Nanotech Security is still undervalued, says Cantor Fitzgerald Canada

Cantor Fitzgerald Canada analyst Ralph Garcea says a prestigious award is further validation of Nanotech Security’s (Nanotech Security Stock Quote, Chart, News: TSXV:NTS) technology. And despite a recent run in the company’s shares, the analyst think there is still plenty of upside to be had in Nanotech.

Cantor Fitzgerald Canada analyst Ralph Garcea says a prestigious award is further validation of Nanotech Security’s (Nanotech Security Stock Quote, Chart, News: TSXV:NTS) technology. And despite a recent run in the company’s shares, the analyst think there is still plenty of upside to be had in Nanotech.

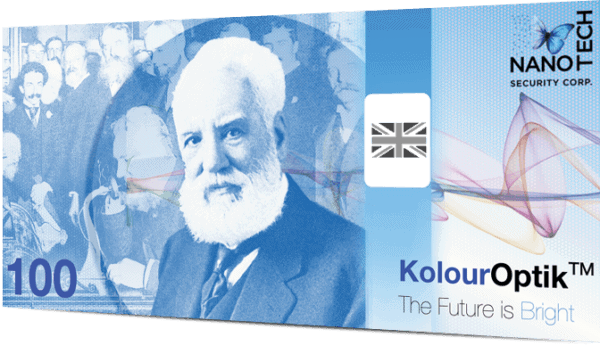

Yesterday, Nanotech Security issued a press release congratulating the National Bank of Kazakhstan on their award winning 20,000 Tenge banknote, a banknote that includes Nanotech’s colour shift optical thin film (OTF) technology. The award was presented by Reconnaissance International at the High Security Printing Europe conference earlier this month in Bucharest, Romania. It recognizes outstanding achievement in the design, technical sophistication, and security of a banknote.

“We are pleased to have our colour shift OTF in the Bank of Kazakhstan’s award winning banknote,” said CEO Doug Blakeway. “Our colour shift OTF threads and patches have now been designed into more than 10 banknotes around the world and we continue to see strong interest from issuing authorities for our colour shift OTF and other security feature platforms.”

Garcea says currency is just one of the large markets that Nanotech is addressing. He notes that the addressable market for Optical Variable Devices is approximately $1 to $2.5 billion annually, half of which is comprised of branded commercial products and one-third for government security documents. The analyst says this validation of the company’s technology bodes well for progress in all verticals it is addressing.

“This award recognizes outstanding achievement in the design, technical sophistication, and security of a banknote,” he says. “NTS’ security products produce intense, high definition optically-variable images and colour-shift optical thin films (“OTF”). Activated by a simple tilt or rotation, with higher resolutions than the best LED-displays, the images are ideal for authentication of currency, passports, and identification cards in addition to distinguishing branded goods from counterfeits. NTS’s contracts are long-term in nature, with an IP licensing driven business model.”

In a research update to client today, Garcea maintained his “Buy” rating and one-year target price of $2.50, implying a return of 95 per cent at the time of publication.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.