Investors looking for a higher risk but potentially higher payout opportunity should be thinking about Canadian software acquisition story Constellation Software (Constellation Software Stock Quote, Chart, News TSX:CSU), according to portfolio manager David Cockfield of Northland Wealth Management.

The company’s long track record of strategic pickups and the steady climb in its share price speak for themselves, he said.

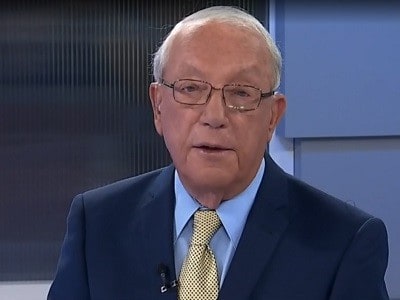

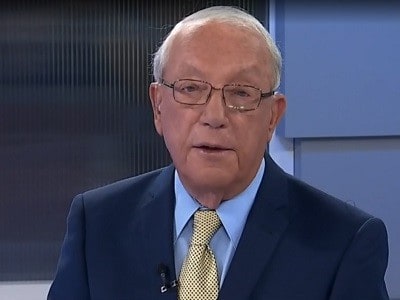

“This is a software firm that’s the kind of company that has really come to the forefront over the last few years. It has a good chart and has been up on a regular basis with constant growth,” said Cockfield, managing director and portfolio manager for Northland Wealth, speaking to BNN Bloomberg on Friday.

“It is in the software business but it has done a good job at finding the spots where there’s growth,” he says. “There’s a higher risk as the stock will be more volatile if the market is volatile. The multiple is not excessive but it’s not low either. It’s also a capital gain stock, it’s not a big dividend payer.”

“If you want to get into (Constellation Software stock), I would dollar average into it over the near term just in case the market decides to have a good correction…”

Constellation Software has done a more than admirable job in 2019 of picking up right where it left off last year before the market pullback in the fourth quarter. Year-to-date in 2019, CSU is up a whopping 53 per cent compared to the larger S&P/TSX Composite Index which is currently up 14 per cent. Over the longer haul, Constellation has been a remarkable investment: selling for $35 per share back in October of 2009, CSU is now worth 38 times that at $1338 per share.

Constellation, which started off in 1995, has made over 250 acquisitions to date, aiming for the most part at startups and smaller purchases of companies that fulfill the needs of niche markets in the software field.

Constellation Software made news earlier this year when it announced that it was lowering its hurdle rate on the minimum rate of return expected from new acquisitions, specifically for potential acquisitions for more than $100 million, potentially a signal that the M&A environment has tightened and that CSU is finding it more difficult to identify potentially accretive businesses at a cheap pickup price.

Cockfield says that to avoid as much as possible the ups and downs inherent to tech investing, those interested in buying Constellation should probably dollar-cost average in rather than trying to correctly time your entry.

“If you want to get into it, I would dollar average into it over the near term just in case the market decides to have a good correction. Leave yourself a little bit of room to add to it if there is a market selloff,” Cockfield said.

Constellation last reported its quarterly results in early August, with revenue for its second quarter ended June 30 up 12 per cent year-over-year to $846 million and adjusted EBITDA up 19 per cent year-over-year to $208 million. Both numbers came in below analysts’ consensus estimate. Management said that CSU made a number of acquisitions over the quarter for a total consideration of $110 million.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment