Investors looking to get in early on a name that could become a leader in the renewable natural gas space should take a close look at Xebec Adsorption (Xebec Adsorption Stock Quote, Chart TSXV:XBC), says M Partners analyst Andrew Hood.

Investors looking to get in early on a name that could become a leader in the renewable natural gas space should take a close look at Xebec Adsorption (Xebec Adsorption Stock Quote, Chart TSXV:XBC), says M Partners analyst Andrew Hood.

In a research report to clients today, Hood initiated coverage of Xebec with a “Buy” rating and a one-year price target of $2.20, implying a return of 71 per cent at the time of publication.

Hood says that after several years of false starts, Xebec now has clear momentum.

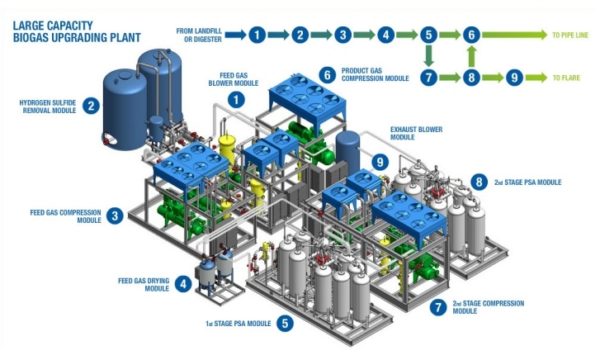

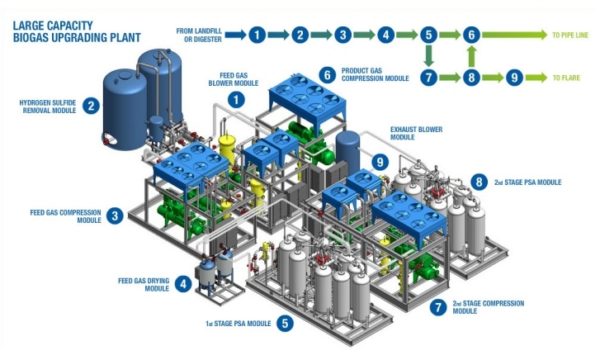

“Xebec is a leading cleantech provider in the early stages for renewable natural gas,” the analyst notes. “XBC systems provide the most reliable, low-cost performance for upgrading biogas to pipelinequality RNG. With the premium cost of RNG acting as a barrier to acceptance by utility regulators, lower-cost systems enjoy a competitive advantage. Xebec is gaining traction, increasing order backlog from $16.7M to $71.4M over the past year.”

The says Xebec is essentially facilitating mandated demand.

“Government support for GHG reduction globally supports investments in RNG infrastructure, with many policies mandating minimum biomethane content,” he adds. “RNG presents the simplest, most reliable solution, with 95% reduction in carbon emissions vs. fossil natural gas, and the flexibility to inject directly into the existing grid. For countries to meet emissions reduction goals, they must invest over the next few years. The market for equipment sales is over $6B in Xebec’s target markets (France, Italy, United States and Canada) for roughly 1,700 potential projects. Investments are already underway, with a $51M order from Sapio in Italy and a $5.5M contract from Enbridge in Toronto over the past year. In the U.S., the opportunity lies in 120-160 landfill sites, at $15-25M for a biogas upgrading contract.”

Hood thinks Xebec will post EBITDA of $1.5-million on revenue of $24.0-million in fiscal 2018. He expects those numbers will improve to EBITDA of $3.8-million on a topline of $45.0-million the following year.

The analyst concludes that Xebec has “massive potential” extending far beyond his admittedly short-term target.

“For the purposes of our target price, our valuation is based on a short-term forecast – longer term we believe Xebec will only continue to generate value for shareholders,” Hood adds. “Since our forecast is focused on the short term, we do not factor in any contributions from the BOO or Power-to-Gas segments, which could ultimately contribute half of Xebec’s revenues in the long-term. We also note that even our short-term forecast would need to be revised in the event that Xebec signs even one landfill order in the U.S. A single order could add $15-25M in revenues and $3.7-7.5M in EBITDA on top of our forecast. Management has guided for $40M in revenues in 2019 as the conservative scenario, and they believe they are likely close to $50M, or $75M with a landfill order. EPS guidance is $0.05 to $0.07 for the year, and we are modelling on the low end.”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment