Mackie Research analyst Nikhil Thadani is admitting that his previous target price for fintech name Mogo (Mogo Stock Quote, Chart, News TSX:MOGO) was too bullish, and as a result, he’s pulling back now reaffirming his “Speculative Buy” recommendation with the new target of $10.00 (was $12.00), which represented a projected 12-month return of 205 per cent at the time of publication.

Mackie Research analyst Nikhil Thadani is admitting that his previous target price for fintech name Mogo (Mogo Stock Quote, Chart, News TSX:MOGO) was too bullish, and as a result, he’s pulling back now reaffirming his “Speculative Buy” recommendation with the new target of $10.00 (was $12.00), which represented a projected 12-month return of 205 per cent at the time of publication.

Vancouver-based Mogo on August 14 announced its financial results for the three and six months ended June 30, 2019. The company says that over its second quarter, it grew its core revenue by 41 per cent to $16.4 million, compared to $11.6 million during last year’s Q2, while gross profit increased by five per cent year-over-year to $10.4 million.

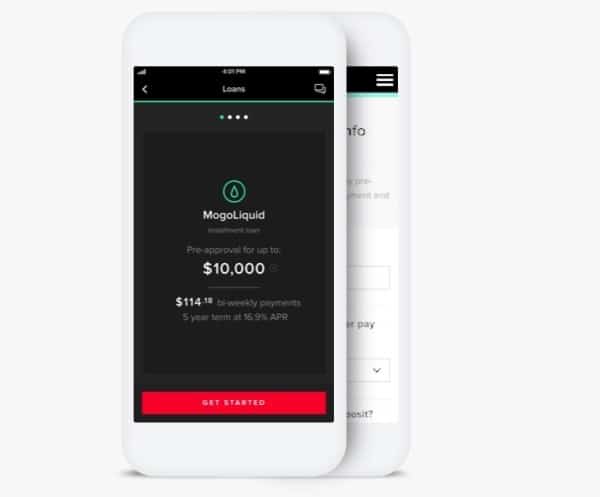

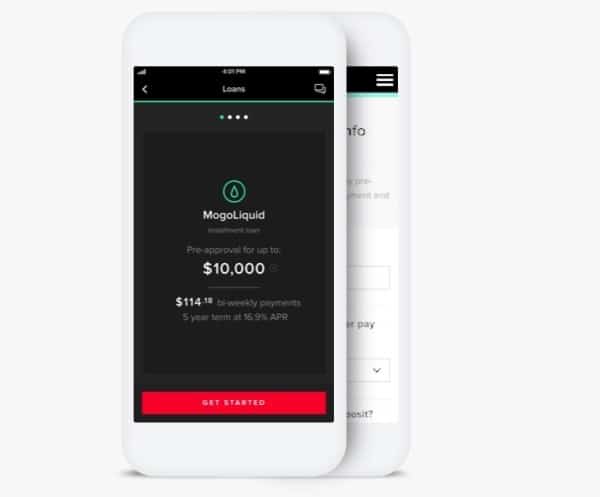

Mogo founder and CEO David Feller wrote in the company’s quarterly release that along with offering up another solid quarter of execution, the second quarter produced a strategic milestone with the development of its partner lending service, which allows third party lenders to integrate and offer loans through Mogo’s platform.

“This new partner lending capability will enable us to not only expand our offering but scale loans to our members without the capital constraints of on-balance sheet lending,” Feller wrote.

Thadani agrees. In his update to clients on Monday, the analyst wrote that the partner lending model could make for revenue drivers for Mogo’s 2020.

“We have previously suggested that Mogo’s lending marketplace partnership/s could open another growth avenue, likely in 2020. To this end, management indicated that the first consumer loan book oriented partnership could be in place by the end of 2019 (including loan originations).”

“We have previously suggested that Mogo’s lending marketplace partnership/s could open another growth avenue, likely in 2020. To this end, management indicated that the first consumer loan book oriented partnership could be in place by the end of 2019 (including loan originations). The company could also announce wealth management related partnership/s by the end of the year. We believe such partnerships help Mogo monetize new and existing members in a more capital efficient manner. Mogo would likely collect a fee, not take on credit risk and most importantly, not utilize its cash to make loan advances, while at the same time leverage Mogo’s core competence of adjudicating credit risk online,” Thadani writes.

As to the quarterly results, Thadani says that Mogo came in-line with his and the Street’s estimates. The $16.8-million in revenue compared to Thadani’s $16.7-million forecast and the consensus $16.4 million, while the $1.1-million in adjusted EBITDA was equal to Thadani’s estimate but lower than the consensus $1.6 million. Adjusted diluted EPS of negative $0.23 per share compared to Thadani’s and the Street’s negative $0.22 per share.

The analyst has updated his forecast, taking out any bitcoin mining revenue and costs, a segment which the company is currently exiting, and adding in the impact of the partner lending roll-out and adoption. His 2019 revenue forecast drops 5.9 per cent to $64.6 million and his EBITDA forecast climbs 10.9 per cent to $5.9 million. For 2020, he is calling for revenue of $86.8 million (down 8.6 per cent) and EBITDA of $10.8 million, down 27.2 per cent.

As of late-day trading on Monday, Mogo’s share price was down 34.5 per cent over the past 12 months and down 0.9 per cent year-to-date.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment