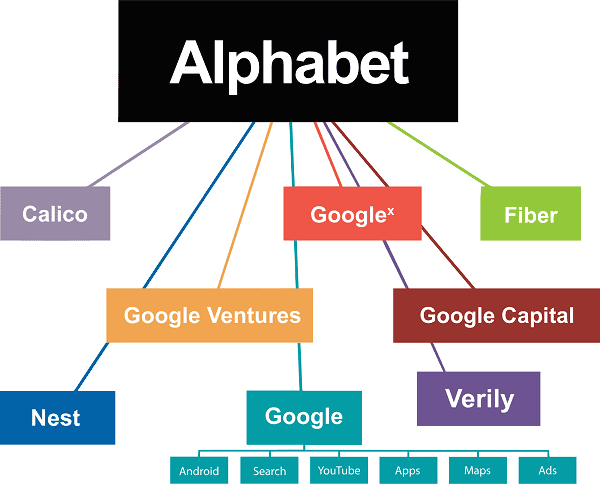

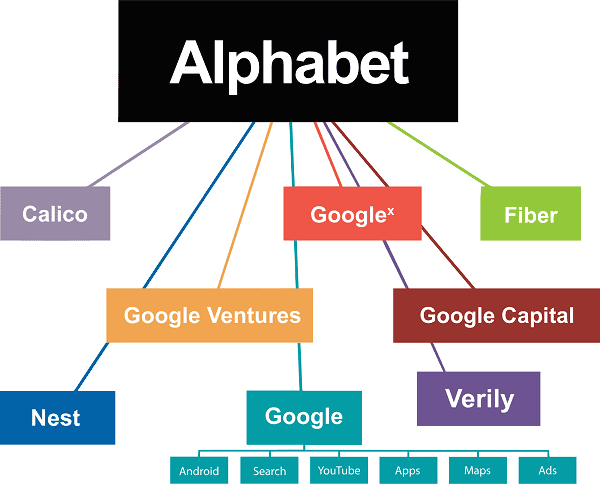

Both Facebook (Facebook Stock Quote, Chart, News NASDAQ:FB) and Google parent company Alphabet (Alphabet Stock Quote, Chart, News NASDAQ:GOOGL) have had great years in 2019 but for those investors looking for exposure in online advertising, portfolio manager Chris Blumas says his choice is Alphabet.

Both Facebook (Facebook Stock Quote, Chart, News NASDAQ:FB) and Google parent company Alphabet (Alphabet Stock Quote, Chart, News NASDAQ:GOOGL) have had great years in 2019 but for those investors looking for exposure in online advertising, portfolio manager Chris Blumas says his choice is Alphabet.

“In the end, there’s a huge universe of stocks and you can’t like everything and you make tradeoffs. If you want to play online advertising, there’s really two ways to play that, it’s with Google and Facebook,” said Blumas, vice president of GlobeInvest Capital Management, speaking with BNN Bloomberg on Monday.

“And in terms of a business model that I think is phenomenal it’s Alphabet and Google. In terms of where we’ve chosen to allocate capital for our clients, we’ve done Alphabet,” he said.

After enduring major selloffs to round out 2018, the FAANG stocks including Facebook and Google had excellent returns in 2019. Year-to-date, Facebook is now up 50 per cent and Google is up 29 per cent.

Facebook peeked above the $200 per share mark again last week before the stock dropped in response to news that the US Federal Trade Commission could be seeking a preliminary injunction against the social media giant over antitrust concerns. As reported in the Wall Street Journal, the injunction would seek to control the way Facebook’s stable of apps interact with each other, pushing against the company’s plans to integrate Facebook’s platform with both Instagram and WhatsApp.

But Blumas says that the grounds for antitrust pressure on Facebook aren’t all that clear.

“You can say whatever you want about its behaviour and in the end that will be forced to be changed. It’s very difficult from an anti-trust perspective, it’s awkward,” Blumas said.

“You can’t just force companies to break up because you want them to. In the end, customers aren’t paying for Facebook, they’re paying through giving their data and Facebook is using that data to target ads towards them. So, I don’t think the threat of anti-trust is as big as people think,” he said.

“I think that their behaviour has to change but it already has started to,” Blumas said.

For its part, Google saw its advertising revenue rise from $28.95 billion in the third quarter of 2018 to $33.92 billion in Q3 2019, delivered in late October. Facebook’s third quarter delivered advertising revenue of $17.38 billion, up from $13.54 billion a year ago. (All figures in US dollars.)

Facebook surpassed analysts’ expectations on both earnings and revenue for its Q3, coming in with EPS of $2.12 per share versus the consensus estimate of $1.91 per share. Google’s Q3 featured revenue of $40.5 billion in revenue versus the Street’s $40.32 billion while the company missed on earnings, coming in with $10.12 per share versus the expected $12.42 per share.

“In terms of valuation, [Facebook] is a discount to its large cap peers, so if you think of Facebook, 21x earnings and 15x cash flows — I’ll definitely concede that the valuation is attractive,” Blumas said.

“The thing for me is more about the opportunity cost. I think there are better ways to allocate capital so Facebook for me is a no-go but I get it if you like it,” he said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment