After its latest quarterly numbers, Liminal BioSciences (Liminal BioSciences Stock Quote, Chart, News TSX:LMNL) is still a “Hold,” according to Echelon Wealth Partners analyst Douglas Loe, who reviewed the pharmaceutical company’s Q3 in an update to clients on Wednesday.

After its latest quarterly numbers, Liminal BioSciences (Liminal BioSciences Stock Quote, Chart, News TSX:LMNL) is still a “Hold,” according to Echelon Wealth Partners analyst Douglas Loe, who reviewed the pharmaceutical company’s Q3 in an update to clients on Wednesday.

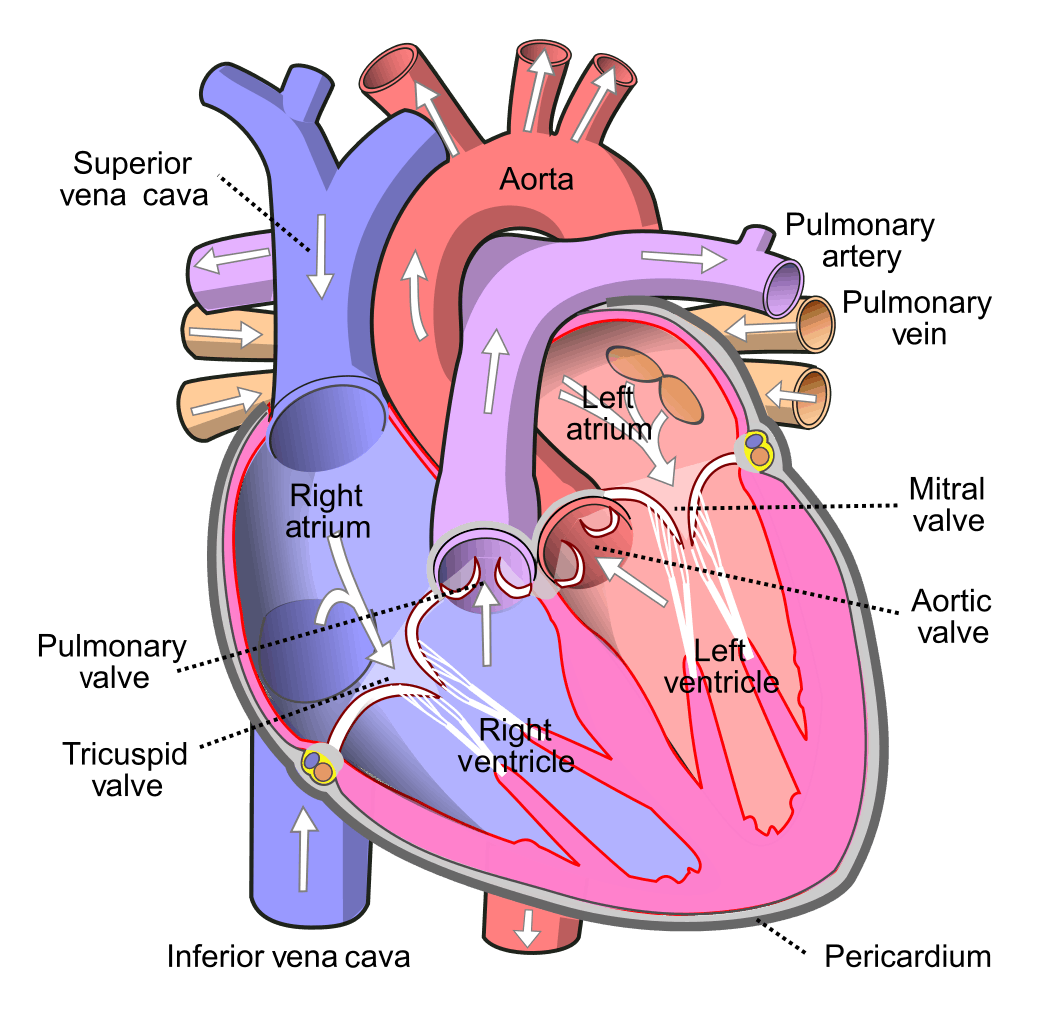

Quebec-based Liminal (formerly “Prometic Life Sciences”) is the developer of affinity-purified plasma products and small-molecule therapeutics targeting fibrotic and metabolic diseases of the liver, kidney and respiratory system. The company’s lead plasma-derived product is Ryplazim (plasmogen), for which the company is expecting to file a biologics license application (BLA) with the US FDA in the first half of 2020.

Liminal reported its third quarter fiscal 2019 financials on Monday, featuring a net loss of $29.7 million on revenues of $5.3 million, down from $12.3 million a year earlier. Along with the name change, the company has done some restructuring, most notably in selling off its UK-based bioseparations subsidiary to investment firm KKR. Liminal also recently took on a $75-million line of credit to help it execute its new corporate strategy.

“Over the past three months we have made significant progress on our new vision for Liminal BioSciences notably through the signing of an agreement to sell Prometic Bioseparations Ltd to KKR & Co. Inc. and change of name to Liminal BioSciences. The divestment of PBL reflects our strategy to simplify our business operations, reduce headcount and other operating costs, and focus resources on the clinical development of our small molecule pipeline”, said Kenneth Galbraith, Liminal’s CEO in a press release.

Loe says that with the bulk of Liminal’s revenue having come from its soon-to-be gone bioseparations segment ($4.5 million for the Q3), the top line will look pretty bare going forward, as the company reverts back to a pure-play drug developer —at least until the potential launch of Ryplazim.

The analyst mentions that the quarterly numbers showed a modest improvement in R&D burn.

“One of the key expenses we track closely is Liminal’s R&D expense, which on a consolidated basis, has been averaging $24 million per quarter in 2017 and 2018 respectively. Part of the fault lies in the firm embedding manufacturing activities associated with therapeutics aimed at clinical development as well as within the R&D line, along with other associated R&D costs that would have been involved in the actual costs of running clinical trials. This quarter, we observed a modest q/q improvement of the R&D cost line from $24.2 million to $19.6 million,” writes Loe.

By his estimates, Loe says Liminal’s $114.8-million cash position leaves it less likely to take up the above-mentioned line of credit. Loe says looking ahead, LMNL has potential milestones in the BLA resubmission for Ryplazim during the first half of 2020 with an approval expected by the end of 2020. The company should also be starting pivotal testing for its drug PBI-4050 for Alstrom Syndrome by 2020.

Loe is maintaining his “Hold” rating and $9.25 target price, which translates to a projected 12-month return of 18.6 per cent at the time of publication.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment