Following the company’s third quarter results, Echelon Wealth Partners analyst Rob Goff is maintaining his bullish stance on Quisitive Technology Solutions (Quisitive Technology Solutions Stock Quote, Chart, News TSXV:QUIS).

Following the company’s third quarter results, Echelon Wealth Partners analyst Rob Goff is maintaining his bullish stance on Quisitive Technology Solutions (Quisitive Technology Solutions Stock Quote, Chart, News TSXV:QUIS).

On Monday, Quisitive reported its Q3, 2019 results. The company lost $507,714 on revenue of $5.34-million, a topline that was up 65 per cent over the same period last year.

“Our second quarter market recognition and acquisition transaction were the catalysts for the revenue impact we demonstrated in our third quarter,” CFO Mike Murphy said. “The momentum we had coming into this quarter contributed to the significant increase in enterprise consulting engagements and record revenues.”

Goff notes that the quarter exceeded his expectations on both the top and bottom line. He says that while some may be waiting for more M&A activity, the company is performing well organically.

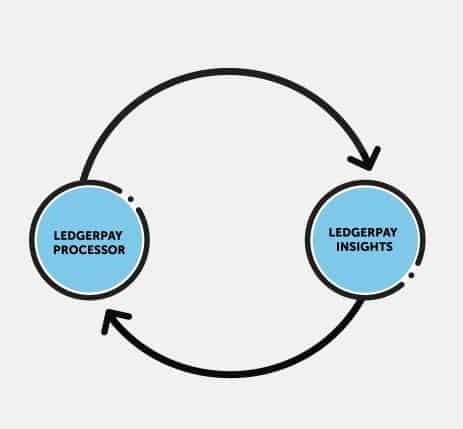

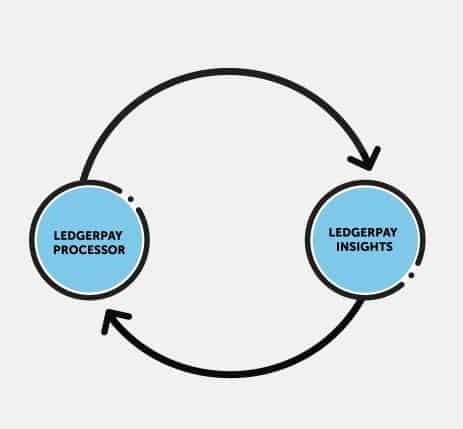

While investors are likely to await further evidence of the company’s ability to successfully acquire as it looks to accelerate organic growth where 20% y/y growth is seen as a baseline level,” he said. “We look for a successful follow-on acquisition, initial traction on its LedgerPay initiative along with ongoing organic growth to materially revalue the shares. However, we are cognizant that investors in these markets awaits clear evidence of success.

The analyst says Quisitive Technology has plenty of runway.

“We continue to forecast strong shareholder returns as Quisitive gains traction and scale over time as a consolidator in the Azure professional services space,” Goff wrote. “Acquisition terms look for immediate accretion before considering revenue synergies expected through layering additional products onto the acquired sales teams along with scale efficiencies. We see Azure gaining share in the broadly defined cloud ecosystem where QUIS looks to be a consolidator of the fragmented tier of mid/small sized professional service providers. The strength of Quisitive’s Microsoft alignment was reflected in both its selection as Microsoft’s US Partner of the year and in tangible Microsoft leads. For many of the acquisition targets, the move to cloud services represents both exciting growth and challenges as the end client moves to next gen services. The industry inflection towards cloud-based SaaS models is expected to accelerate consolidation in the professional services space. Its LedgerPay product should contribute higher margin SaaS revenues beginning in H120.”

In a research update to clients today, Goff maintained his “Speculative Buy” rating and one-year price target of $0.46 on Quisitive Technology, a figure that implied a return of 217 per cent at the time of publication.

Goff thinks QUIS will post Adjusted EBITDA of $2.0-million on revenue of $19.0-million in fiscal 2019. He expects those numbers will improve to EBITDA of $3.5-million on a topline of $24.0-million the following year.

“QUIS is currently trading at a C2020 EV/Sales and EV/EBITDA of 1.0x and 9.1x, respectively, versus its North American IT Services and Consultants/Managed Services comparables trading at 1.3x and 11.6x, and 3.0x and 16.6x, respectively,” the analyst added.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment