Vancouver-based IoT firm Universal mCloud Corp. (Quote, Chart TSXV:MCLD) announced its second quarter 2018 financials today, with the company providing what Echelon Wealth Partners analyst Ralph Garcea calls a positive corporate update.

Vancouver-based IoT firm Universal mCloud Corp. (Quote, Chart TSXV:MCLD) announced its second quarter 2018 financials today, with the company providing what Echelon Wealth Partners analyst Ralph Garcea calls a positive corporate update.

MCLD’s second quarter pro forma results include a 26 per cent quarter-over-quarter revenue increase and what management described as Adjusted EBITDA that is tracking in the right direction.

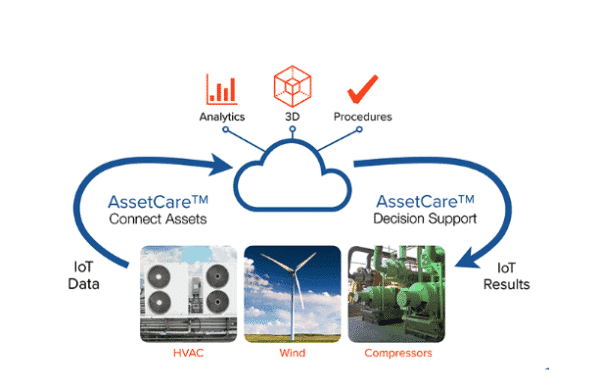

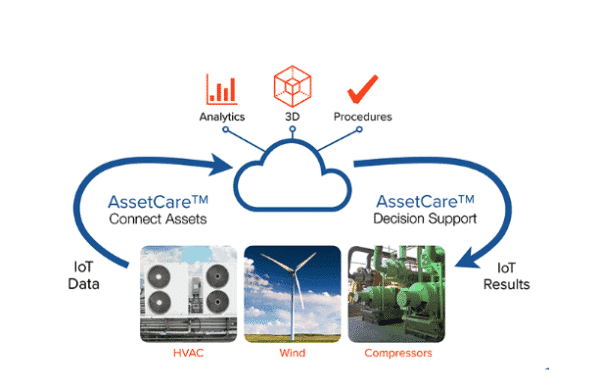

“Q2 was another quarter of robust growth in the aggregate of the technology segments we have been combining to form mCloud’s AssetCare Platform,” CEO Russel McMeekin said. “We remain focused on improving our balance sheet, ensuring we continue to build the high-margin recurring revenue base that is driving us towards profitability. Our continued improvement of working capital via capital from the exercise of warrants supports our acquisitions plan. We continue to build solid momentum in all aspects of our business and expect a robust second half of 2018 which will position us well for continued growth into 2019.”

In response, Garcea has maintained his “Speculative Buy” rating and DCF-based price target of $1.50, representing a projected 12-month return of 150 per cent at the time of publication.

“MCLD announced pro-forma results (of all acquisitions pending and closed) of $3.0 million versus $2.4 million q/q and our $2.8 million estimate,” says Garcea in a client update on Thursday. “Gross margin was 64 per cent due to the technology operating leverages at play. Pro-forma Adjusted EBITDA continued to trend towards break-even, coming in at negative $0.3 million versus negative $0.4M q/q.”

“MCLD is currently trading, on our estimates, at a 2018E EV/Sales of 2.9x versus its Supply Chain Management SaaS comparables at 8.2x/8.1x, respectively,” he says.

The analyst has revised his estimates for 2018, now calling for revenue of $9.30 million (was $11.55 million), EBITDA of $2.87 million (was negative $1.43 million) and EPS of negative $0.08 (was negative $0.03).

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment