Here’s Canaccord Genuity’s new top pick in the cannabis space

The first mover advantage is real in the cannabis sector, but recent developments have opened the door for new entries, says Canaccord Genuity analyst Neil Maruoka.

The first mover advantage is real in the cannabis sector, but recent developments have opened the door for new entries, says Canaccord Genuity analyst Neil Maruoka.

In a research report to clients this morning, Maruoka initiated coverage of three marijuana stocks; Maricann Group (CSE:MARI), Cronos Group (TSXV:MJN), and Invictus MD Strategies (TSXV:IMH).

Maruoka says he has made some tweaks to his assumptions about the marijuana space of late. He now believes that production issues will reduce near-term supply, but thinks that gap will be filled because of the influx of production licenses, a development that will divide the market amongst a wider array of participants.

“Recent results suggest that many LPs have struggled to ramp production and have therefore missed consensus expectations for sales volumes,” the analyst says. “While such growing pains are to be expected, on the positive side, quarterly earnings also suggest that cannabis prices have climbed higher due to supply constraints. Further, we expect Health Canada’s move to facilitate new licences could intensify competition. Although we believe incumbent LPs have a distinct first-mover advantage with strong balance sheets and aggressive expansion plans, we still expect the growing number of new licencees will capture meaningful market share.”

Maruoka today launched coverage of Maricann Group with a “Speculative Buy” rating and a one-year price target of $5.00, implying a return of 265 per cent at the time of publication. The analyst says he now places this company alone as his top pick amongst Licensed Producers.

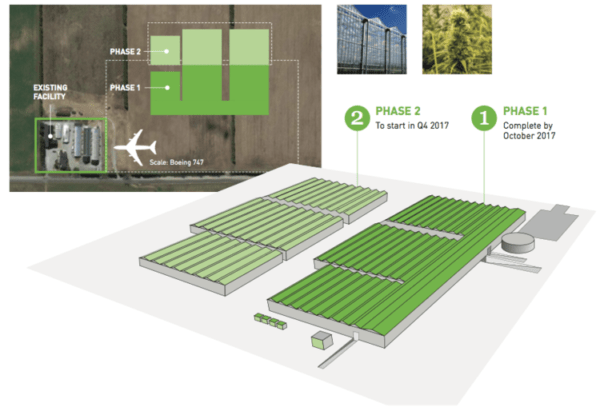

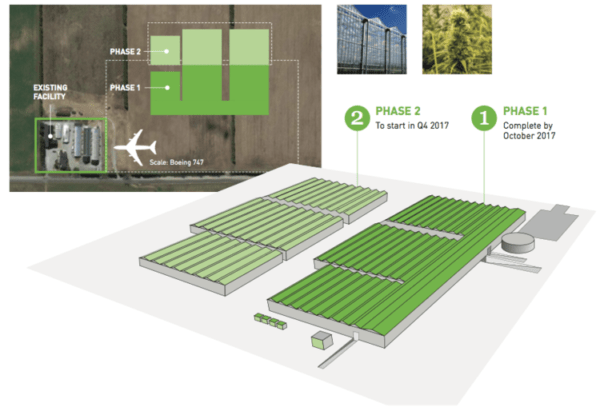

“With this initiation report, Maricann becomes our Top Pick amongst Canadian LPs,” the analyst says. “We believe that Maricann is positioned to become a top-10 producer of cannabis in Canada. The company is constructing the first phase of a planned 800,000 sq. ft., ~100,000 kg-capacity hybrid greenhouse and electricity co-generation plant that we project could drive production costs close to ~$1.35 per gram, and place Maricann as a low-cost operator in Canada. While we view Maricann’s Canadian business alone to be an attractive opportunity for investors, we believe the company is also well positioned to become a leading domestic cannabis producer in the emerging German medical market.”

Maruoka thinks Maricann will post EBITDA of negative $5.3-million on revenue of $6-million in fiscal 2017. He thinks those numbers will improve to EBITDA of positive $4.9-million on a topline of $23-million the following year.

Maruoka says a recent controversy for Cronos Group isn’t dampening his enthusiasm for the stock. The analyst today initiated coverage of it with a “Speculative Buy” rating and one-year price target of $3.00, implying a return of 75.4 per cent at the time of publication.

“Although Cronos recently announced a sizable expansion at wholly owned Peace Naturals, the stock is still down (33%) after trace levels of contaminants were found,” the analyst notes. “While we do not view this issue to be serious, Cronos is nonetheless the fourth LP to issue a product recall. However, as the company continues to build out its facilities and execute on its diversified strategy, we believe Cronos should justify a premium valuation to peers. Cronos currently trades at 7.1x funded capacity.”

Maruoka thinks Cronos Group will post EBITDA of negative $2.3-million on revenue of $9-million in fiscal 2017. He thinks those numbers will improve to positive $13.0-million on a topline of $44-million the following year.

Finally, Maruoka today launched coverage of Invictus MD Strategies with a “Hold” rating and one-year price target of $1.35, implying a return of 22.7 per cent at the time of publication.

“Led by crown jewel Acreage Pharms, Invictus has acquired a portfolio that we believe provides investors with moderate diversification. Although Acreage is a blue-chip prospect, we do not believe a premium valuation is warranted due to the time/risk involved with expansions, obtaining sales licences, and implementing its oil strategy. Invictus trades at 5.3x funded capacity (a discount to peers), which we believe is reasonable at this stage of development.”

Maruoka thinks Invictus MD Strategies will post EBITDA of negative $4.0-million on revenue of $3.0-million in fiscal 2018. He expects thoe numbers will improve to EBITDA of positive $6.4-million on a topline of $25.0-million the following year.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.