“After touring the manufacturing operations and corporate office we have increased confidence in the quality of manufacturing and the sensibility of the long-term business strategy,” Hood said in an update to clients.

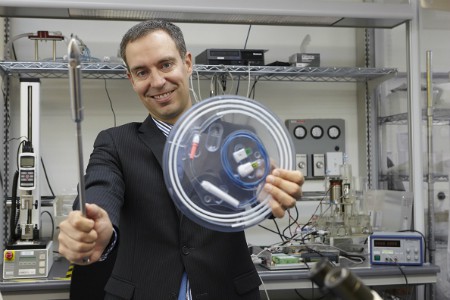

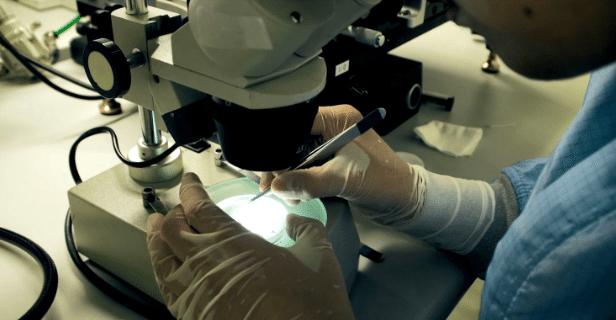

“Current operations make effective use of human resources and capital, while also offering the means to increase production with relative ease and limited capital expenditures. It is also evident that the flexibility of the manufacturing facility, in combination with the versatility of Opsens technology, enables innovation and applications across other industries, including semiconductors and aerospace,” he says.

Hood thinks that over time and with continued improvements in sales and marketing, Opsens should be able to increase its market share from the current three per cent. The analyst also sees likely improvement in gross margin, especially through increased sales in Canada and the US.

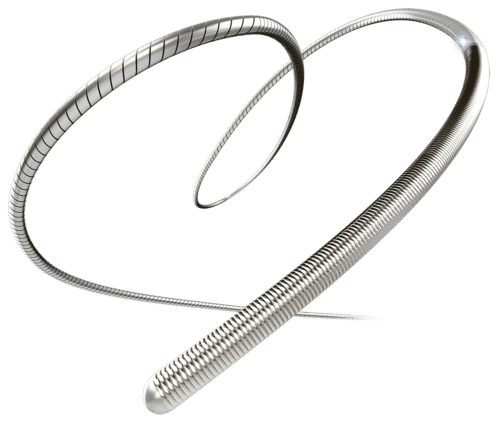

As for catalysts, Hood points to the company’s earnings report due on April 11, an augmentation of the company’s relationship with medical implant device company Abiomed, FDA approval of Opsens’ dPR algorithm and the release of the next iteration of its flagship product OptoWire (now in its third iteration and expected this summer).

“After discussions with management, we have updated our financial estimates. The most meaningful change was a ~$1 million increase in R&D expenses in 2019 to reflect work on the OptoWire III and other innovations,” says Hood.

The analyst sees OPS generating fiscal 2019 revenue and EBITDA of $31.2 million and negative $1.2 million, respectively. Hood is maintaining his “Buy” rating with the new target of $1.60 (was $1.20), representing a projected return to target of 108 per cent at the time of publication.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment