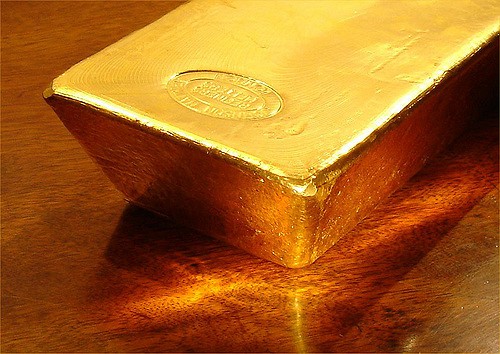

GoldMoney Inc’s acquisition of Schiff Gold makes sense, says Mackie

Mackie Research Capital analyst Nikhil Thadani thinks GoldMoney’s (GoldMoney Stock Quote, Chart, News: TSXV:XAU) recently announced acquisition of Schiff Gold could spike the former’s organic growth.

Mackie Research Capital analyst Nikhil Thadani thinks GoldMoney’s (GoldMoney Stock Quote, Chart, News: TSXV:XAU) recently announced acquisition of Schiff Gold could spike the former’s organic growth.

On July 8, GoldMoney announced it had entered into an agreement to acquire retail gold dealer Schiff Gold Inc. and to form a marketing and service agreement with Peter Schiff. Schiff Gold generated more than $2.8-million in gross profit in 2015.

“Peter is the LeBron James of the gold market with hundreds of thousands of trusted followers and an unrivalled track record in predicting some of the most important macroeconomic events of the last 20 years,” said GoldMoney CEO Roy Sebag. “Following an initially heated public debate in March, Peter and I struck a private friendship. Through in-person meetings and many thoughtful conversations it became clear to both Peter and I that we shared the same vision and goals, that Peter was motivated by the same mission that guided us, and that his business and brand could be better leveraged using the Goldmoney technology. I am extremely excited to be welcoming Peter to the Goldmoney tent and I believe his millions of followers will be much better monetized through a platform that can economically service a global user base with no minimums, superior technology, and multiple deposit and redemption options. We will unveil the full combination strategy at closing.”

Thadani thinks there are natural synergies between the pair.

“We would not be surprised to see XAU’s organic growth benefit strongly,” says the analyst. “Mr. Schiff adds meaningful marketing muscle to XAU with ~38 mln YouTube channel views, ~400K users in database and tens of thousands of users transacting. A key hurdle for Schiff Gold has been $10K minimums & wire transfer transactions; two pain points XAU can smooth. Overall, with ~2-3% equity dilution XAU immediately benefits from ~30% Gross Profit accretion (run-rate basis), before marketing benefits or revenue/cost synergies.”

In a research update to clients today, Thadani maintained his “Speculative Buy” rating and one-year price target of $7.00 on GoldMoney, implying a return of 31 per cent at the time of publication.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.