Weed stock Maricann Group gets price target raise at Canaccord Genuity

Weed sector investors should keep their eye on Maricann Group (CSE:MARI), Canaccord Genuity analyst Neil Maruoka says.

Weed sector investors should keep their eye on Maricann Group (CSE:MARI), Canaccord Genuity analyst Neil Maruoka says.

On Wednesday, Maricann announced it planned to acquire Swiss-based Haxxon AG, which operates in a 60,000-square-foot facility where it cultivates female hemp cannabis flowers with less than one per cent THC, to the European market.

Maruoka says this is a small “tuck in” acquisition that should further MARI’s European footprint and provide a foothold for the company in Switzerland, where it may be able to sell value-added products and extracts.

The analyst says with sky high valuations in the cannabis sector, Maricann Group looks appealing with a two-year forward EV/EBITDA estimate of 13.2x versus peers at 21.8x.

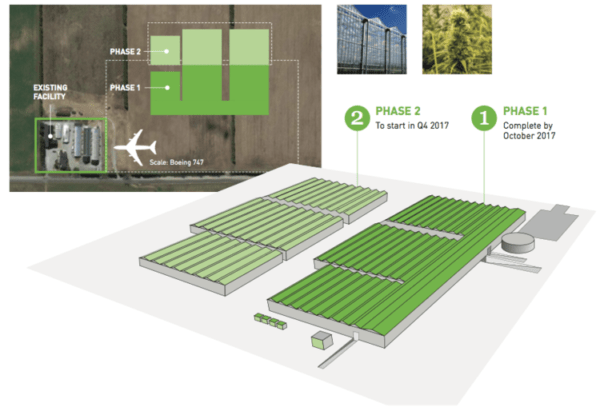

“We believe Maricann presents a combination of low-cost production, true global diversification, and attractive valuation,” the analyst says. “Near-term news on Maricann’s German licensing status and completion of the first 22,500 kg of its new production facility could provide significant catalysts for the stock.”

In a research update to client today, Maruoka maintained his “Speculative Buy” rating, but raised his one-year price target on the stock from $4.25 to $4.50, implying a return of 7.1 per cent at the time of publication.

Maruoka thinks Maricann will generate EBITDA of negative $14.9-million on revenue of $4.0-million in fiscal 2017. He expects those numbers will improve to EBITDA of positive $4.4-million on a topline of $30.0-million the following year.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.