Cresco Labs (Cresco Labs Stock Quote, Chart, News CSE:CL) is over another hurdle in its deal to buy Origin House, but there are a number of issues still up in the air for the US cannabis company.

Cresco Labs (Cresco Labs Stock Quote, Chart, News CSE:CL) is over another hurdle in its deal to buy Origin House, but there are a number of issues still up in the air for the US cannabis company.

So says Echelon Wealth Partners analyst Matthew Pallotta, who delivered an update to clients on Friday.

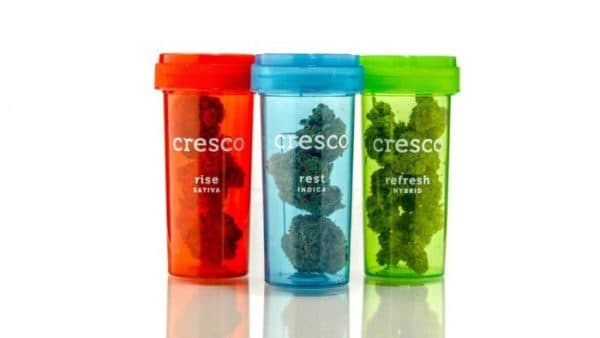

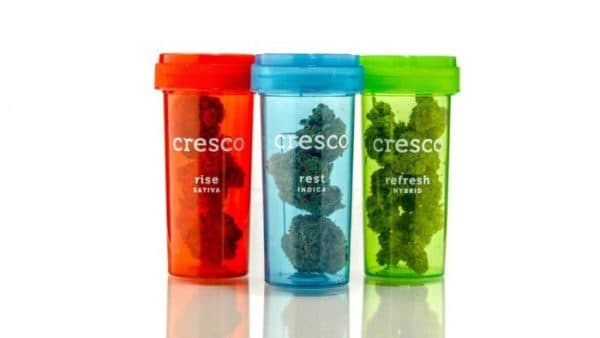

Chicago-based Cresco, a vertically-integrated cannabis consumer goods company with across 12 states, announced on Tuesday that the 30-day waiting perioed under the Hart-Scott-Rodino Antitrust Improvements Act (HSR Act) has expired, allowing the company to proceed with its previously-announced acquisition of Origin House.

“We look forward to working through the remaining steps required to close the Transaction,” said Charlie Bachtell, CEO and Co-founder of Cresco Labs, in a press release.

Pallotta says that he views the development positively, even as there remains the potential for the terms of the deal to be re-opened for negotiation, especially considering the growing spread between Origin House’s trading price and the implied value of the Cresco offer.

“This possibility must at least be considered, given the developments with respect to valuation since April, when the agreement was first announced,” says Pallotta. “In the event that terms of the deal have been re-opened, we believe the negotiations would most likely favour Cresco Labs’ shareholders. Although, as with any (potential) renegotiation process, there is also some level of risk that the deal could be cancelled outright.”

Other uncertainties which could be potentially weighing on Cresco’s stock, according to the analyst, include the company’s financial needs and its pending M&A. Pallotta is putting Cresco’s current forecasted funding gap at $200 million but says that he believes that it can be covered using non-dilutive capital, even as the capital markets for cannabis companies have dried up considerably in recent months.

“We believe that the Company’s actions to address concerns over the balance sheet and risks related to pending acquisitions will go a long way in removing uncertainties around the outlook for Cresco Labs. Until these risks are addressed, they could potentially continue weigh on the stock, given the market’s far more cautious sentiment with respect to cannabis issuers at this time,” Pallotta writes.

On the potential for renegotiation of the OH deal, Pallotta thinks that such an event would appear to favour Cresco, not only as Origin House would be in a weaker position as a standalone business relative to Cresco, according to Pallotta, but that the structure of the proposed deal requires OH to pay a C$45 million fee to Cresco under certain conditions, one of which seems to be if the deal does not get done by an Outside Date, which has been pegged at November 15, 2019 — and OH doesn’t have the $34 million in cash, according to Pallotta.

“With the acquisition passing HSR review, we continue to maintain our assumption that the Origin House transaction will close by December of 2019, and do not assume the terms are renegotiated,” writes Pallotta.

Ahead of Cresco’s third quarter earnings due in the latter half of November, Pallotta has rejigged his estimates to account for pushed-back timelines for pending acquisitions, slower-than-expected sales in Massachusetts, a more conservative stance on Michigan, reduced wholesale numbers in Arizona and New York, pushed out timelines for dispensary approvals in Pennsylvania and Florida and changes to his financing and cost of capital assumptions.

The analyst is now calling for full-year fiscal 2019 revenue and adjusted EBITDA of $131.6 million and $6.1 million, respectively. With the update Pallotta is reasserting his “Speculative Buy” rating but lowering his target price from C$15.00 to C$13.00, representing a projected return of 57 per cent at the time of publication. (All figures in US dollars unless where noted otherwise.)

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment