Nanotech Security is undervalued, says Haywood

Haywood analyst Pardeep Sangha says next-generation anti-counterfeiting firm Nanotech Security (Nanotech Security Stock Quote, Chart, News: TSXV:NTS) is undervalued.

Haywood analyst Pardeep Sangha says next-generation anti-counterfeiting firm Nanotech Security (Nanotech Security Stock Quote, Chart, News: TSXV:NTS) is undervalued.

In a research report to clients Monday, Sangha initiated coverage of Nanotech with a “Buy” rating and a one-year price target of $2.00, implying a return of 62.6 per cent at the time of publication, though the analyst categorizes the overall risk rating on the stock as “very high”.

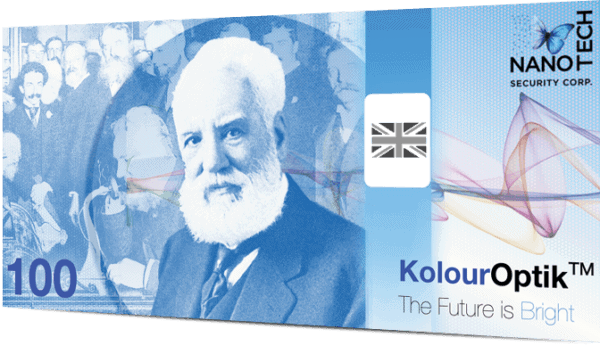

Sangha says the opportunity for Nanotech, whose KolourOptik technology produces rich hologram-like images that are extremely difficult to copy, is immense.

“Nanotech develops next-generation anti-counterfeiting products, initially targeting the banknote industry,” explains the analyst. “Counterfeiting is a US$650B per year problem across numerous industries including banknotes, secure documents, ticketing, commercial branding, and pharmaceuticals. We believe Nanotech is at a growth inflection point as it transitions from research to commercialization stage with several large growth initiatives.”

Sangha notes that Nanotech recently announced a five-year $30-million development contract and expects to ship its Optical Thin Film to a large Asian banknote issuing authority later this year. He thinks this points to one conclusion.

“We believe KolourOptik has the potential to disrupt the banknote industry,” he says.

Sangha thinks Nanotech Security will generate EBITDA of zero on revenue of $10.5-million in fiscal 2017. He expects these numbers will improve to EBITDA of $4.6-million on a topline of $21.5-million the following year and then to EBITDA of $14.9-million on revenue of $41.0-million in fiscal 2018.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.