“This is a tough one. The company really screwed up badly and the stock went from close to ten dollars to around a dollar. Then it was put up for sale and nobody wanted to buy it, and so investors are saying, ‘Now, what do we do?’” says Hodson, founder and head of research at 5i Research, to BNN Bloomberg on Wednesday.

“They still have two real issues. One is execution on earnings: they have a very volatile earnings history, based on what’s going on at the time in the quarter. And two, they still have a pretty big debt level,” he says.

Last week, DHX reported its second quarter results for its fiscal 2019, featuring EBITDA of $22.0 million and revenue of $117.0 million, down from $121.9 million a year ago. Both its top and bottom lines came in moderately below the consensus estimates.

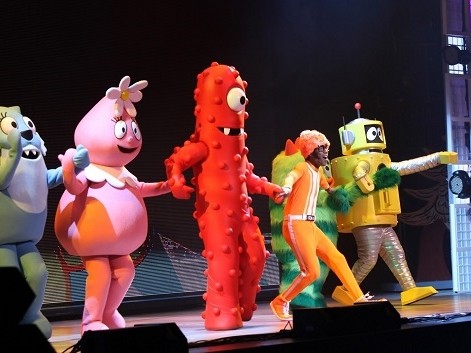

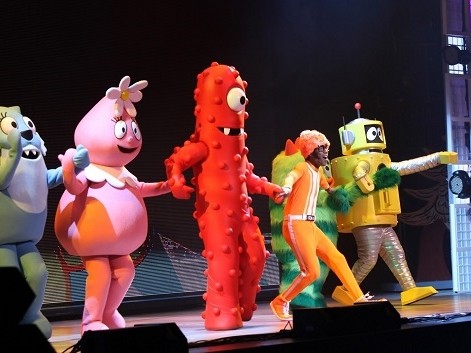

At the same time, the company’s internet-focused subsidiary WildBrain had its best quarter yet with revenue up 13 per cent to $19.9 million. Management also announced a company reorganization, effectively splitting DHX into two subsidiaries, one comprised of its production studios and TV business and the other made up of global distribution and merchandising.

“In our second quarter, we made progress against our three strategic priorities of producing premium content, growing WildBrain and improving cash generation,” said Michael Donovan, Executive Chair and CEO, in a press release. “We signed the largest content deal in the history of the Company, which we believe will contribute steady EBITDA for the coming years, and WildBrain continued to deliver double-digit growth. We also experienced a seven per cent rise in consumer products revenue from Peanuts. Our strategic shift and disciplined cost management contributed to positive cash flow and allowed us to pay down $9.5 million of our debt in the quarter.”

Hodson advises that investors stay on the sidelines for a while longer.

“We’d like to like this company a little bit more. They’ve got a very valuable library. There’s value there if they can make the deals. They just haven’t been able to make the deals as fast as investors were expecting,” he says.

“I’d give this one a couple more quarters. We really didn’t like it and now we’re just kind of neutral towards it,” he says.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment