Biopharmaceutical company Bellus Health Inc. (Bellus Health Stock Quote, Chart, News: TSX:BLU) is developing a cough treatment drug that could have widespread application, says analyst Andre Uddin from Mackie Research Capital Corporation, who gives BLU a “Speculative Buy” rating and one-year target price of $1.00.

On Thursday, Bellus Health released its financial and operating results for the year ended December 31, 2017, reporting Q4 revenues of $0.0 million and net income of $-1.6 million. The company is all cashed up, having zero debt on its balance sheet and $23.9 million in cash after closing in December on a $20 million in financing led by Bloom Burton Securities Inc.

“2017 has been a very productive year for BELLUS Health, beginning with the in-licensing of our new lead program BLU-5937, that has the potential to be a best-in-class treatment for chronic cough, and closing the year with a $20 million financing, a testament to the potential of the program,” said Roberto Bellini, President and Chief Executive Officer of BELLUS Health, in a press release.

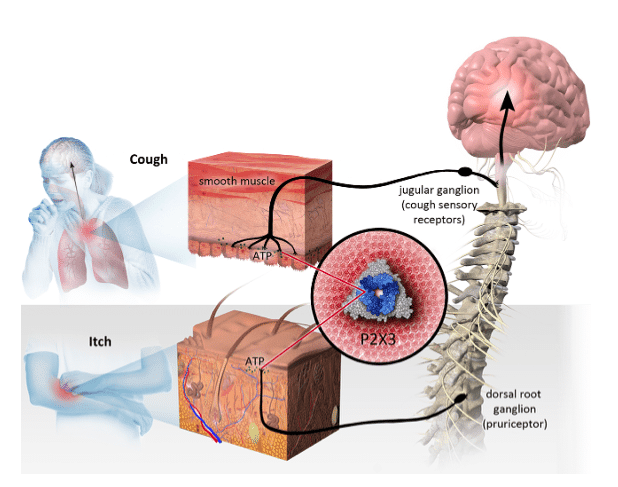

Last September, Bellus announced positive results from preclinical models for the chronic cough drug BLU-5937. Over 26 million patients suffering from chronic cough in the United States alone, and no new drugs have been approved for 50 years to treat the condition, leading to wide potential application for BLU-5937.

Uddin reports that pharmaceutical giant Merck paid $500 million USD in upfront and $750 USD in contingent value for Afferent Pharmaceuticals and its Phase 2 cough drug candidate, MK-7264.

“In our model, we assume that BLU-5937 is out-licensed after Phase II trails (2020) for $150 million CDN in upfront and $450 CDN in milestones,” says the analyst in a report to clients on Wednesday. “We believe BLU-5937 is a promising early-stage drug candidate in development to treat chronic cough, which has best-in-class potential.”

The analyst is maintaining his “Speculative Buy” rating for BLU and a one-year price target of $1.00, representing a projected return of 182 per cent at the time of publication.

The analyst’s rating is based on a two-stage probability-adjusted discounted cash flow methodology.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment