There’s nothing wrong with CAE (CAE Stock Quote, Chart, News TSX:CAE) and investors should be keen to participate in the fast-growing company’s success. It’s just that you might want to wait for a pullback, says Rob Lauzon of Middlefield Capital.

There’s nothing wrong with CAE (CAE Stock Quote, Chart, News TSX:CAE) and investors should be keen to participate in the fast-growing company’s success. It’s just that you might want to wait for a pullback, says Rob Lauzon of Middlefield Capital.

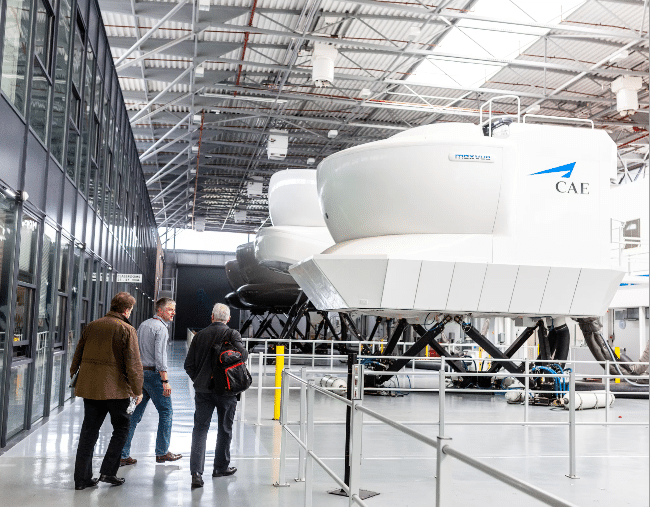

Montreal-based CAE is a flight simulator company which offers tech and training to customers in the airline, aircraft manufacturer and defence industries, and the company has been growing at a steady clip in recent years.

Take the company’s latest quarterly results as an example, where CAE reported revenue of $896.8 million for its fiscal second quarter 2020. That top line was up 21 per cent from the $743.8 million for Q2 2018, which itself was up 20 per cent from the $618.2 million for Q2 2017. Profit was also up almost 22 per cent for the Q2 2020, delivered on November 13 of last year, to $73.8 million or 28 cents per share. Analysts had been expecting 25 cents per share.

CAE is experiencing growth in its Civil Aviation Training Solutions segment, which was up 35 per cent to $529.9 million for the second quarter, while Defence and Security has seen more modest top line growth, up five per cent to $336.5 million.

All that good news has surely been reflected in CAE’s share price, which grew 37 per cent in value in 2019 and has already popped another 14 per cent in January. The recent spike came about as plane-maker Boeing announced earlier this month a recommendation that 737 Max pilots should complete simulation training before flying the plane which remains grounded since last spring following two 737 Max 8 crashes. Typically, Boeing recommends computer-based training rather than simulators for pilots.

For its part, CAE had said late last year that it was making 737 Max full-flight simulators even without customer orders in hand, a move which in hindsight appears prescient. “We’re kind of happy that we made the decision back in November to do that,” said CAE spokeswoman Helene Gagnon, as reported by Bloomberg News on January 8.

Lauzon says that with the stock’s rise of late, there’s merit in holding off on buying CAE until a dip comes around.

“We don’t own CAE currently but it does have great technology and there isn’t much competition in their aviation side of things where they train pilots. It’s one of Canada’s great technology success stories with the innovation that they’ve brought to the aviation market,” says Lauzon, managing director and deputy CIO at Middlefield, speaking to BNN Bloomberg on Tuesday.

“You have to buy it on a dip. Maybe the company will stumble one quarter and that gives you that opportunity. It’s a great grower and it’s got a bit of a dividend. I would recommend it,” he said.

“A day like [Monday] you might get it a per cent down. To get a big five to ten per cent correction in this market, which we could have at any time and get back to a 17x, 18x multiple on the market, which would not be unreasonable — that would be your time to buy CAE, for sure,” Lauzon said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment