Canadian cleantech stocks seem to be having a moment in the sun.

Canadian cleantech stocks seem to be having a moment in the sun.

The on-again-off-again cleantech sector is all the rage both globally and here in Canada, where federal and provincial governments are putting up big bucks to back innovation in clean technology, said to be a worldwide $2.5-trillion industry by 2022.

Last month, for instance, Sustainable Development Technology Canada announced $56 million in funding for 18 cleantech companies, while the Businesses Development Bank of Canada made another $10 million available to clean energy innovations.

“Canadians are leading the world’s transition to a low-carbon economy, and clean technology is part of the solution. Our government is positioning Canadians to seize the opportunities created by cleantech to create good jobs and leave a cleaner planet for our kids,” said Minister of Innovation, Science and Economic Development Navdeep Bains.

Meanwhile, there are plenty of ways for retail investors to participate in Canadian cleantech stocks, including the following three companies all of which have recently received positive ratings from analysts covered by Cantech Letter.

“Starting to see increased traction…”

Greenlane Renewables (Greenlane Renewables Stock Quote, Chart, News TSXV:GRN)

Analyst: Beacon Securities, Ahmad Shaath

Projected Return: 182 per cent

Third on the list is BC-based biogas systems company Greenlane Renewables, which joined the TSX’s junior exchange in June after a qualifying transaction. Analyst Ahmad Shaath of Beacon Securities reviewed the stock in a note to clients this week, saying that the company has an excellent risk-reward profile.

“Greenlane is focused on partnering with project developers to offer its biogas-to-RNG upgrading equipment to earn into the projects, with the main focus being projects with established flow of raw biogas (as opposed to greenfield projects where Greenlane would have to act as a project developer, a process that could take up to 36 months),” says Shaath.

“With the qualifying transaction behind them, management is now fully focused on establishing this business line, and is starting to see increased traction and is developing deeper conversations with its potential partners,” he writes.

What’s more, Shaath says that GRN is a cheap pickup: for comparison’s sake, Shaath calculates that GRN is trading at an EV/Sales multiple of 1.3x while Xebec, its closest peer, is currently at 1.6x. Shaath’s reiterated “Buy” rating comes with a $0.55 per share target.

“A compelling investment case at current valuation…”

Questor Technology (Questor Technology Stock Quote, Chart, News TSXV:QST)

Analyst: GMP Securities, Justin Keywood

Projected 12-Month Return: 61 per cent

Justin Keywood of GMP Securities who is bullish on waste gas combustion company Questor Technology . Questor has come a long way over the past couple of years, rising from sub-$1.00 in 2016 and 2017 to the mid-$4.00 range arrived at this year.

But there should be more upside yet, says Keywood, who puts a “Buy” recommendation and 12-month target price of $7.25 on Questor.

“We see QST as supplying the best in class closed combustion systems to the oil and gas industry with strong expansion driven by regulatory changes and a pursuit for clean air. As additional states and regions enact and enforce stricter regulations, we expect QST to capitalize with its high ROI solutions as it has in Colorado,” writes Keywood.

Last week, Keywood reviewed the company’s latest quarterly earnings where its fiscal second quarter revenue of $7.4 million was up 28 per cent year-over-year but came in a hair off Keywood’s $7.7-million estimate. EBITDA of $3.6 million was a little above Keywood’s $3.5-million estimate. The analyst had praise for Questor’s strong cash flow which for its second quarter was up 58 per cent to $4.8 million.

“QST has recently secured $12 million of new contracts in North Dakota, Texas and Mexico as evidence and our discussions with regulators point to continued high growth ahead. We also see potential for QST to provide additional solutions to its customers and into new verticals. A diversifying, high ROIC business in expansion mode shows a compelling investment case at current valuation,” Keywood writes.

“Tremendous potential to exceed our estimates for EBITDA with even one large order…

Xebec Adsorption (Xebec Adsorption Stock Quote, Chart, News TSXV:XBC)

Analyst: M Partners, Andrew Hood

Projected Return: 30 per cent

As Canadian cleantech stocks go, renewable natural gas play Xebec Adsorption has a bright future ahead of it, according to analyst Andrew Hood of M Partners, who on August 14 reiterated his “Buy” recommendation and $2.20 per share target, saying that the company could be picking up some big contract wins in emerging international markets.

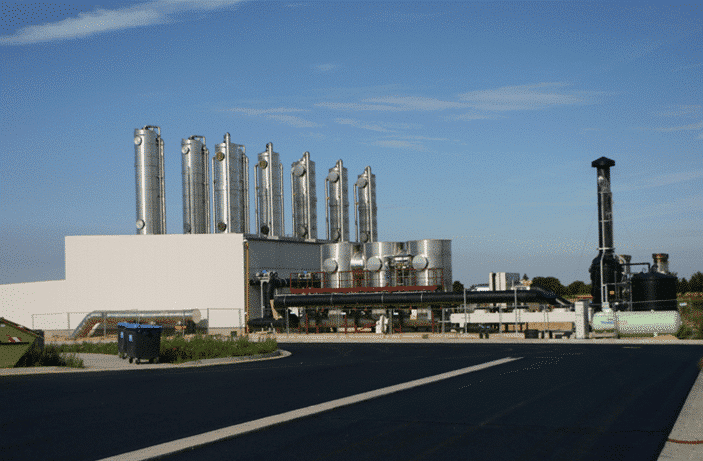

Xebec, which manufactures systems to transform raw gases such as those from landfills into marketable energy, impressed in its second quarter fiscal 2019 financials last month, producing $12.8 million in revenue compared to $5.3 million a year earlier and positive EBITDA of $1.8 million compared to $0.3 million last year. The top line was better than Hood’s $12.6-million estimate while the EBITDA was in line with his forecast.

“In the short-term the biggest accelerator to additional upside on Xebec stock is the potential for large landfill contracts in the US. XBC has been in discussions for one or two landfills and anticipates an update to shareholders later this year. If Xebec were to secure two of these contracts, it would provide $40-60 million in additional revenues next year and set the Company on the path towards a $100-million run rate,” writes Hood.

“Xebec has tremendous potential to exceed our estimates for EBITDA with even one large order. Considering the traction the Company is building in key markets, it is possible that multiple large orders are secured over the next couple years, expanding EBITDA and potentially leading to a re-rating on the multiple,” he says.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment