Newly listed Greenlane Renewables (Greenlane Renewables Stock Quote, Chart, News TSXV:GRN) may not have a lot of relevant data in its first quarterly report but the cleantech company sure has an attractive growth profile.

Newly listed Greenlane Renewables (Greenlane Renewables Stock Quote, Chart, News TSXV:GRN) may not have a lot of relevant data in its first quarterly report but the cleantech company sure has an attractive growth profile.

That’s according to Ahmad Shaath of Beacon Securities, who in a Tuesday update to clients maintained his “Buy” rating and $0.55 per share target price.

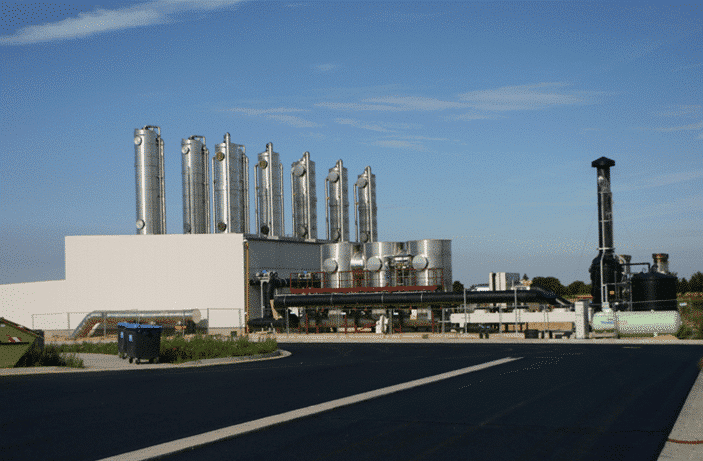

Burnaby, BC-based Greenlane Renewables, a global provider of biogas systems, posted its second quarter ended June 30, 2019, results last Friday. The quarter was the first for the public company which began as capital pool corporation before completing a qualifying transaction on June 3 and joining the TSX Venture Exchange.

Greenlane thus reported only 27 days’ worth of operations with its Q2, which featured $0.9 million in revenue and an adjusted EBITDA loss of $0.2 million for gross margin of 48 per cent. Management says that its net loss for time period was $2.1 million, of which $1.8 million came in relation to the issuing of special warrants and other non-operating expenses. As of the end of June, Greenlane had an order backlog of $10.7 million compared to $10.6 million as of six months prior, with a backlog of $13.5 million to be delivered over the next 12 to 18 months and a sales pipeline value of over $600 million (management defines its sales pipeline as prospective projects that can convert into orders within 24 months).

“We are excited to have successfully launched as a public company this quarter,” said Brad Douville, President and CEO of Greenlane Renewables in the quarterly press release. “With this transaction now complete, we’re focused on continuing to build Greenlane’s foundation including our team, industry presence and sales activities in preparation for the next phase of growth including launching our build, own, operate business model to add new recurring revenue and profits to the business as the market for RNG rapidly emerges.”

Shaath says that given the lumpiness of the overall biogas upgrading business and the short less-than-one-month time span, there aren’t any meaningful takeaways from the Q2 numbers, but the analyst nonetheless highlighted the company’s continuing efforts to establish itself as a renewable natural gas project builder and operator, saying,

“Greenlane is focused on partnering with project developers to offer its biogas-to-RNG upgrading equipment to earn into the projects, with the main focus being projects with established flow of raw biogas (as opposed to greenfield projects where Greenlane would have to act as a project developer, a process that could take up to 36 months). With the qualifying transaction behind them, management is now fully focused on establishing this business line, and is starting to see increased traction and is developing deeper conversations with its potential partners,” writes Shaath.

The analyst thinks that GRN is attractively valued, estimating that it currently trades at an EV/Sales multiple of 1.3x based on his fiscal 2019 forecast of $19 million while its closest peer, Xebec Adsorption, which has seen multiple expansion over the past 12 months, is currently trading at 1.6x.

“We continue to believe GRN represents an excellent risk-reward trade given its cheap valuation and accelerating revenue growth profile,” writes Shaath.

His $0.55 per share target represented a projected return on investment of 182 per cent at the time of publication.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment