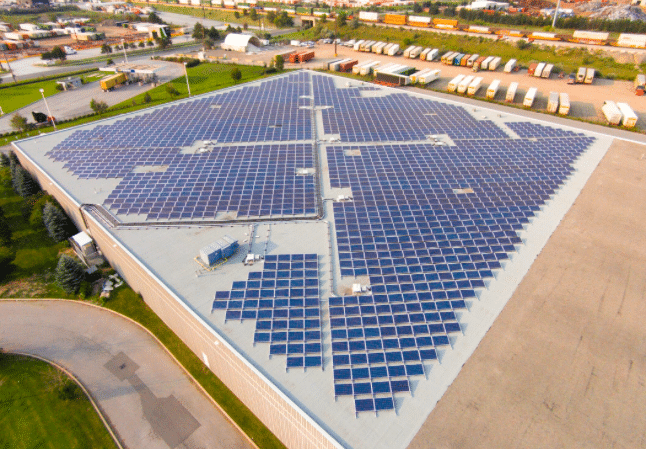

With headquarters in both Toronto and New York City, UGE has commercial and industrial clients and now over 380 MW of experience in solar energy. Last month, the company announced a handful of new contracts, including energy systems for a storage facility roof in Holbrook, New York, a high school in the Philippines and a ‘repower’ project for a rooftop system in Ontario, all projects expected to completed in 2020.

McWhirter said UGE’s backlog is significant, especially when balanced against the stock’s market capitalization.

“The biggest advantage of the company is that they have a very modest market cap and they have a huge backlog relative to the size that market cap,” said McWhirter, speaking with BNN Bloomberg on Tuesday. “Their total enterprise value of debt plus market cap is approximately ten million bucks. Their backlog is many, many multiples of that.”

“They are currently bidding on a project that they hope to have the results for by the end of March, which then may increase the backlog even further,” McWhirter said. “So overall, if you look at the location they have which is New York State and the clients that they have, as well, we think that the backlog is solid.”

UGE’s market cap stands at $7.3 million with just over 23-million shares outstanding. The stock hit a

high of $3.20 a few years back but fell from there, landing below the $0.50 mark last April. Revenue has been lumpy for the company in recent years and UGE bottomed out this past December at $0.125 but has since climbed to $0.30 per share.

McWhirter said there’s upside potential from here.

“New York State just went ahead with a huge project with Boralex in upper New YorkState. My understanding from UGE is that the economics are even better in the southern portion of New York State,” McWhirter said. “I own it. I think the stock, because of the backlog and the opportunity, basically they have the opportunity to have the stock easily move to a 40 cent level or beyond.”

UGE last reported its financials in November where its third quarter fiscal 2019 featured revenue of $496,000, a major drop from $4.2 million a year earlier, and an adjusted EBITDA loss of $570,000 compared to a loss of $671,000 a year earlier.

Management said that with its third quarter, UGE was continuing to transition towards more profitable markets and higher margin, self-developed projects in the US and Philippines. Gross margins increased in the Q3 from 13 per cent to 29 per cent.

“The third quarter saw us move a significant number of new projects forward, including the procurement of 4.6MW of solar panels,” said CEO Nick Blitterswyk in a November 14 press release. “With 27 new projects underway in the US and Philippines, we are excited to significantly build on our emergence from the transition in the last months of 2019, and to see much improved results going forward.”

Tara Whittet

Writer

Tara Whittet is Senior Sales Manager at Cantech Letter.