I wouldn’t touch Maxar Technologies right now, this analyst says

If there’s anything good to be said about Maxar Technologies (Maxar Technologies Stock Quote, Chart TSX:MAXR), investors might be taking comfort in the fact that the stock seems to have leveled off after a good half-year of steep declines.

If there’s anything good to be said about Maxar Technologies (Maxar Technologies Stock Quote, Chart TSX:MAXR), investors might be taking comfort in the fact that the stock seems to have leveled off after a good half-year of steep declines.

But don’t get too comfortable, says research analyst Brooke Thackray, who claims that on both a fundamental and technical basis there’s still a lot of uncertainty surrounding the name.

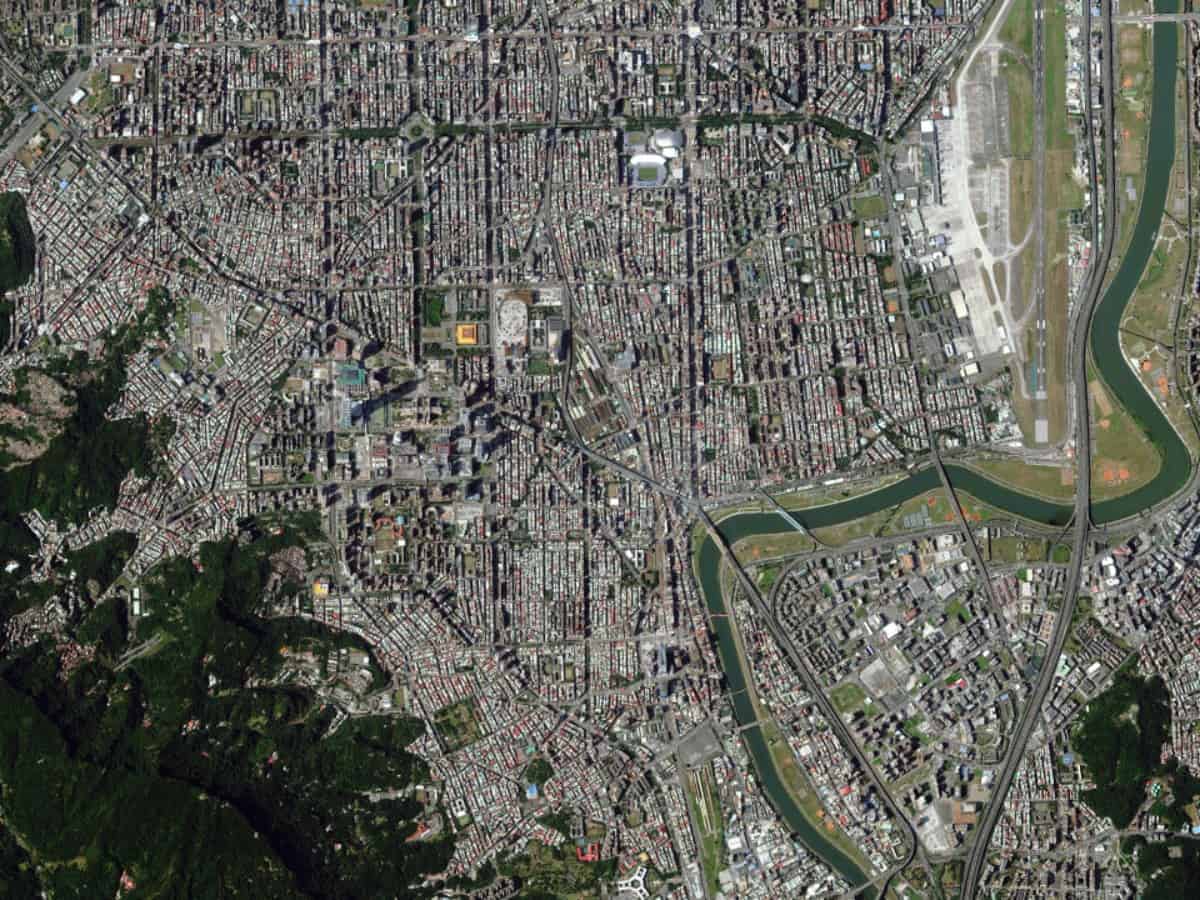

The past 12 months have been more than a little difficult for Maxar, as the former MacDonald, Dettwiler and Associates has dealt with a number of setbacks, from last year’s write-down of its satellite business and a short-seller attack on its accounting practices to this year’s loss of a key revenue-generating satellite and the departure of its CEO. The drama has certainly impacted the company’s share price, with MAXR dropping from a high of C$72 last July to where it currently trades in the C$6 range.

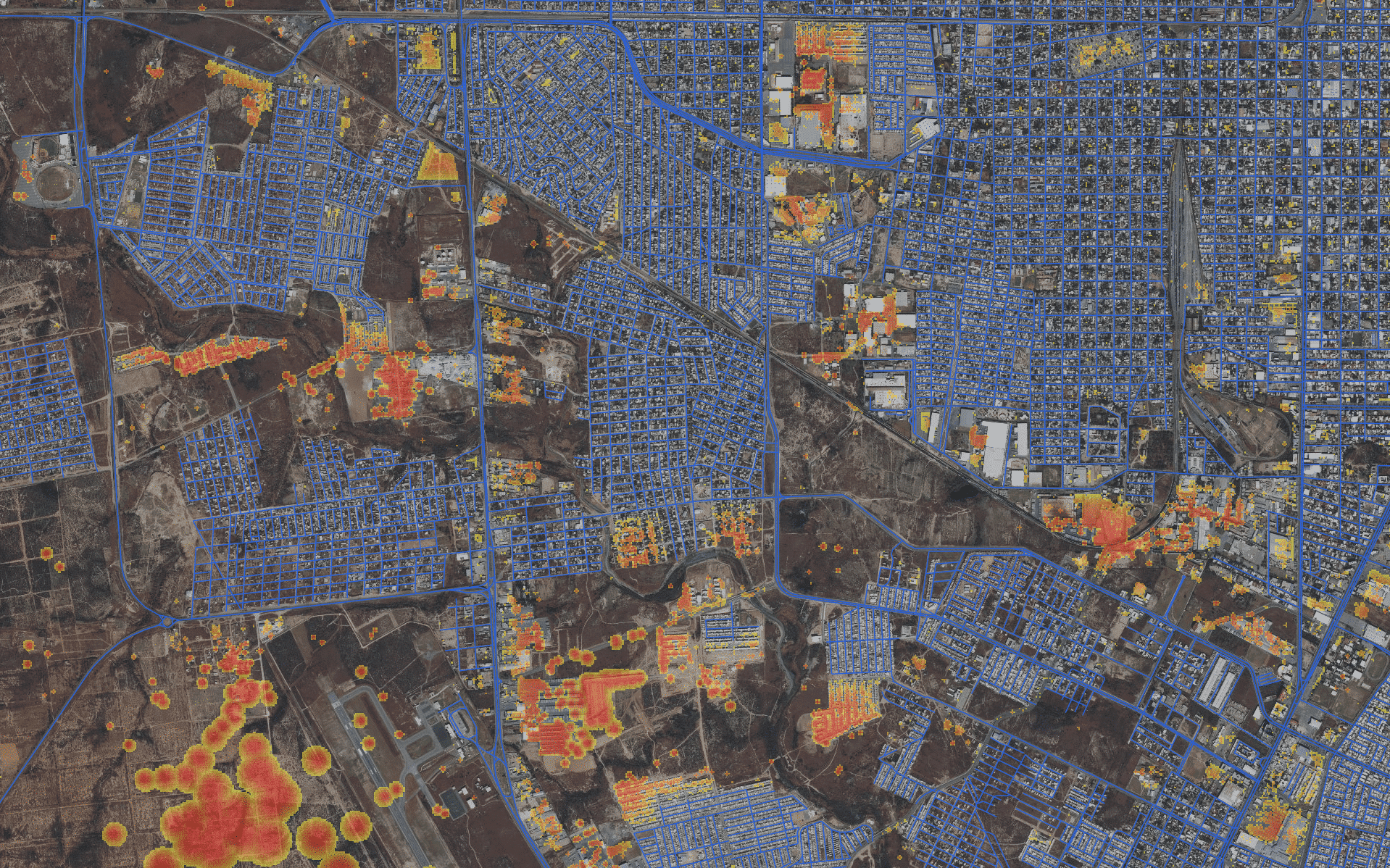

Thackray says that while the stock looks like it’s been forming a base in recent weeks, there’s no clarity on whether the next break will be up or down.

“If you look [at the chart], what’s happening here is that we’re still basing,” said Thackray, research analyst for Horizons ETF, to BNN Bloomberg on Wednesday. “The longer the base, the greater the case, [but] we can’t tell yet, it’s really just consolidating.

“If it breaks out and goes up then that’s actually a positive,” he says. “If it builds that base, it can move higher or, if it goes down, that also says that’s the new trend. The consolidation base establishes the trend to be either up or down. And right now, we don’t know which one it is. I know it has gone down a lot, but it still could go down more.”

Maxar’s latest quarterly results came on February 28 when the space tech company posted fourth quarter revenue of $496 million, which was below analyst expectations of $560.3 million, and a net loss of $950 million or $16.10 per share, which compared to a profit of $55 million or $0.99 per share a year earlier. The company’s debt has also been noted as a problem, with its long-term debt load growing to $3.03 billion for the period ended December 31, 2018, down from $3.94 a year earlier. (All figures in US dollars unless indicated otherwise.)

Thackray says that on a fundamental basis there are red flags flying, as well.

“They did lose a satellite and they changed their accounting method to US GAAP, so there’s a lot of stuff going on, and I really have to question, when all of that noise is going on, do you want to be in that?” he says.

“You have to really know the company and get down to the nitty gritty when you’re trying to do that real buy at the bottom, and that makes it tough,” Thackray says.

“So, right now on a seasonal basis I wouldn’t be touching this and on a fundamental basis there’s so much going on,” he says.