Its third quarter was a bit of a disappointment, but Canaccord Genuity analyst Neil Maruoka is sticking to his guns on Maricann Group. (CSE:MARI).

Its third quarter was a bit of a disappointment, but Canaccord Genuity analyst Neil Maruoka is sticking to his guns on Maricann Group. (CSE:MARI).

On Tuesday, Maricann reported its Q3 results. The company posted an Adjusted EBITDA loss of $5.43-million on revenue of $721,000, a topline that fell below Maruoka’s estimate of $1.1-million. But the analyst says he isn’t that bothered by the results.

“We do not believe that quarterly performance is particularly important during the early stages of growth for cannabis companies; nonetheless, we have revisited our financial assumptions for 2017 and 2018, where we had underestimated G&A spend over the next five quarters,” Maruoka says. “Because this change is restricted to a short ~one-year period, the impact to our valuation is nominal. Further, we have adjusted the depreciation schedule to reflect Maricann’s reported D&A. Following these changes, our adjusted EBITDA forecasts decline through next year; however, this is largely offset in our EPS estimates over that period due to lower depreciation expense (which has no impact on our valuation).

In a research update to clients today, Maruoka maintained his “Speculative Buy” rating and one-year price target of $4.25 on Maricann Group, implying a return of 102.4 per cent at the time of publication.

Maruoka thinks Maricann will generate EBITDA of negative $14.9-million on revenue of $4.0-million in fiscal 2017. He expects those numbers will improve to EBITDA of positive $1.9-million on a topline of $23.0-million the following year.

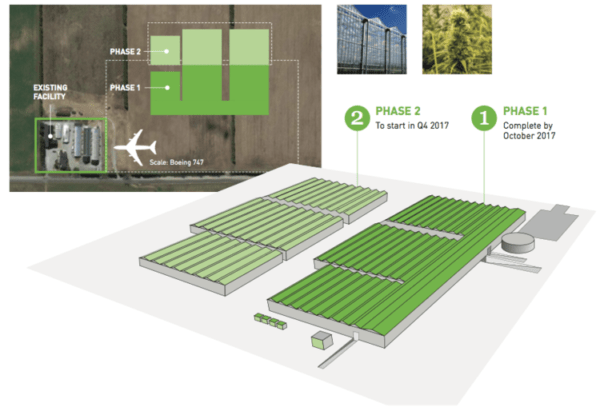

“We believe MARI presents a combination of low-cost production, global diversification, and attractive valuation,” Maruoka adds. “We await near-term news on Maricann’s licensing status in Germany, as well as the completion of the first phase of its new 25,000 kg production facility, both of which could provide significant catalysts for the stock.”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment