Greenlane Renewables is a cleantech junior with promise, says Beacon Securities

Cleantech company Greenlane Renewables (Greenlane Renewables Stock Quote, Chart, News TSXV:GRN) ended 2019 on a high note with a major contract, win but there’s likely a lot more where that came from, according to Beacon Securities analyst Ahmad Shaath, who delivered an update on the stock to clients on Monday.

Cleantech company Greenlane Renewables (Greenlane Renewables Stock Quote, Chart, News TSXV:GRN) ended 2019 on a high note with a major contract, win but there’s likely a lot more where that came from, according to Beacon Securities analyst Ahmad Shaath, who delivered an update on the stock to clients on Monday.

The analyst reiterated his “Buy” rating and $0.50 per share target price, saying the stock represents a buying opportunity at its current valuation.

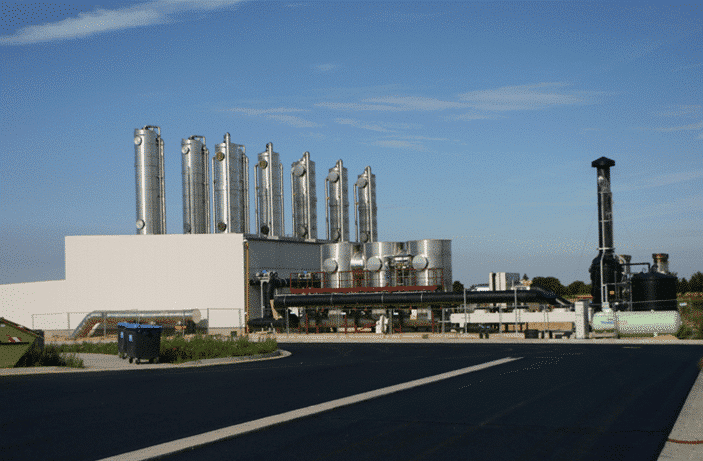

Burnaby, BC’s Greenlane Renewables, which joined the TSX Venture exchange after a qualifying transaction last June, makes biogas upgrading systems for producing low-carbon renewable natural gas from organic waste sources. Late last month the company announced a new $8.3-million contract with a California-based landfill company whereby Greenlane will be targeting 100 per cent methane capture, to be then upgraded and supplied to SoCalGas’ natural gas grid, a first for the natural gas provider.

“This project is a great opportunity to showcase Greenlane’s advanced and reliable technology,” said Brad Douville, President & CEO of Greenlane, in a press release. “This is a real win-win for the environment and generates attractive economics.”

After the new contract announcement, Shaath says that he has greater confidence that Greenlane has what it takes to close on more wins from its $650-million-plus quote log as it shows prospective clients that GRN “has the ability to take on larger projects and provide innovative solutions using the right technologies,” Shaath wrote.

Moreover, Shaath says that at $8.3 million, the size of the contract shows that Greenlane’s relatively small size (a $23-million market cap compared to its RNG competitor Xebec Adsorption at $200 million) is no hindrance and that GRN has effectively “turbocharged” its progress with the deal.

“In our view, GRN is on track to repeat the playbook we have seen play out with XBC over 2019. XBC’s valuation multiple nearly doubled to 2.0x EV/sales as it: (a) demonstrated an exceptional track record in execution; (b) reported triple-digit revenue growth; and (c) capitalized on the positive macro tailwinds in the RNG industry through contract wins (at increased size per project as well),” Shaath wrote.

“We believe the timing is just right for GRN to experience a similar path, which we argue could develop faster as evidenced by GRN’s ability to win the larger contracts sooner than anticipated. Thus we believe its current valuation of 1.4x EV/Sales represents a great buying opportunity,” he said.

Shaath added that with the EPA’s new finalized volume requirements under the Renewable Fuel Standard for compliance year 2020, the call is for 590 million gallons of ethanol equivalent in cellulosic biofuels (under which RNG form landfill gas falls) to be produced in 2020. The analyst figures that number implies another $300 to $350 million needed in upgrading investments this year to satisfy additional volumes.

With the update, the analyst has increased his fiscal 2019 and 2020 forecasts for GRN, now calling for 2019 revenue and adjusted EBITDA of $10.9 million and negative $1.4 million and 2020 revenue and adjusted EBITDA of $25.0 million and negative $0.3 million. His $0.50 target represents a projected 12-month return of 22 per cent at the time of publication.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.