Its share price has finally stabilized after falling for much of 2023, but Echelon Capital Markets analyst Rob Goff thinks there is money to be made on Quisitive Technology Solutions (Quisitive Technology Solutions Stock Quote, Chart, News, Analysts, Financials TSXV:QUIS).

In a research update to clients September 27, Goff maintained his “Speculative Buy” rating and one-year price target of $1.00 on QUIS, implying a return of 208 per cent at the time of publication.

The analyst explained his thesis on the stock’s current valuation.

“We believe QUIS shares are very attractive against consolidated valuation measures such as the EV/EBITDA and FCF yield,” the analyst argued. “We have the shares at 5.4x 2024 EV/EBITDA as reported or 4.8x after excluding PayiQ losses at roughly $4.5M. We forecast 2024 FCF at $18.9M or $0.05/shr supporting an FCF yield of 20%. We believe the shares offer exceptional value against our SOTP’s (Sum of The Parts) valuation at C$1.46. We believe our SOTP valuation benchmarks stand up despite tough market conditions.

Goff thinks QUIS will generate EBITDA of $26.8-million on revenue of $187.8-million in fiscal 2023. He expects those numbers will improve to EBITDA of $32.5-million on a topline of $204.4-million the following year.

What does Quisitive do? (via company handout)

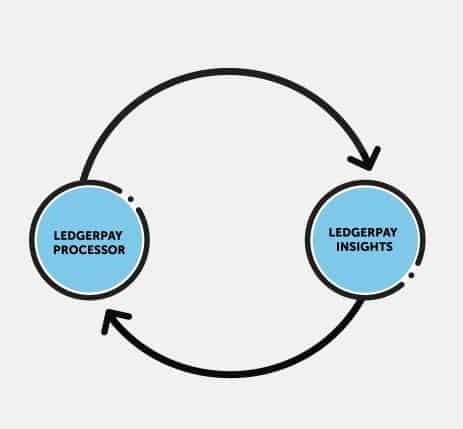

Quisitive (TSXV: QUIS, OTCQX: QUISF) is a premier, global Microsoft partner that harnesses the Microsoft cloud platform and complementary technologies, including custom solutions and first-party offerings, to generate transformational impact for enterprise customers. Our Cloud Solutions business focuses on helping enterprises move, operate, and innovate in the three Microsoft clouds. Our Payments Solutions division, leverages the PayiQ platform powered by Microsoft Azure to transform the payment processing industry into an entirely new source of customer engagement and consumer value. Quisitive serves clients globally from seventeen employee hubs across the world.

Share

Share Tweet

Tweet Share

Share

Comment