This report was adapted by Cantech Letter from a piece prepared by Sophic Capital. For the original report, and more in-depth research, please visit Sophic Capital’s website, here.

This report was adapted by Cantech Letter from a piece prepared by Sophic Capital. For the original report, and more in-depth research, please visit Sophic Capital’s website, here.

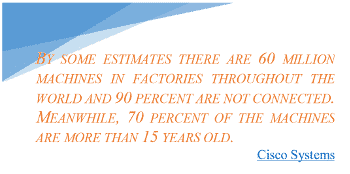

We live in a data-driven society where we’re constantly connected to each other. Now the Internet of Things (IoT) is connecting “things” together. But one industry lags when it comes to connecting “things”. Most industrial plant managers, CEOs and CFOs don’t know what’s happening on their shop floors since their manufacturing machines are “islands of automation” that aren’t connected to each other, or able to report on their productivity in real-time. One public Canadian company has solved this problem. Leading manufacturers are purchasing this company’s “industrial” IoT, or IIoT, solution and seeing significant returns with an average Internal Rate of Return of 300%, which means payback in 4 months or less. Manufacturers aren’t the only ones recognizing this company; Cisco Systems and Mazak Corporation have formed alliances with it to conquer the IIoT opportunity.

Why You Need to Read this Report

Why You Need to Read this Report

- Discover the Industrial Internet of Things (IIoT), and find out how big the long-term market opportunity could be – hint: not “billions” but “trillions”;

- Learn how manufacturing evolved from hand tools to big data on machine shop equipment;

- Unearth established technologies that will benefit from the next industrial revolution;

- We reveal ways for investors to get exposure to IIoT, including a public Canadian company that not only is selling products but has also recently formed an alliance with a tech giant and one of the world’s biggest machine tool manufacturers, and;

- We look at some real world case studies and quantify the operational and financial benefits from adopting IIoT.

Introduction

A revolution is starting in manufacturing: automatically measuring the real-time productivity of machines on factory floors. Most manufacturing machines are not equipped with analytic software to measure, monitor, and optimize performance metrics. Managers in these shops can capture a vital metric called Overall Equipment Effectiveness or “OEE”, albeit not in real-time or accurately. The norm is that workers manually record downtime and associated performance issues on clip-boards then enter the numbers, or have someone else enter the numbers, into Excel. It’s not an accurate or efficient method to collect data that is compiled long after an issue could have already been fixed, and can result in mis-statements of this vital productivity metric by 50% or more.

Professional services company Accenture estimates IIoT’s contribution to the global economy could be as high as $14.2 trillion by 2030. With IIoT, manufacturers are now networking their machines to extract and analyze machine data. In this report, we highlight MEMEX Inc. (TSXV:OEE), a Sophic Capital client already grabbing a piece of the Industrial Internet of Things (IIoT) market with existing customers fully deploying across their footprints. The Company also has a partnership with Cisco Systems (NASDAQ:CSCO) and Mazak USA (private) to specifically address the IIoT opportunity. But before we delve into the IIoT, we will discuss its parent: The Internet of Things (IoT).

Internet of Things – Let the Machines Speak

The Internet of Things (IoT) is a term coined by British visionary named Kevin Ashton in 1999 to describe the connection of machines so that they can communicate with each other and make our lives better. Until recently, the flow of information was dependent upon people. Now, machines are adding their say and adjusting themselves and other machines to make human life easier. Imagine your refrigerator checking its contents, then sending your smartphone a message that you need milk. Or how about a highway that detects weather changes, traffic jams, and accidents and displays this information on signs (or in a few years directly to your eyes through augmented reality glasses)? Or, for the purposes of this report, improving the OEE of both new and legacy manufacturing equipment to drive out inefficiencies so entire plants and multi-plant installations are connected and reporting real time productivity analytics. These examples demonstrate the potential benefits of measuring what machines are “seeing” and doing and then collecting that information and using it to make better decisions.

IoT is more than the connection of machines. IoT relies upon data collection and converting those ones and zeros into information. That data is usually stored in databases, often inside the manufacturing enterprise but sometimes in cloud-based data stores. This means that Internet connections, the supporting networking gear, and network security infrastructure are required to facilitate this data transfer.

Market Opportunity

IoT

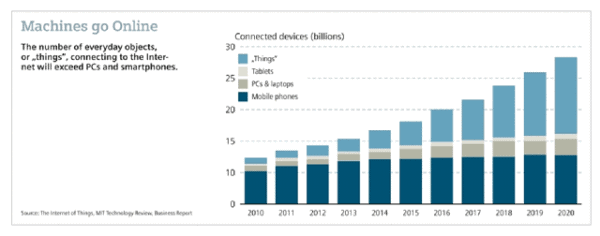

The number of connected devices is more than double the number of people on Earth. Connecting every device, every “thing” is a daunting task. All of these connected “things” will require a lot of sensors. Juniper Research estimates that there were 13.4 billion IoT devices connected in 2015 and that could grow to 38.5 billion by 2020, a 285% increase. Eventually, it is expected the number of “things” that become Internet nodes will exceed the number of PCs, tablets, and smartphones (Exhibit 1).

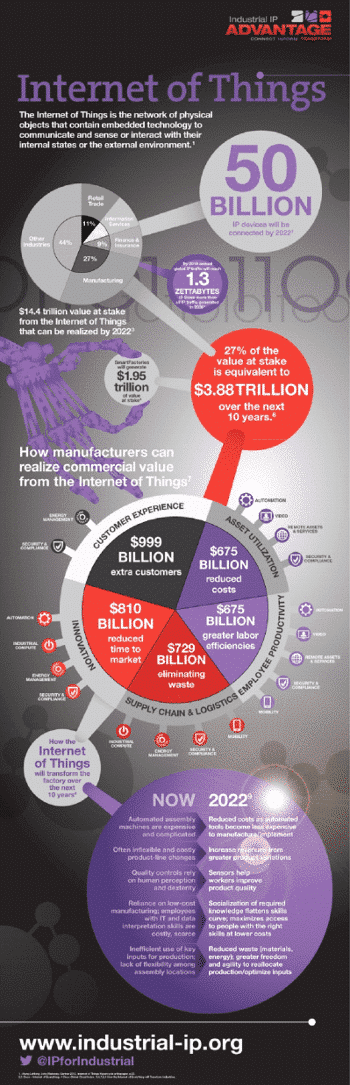

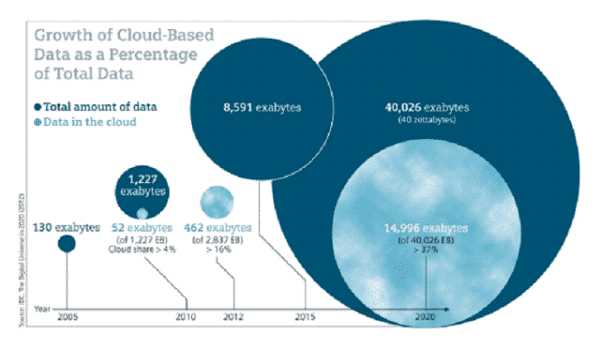

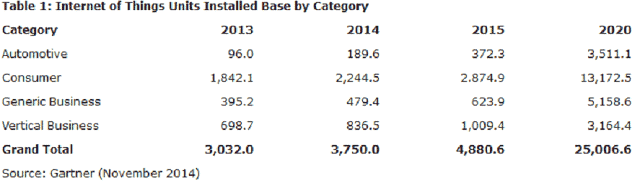

McKinsey & Company believes that IoT could have a $6.2 trillion impact on the global economy by 2025. The firm has stated that 20 to 30 billion devices could be connected by 2020, and that about 10% of IoT value could come from “things” while the balance of value could come from connecting the “things” to the Internet. Gartner has also weighed in with its forecast – 6.4 billion connected things by 2016 (a 30% year-over-year increase) and potentially 21 billion things by 2020. Connecting these billions of things will require storage; by 2020, the cloud will hold upwards of 37% of all data (Exhibit 2). Gartner also believes that consumer installations will dominate IoT unit deployments through 2020 (Exhibit 3). And rounding out the IoT market forecasts, research firm MarketsandMarkets says it could be worth $151 billion by 2020.

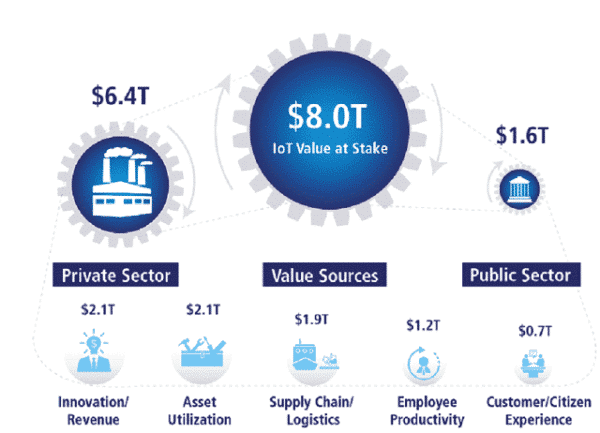

In 2013, Cisco forecasted a $19 trillion Internet of Everything (IoE) market opportunity. IoE includes not only “things” but also people and data. Cisco anticipates that IoE could become a $1.7 trillion service provider market from 2013 through 2023 and that 50 billion people, data, and things could be connected by 2020. IoT alone will generate $8 trillion value at stake over the next decade (Exhibit 4) according to a DHL (private) report written with Cisco Consulting Services. Cisco recently reaffirmed their conviction about the IoE market opportunity: On February 4, 2016 Cisco announced it largest acquisition since 2013 when it acquired Jasper Technologies, a start-up that connects things like cars and medical devices to the Internet, for US$1.4 billion.

IIoT

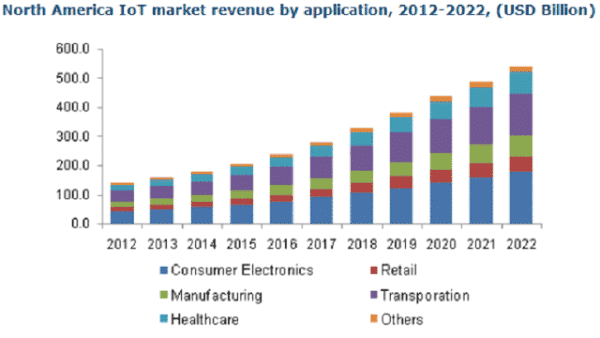

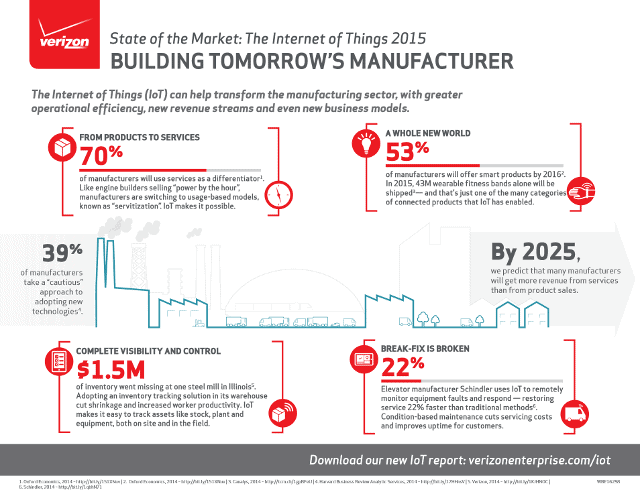

For the manufacturing industry, IIoT has the potential to grow from $42.2 billion in 2013 to $98.8 billion in 2018 (18.6% CAGR). IDC, the research firm that created the forecast, believes that efforts to increase efficiency and link islands of automation will be the drivers behind this growth. Exhibit 5 shows how IIoT (manufacturing) could scale in North America through 2022.

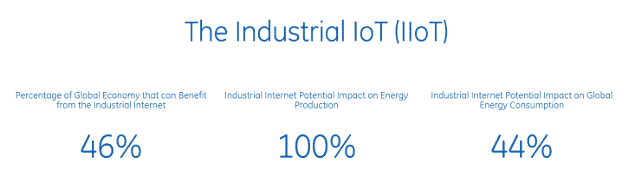

Accenture pegs IIoT’s contribution to the global economy as $14.2 trillion by 2030. The firm also states that 87% of business leaders surveyed believe that IIoT will result in the net creation of jobs.

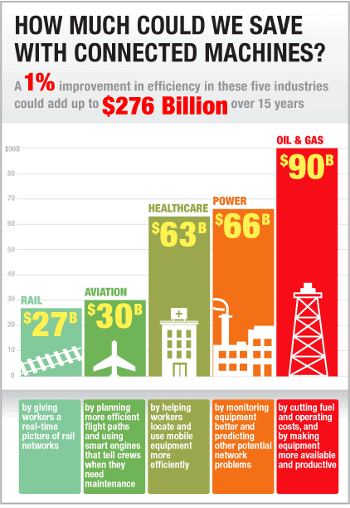

General Electric (NYSE:GE) is bullish on industrial Internet of things (IIoT). The Company believes that IIoT could add $15 trillion to global GDP over the next 20 years and there could be 50 billion connected devices by 2020.

A History of the Industrial Evolution

IIoT is revolutionizing the manufacturing industry. Given this, we believe it’s useful to provide a background on how and why IIoT became prominent within the industrial market. You’ll often hear the four stages of industrialization.

The First Industrial Revolution began with the introduction of mechanical tools. Society became urbanized in the 18th and 19th centuries – both in the United Kingdom and the United States – as people moved from farms to cities. Iron and steel became prevalent work materials and fostered the creation of new technologies including the steam engine (1698) and the loom (1801). The steam engine was particularly important to the First Industrial Revolution as it removed the reliance upon waterwheels to spin machines.

The Second Industrial Revolution saw the era of mass production around the late 1800s. Electric-powered factories allowed cheap sources of power and lighting for late morning/night operations. Assembly lines, like those exemplified by Henry Ford, dropped unit production costs and increased factory revenues.

The Third Industrial Revolution saw innovative inventors take advantage of computers to create control systems on factory floors. This occurred during the mid-20th century and drove assembly line efficiencies. Computer numerical control (CNC) machines entered manufacturing facilities, reading computer aided drawing (CAD) files in order to turn blocks and rods of metal into products and parts.

Now, the Fourth Industrial Revolution as exemplified by IIoT is expanding across the globe. IIoT is about machines, systems, and products communicating with each other. It’s about creating smart factories that will increase manufacturing flexibility, speed, and accuracy. These smart factories will track metrics such as machine utilization in order to optimize production.

Mastering the Fourth Industrial Revolution a Key Davos Theme

Technology’s future impact on industry was at the forefront at the 2016 World Economic Forum. Participants discussed technology’s role beyond manufacturing as integrated between the physical, digital, and even biological worlds. Several technological impacts involved predictive behaviour, where machines are monitored for optimal performance and humans are tracked for optimal health recovery outcomes. The technologies considered were extensive: sensors, robotics, artificial intelligence, and 3D-printed organs to name a few.

Making it All Work: Different Devices, Common Connection

Source: Practical Machinist

“I know exactly what is happening on my plant floor,” is what many shop managers will say – don’t believe them. This is known as Turner’s first law of manufacturing. What this law speaks to is the misconception occurring on many shop floors. Many manufacturers overestimate the operational efficiency of their machines. They do this because they have no means to measure what is happening within their shops – metrics are hunches obtained from clip-boards, spreadsheets, verbal and visual feedback rather than information extracted from real-time machine data trapped inside the machines themselves. Few shops monitor their machines in real-time. Why?

Most machine shops operate legacy equipment that do not output standard communication protocols. Getting legacy machines to communicate with each other has been expensive, time-consuming, and often unsuccessful. What’s been needed is something like Bluetooth to allow machines to “speak”.

MTConnect Enables Measurement

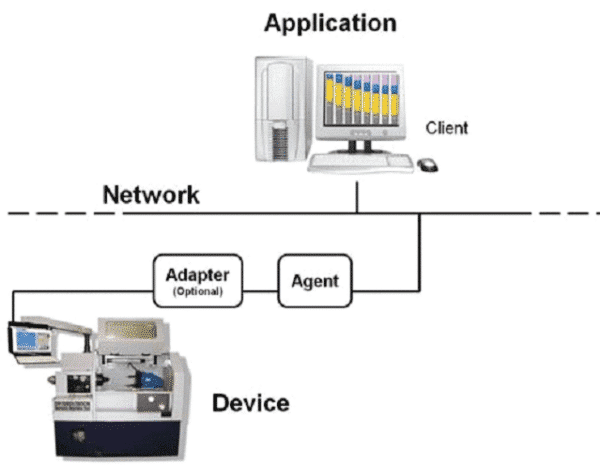

Released in 2008 and already common on new industrial machinery, MTConnect is an open-source, communication protocol that helps shop floor machines communicate with each other and computer programs. Co-founded by Dave Edstrom (currently the Chief Technology Officer of MEMEX Inc.) and Dr. David Patterson (currently a professor of Computer Science at the University of California at Berkley), MTConnect is the Bluetooth of the manufacturing world. Although MTConnect is a blessing for new machinery that “speak” the protocol, many legacy (pre-2008) machines which represent 70% or more of all machines in use today, aren’t MTConnect-enabled. In order to connect these legacy machines to the standard, an MTConnect adaptor and agent are required.

An MTConnect adaptor (Exhibit 6) is hardware that translates data output from legacy machines that still dominate today’s shop floors into the MTConnect standard protocol. Referring to Exhibit 6, an MTConnect agent reads the MTConnect adaptor output and stores the data, making it network ready and available (much like a Web server) for standard MTConnect software applications as needed.

Major shop floor OEM vendors have implemented MTConnect in their new machines including Mazak (private), Bosch-Rexroth (private), DMG-MORI (TYO:6141), GF AgieCharmilles (private), and Okuma (TYO:6103). All have extolled the benefits of MTConnect. But what are they trying to measure?

OEE: If you Can’t Measure it, You Can’t Improve it

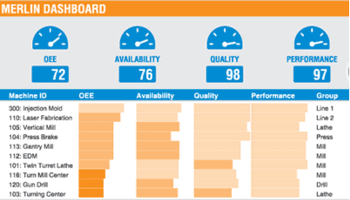

OEE is the measurement of how effectively a machine is utilized. Three ratios determine OEE: Availability, Performance, and Quality. “Availability” relates how much down time the machine had during a scheduled project. “Performance” is how much of the machine’s speed was lost during a project compared to the speed it was programmed to operate at. “Quality” refers to how many pieces were scrapped versus what should have been produced. Factoring these three ratios produces OEE. In other words:

OEE = (Availability) x (Quality) x (Performance)

IIoT will shift manufacturing from making products to producing business outcomes based on real-time availability of OEE metrics. Since MTConnect facilitates machine connectivity, manufacturers can focus on outcome-based technologies that facilitate the measurement of machine availability, performance, and quality. For example, many workers record this data on pieces of paper, then enter them into an Excel spreadsheet. This introduces human error and latency at many levels, which decreases the reliability of information from the data measured. For example, a worker could arrive at a machine that requires attention, repair the machine then record the time required to fix the machine. However, this type of reporting does not account for machine downtime prior to the worker noticing the offline machine. MTConnect for IIoT eliminates these types of human errors.

Source: BMW

The State of IIoT

We’ve all seen recent pictures of shop floors in manufacturing facilities. They look clean, high-tech, and worker-friendly. Now, manufacturers are (or at least thinking about) ways to extract data and then integrating that data into their processes in order to improve productivity.

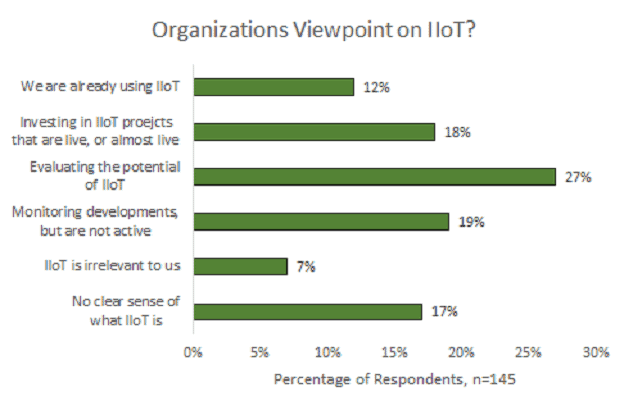

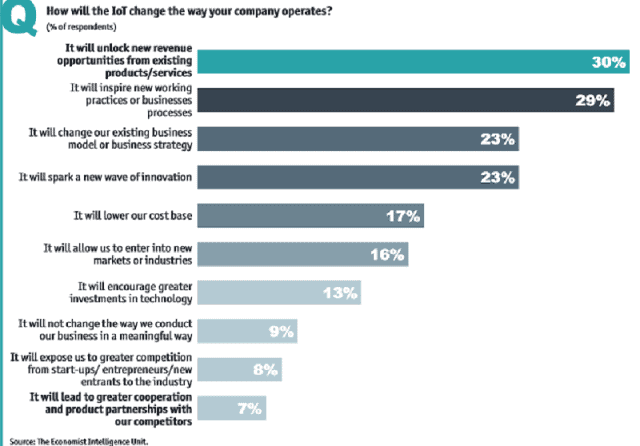

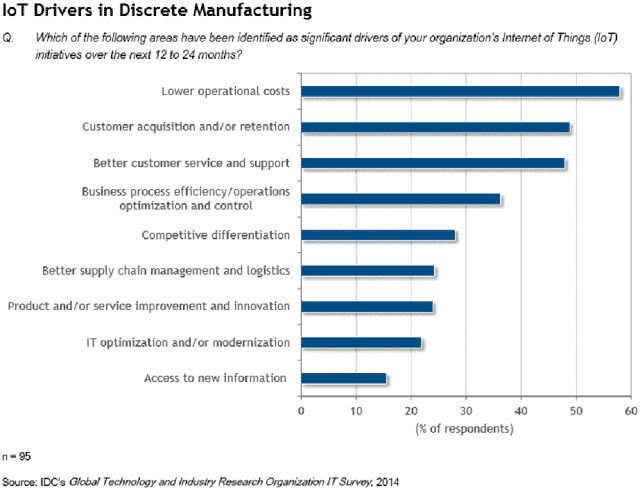

To give you an idea of how nascent the IIoT mega-trend is, only 12% of manufacturers are using IIoT (Exhibit 7). However, several organizations are implementing or evaluating IIoT solutions. Exhibit 8 details some of the drivers that will move manufacturers to implement IoT solutions, and Exhibit 9 shows how manufacturers foresee how IoT will benefit their businesses.

IIoT is beginning to be embraced around the world. Independent research firms and technology companies have accumulated data from the manufacturing world and several have created their own market forecasts. Consider these statistics:

“40% of manufacturers believe that smart manufacturing and its foundational technology – the Internet of Things (IoT) – are within reach and that it’s the right time to invest.”

Kevin O’Marah

The Internet of Things Will Make Manufacturing Smarter, Industry Week, August 14, 2015

“The projections for IoT impact are staggering. Analysts say the global economic impact may reach $19 trillion by 2030.”

Olga Kharif

Cisco CEO Pegs Internet of Things as $19 Trillion Market, Bloomberg Business, January 8, 2014

“And as many as 50 billion devices will be connected collecting and communicating data, causing automated responses.”

Cybersecurity and The Internet of Things, EY, March, 2015

“According to IDC’s 2015 Vertical IT and Communications Survey of 602 United States-based manufacturers, cloud services are at the top of manufacturers’ IT initiatives, and just over 43% of manufacturers are using public clouds and 56% are using private clouds in pilot, proof of concept, or in production.”

Kimberly Knickle and Eric Newmark Eric

Industry Clouds—A Vignette of Manufacturing Industry Adoption, IDC Manufacturing Insights, October 15, 2015

“Research shows that 35% of manufacturers are working on an IoT strategy and putting tactics in place to implement that strategy.”

Research found in Manufacturing Operations Management Survey conducted by LNS Research

“35% of U.S. manufacturers are collecting and using data generated by smart sensors so that they can improve their manufacturing and operating processes.”

PwC

The Internet of Things: what it means for US manufacturing

“The Factory of the Future takes advantage of the latest innovations in IT solutions, as well as refined best practices for shop floor operations. The Factory of the Future is one where interconnected machines and systems communicate, sharing data, and responding to input from customers, supply chain partners, and subcontractors across the globe.”

Infor

Factory of the Future, 2015

“34% of U.S. manufacturers believe it is “extremely critical” that they adopt an IoT strategy in their operations.”

PwC

The Internet of Things: what it means for US manufacturing

“38% currently embed sensors in products that enable end-users/customers to collect sensor-generated data.”

PwC

The Internet of Things: what it means for US manufacturing

Europe is also embracing IIoT. According to the European Parliament, 10% of EU enterprises are classified as manufacturing. There are 2 million European companies in this sector, and collectively they employ 33 million people. European manufacturing accounts for over 80% of exports and 80% of private research and innovation.

Investors Need to Know that IIoT is More than Counting Connected Devices

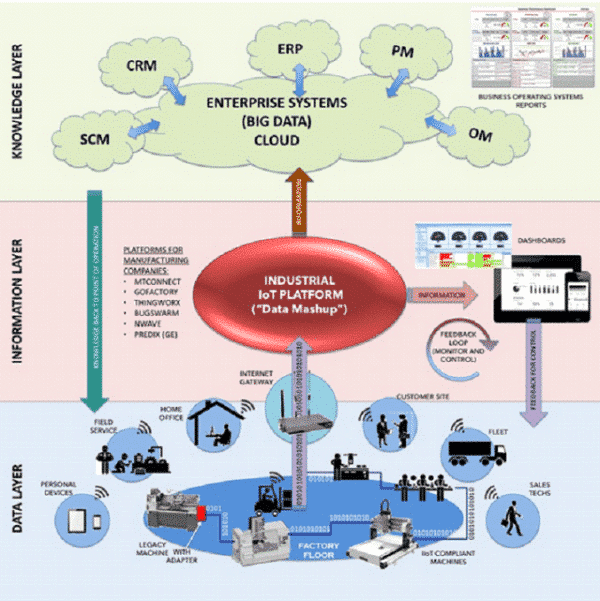

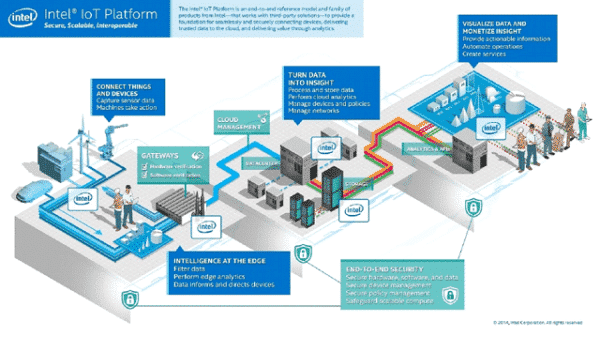

IIoT could be one of the biggest technology plays in history. There is far more behind smart factories than “slapping” sensors onto machines and connecting them to networks (Exhibit 10). In general, data collection occurs in the data layer. The data is processed in the information layer to make it readable to humans. From there, the information is stored into the knowledge layer, where enterprise software can perform analytics. Production is de-centralized as an entire ecosystem of technology that links machines, people, suppliers, and customers provides the visibility for monitoring, measuring, and control duties. This de-centralization needs technology – a lot of it, and Intel’s infographic (Exhibit 11) provides a summary of the technologies manufacturers require.

3D Printing – Rapid Prototypes

When people think of 3D printing, many think about using plastic as the print material. This is true for most consumer 3D printers, but industrial additive printers can print with metals and ceramics as well. This facilitates rapid prototyping (the process of building a product model for evaluation). Design teams can modify prototypes not only for functionality but also manufacturability and incorporate the information from each successive iteration fed back into the design for a new prototype print. We believe that 3D printers won’t replace traditional mass production processes like casting and injection molding, but 3D printers will accelerate the product development process.

For more information regarding the 3D printing industry, please refer to Sophic Capital’s report: The Inside Story from the Inside 3D Printing and 3D Printshow Conferences (April 23, 2015).

Big Data – Data Rich, Info Rich

Machines generate data – a lot of it. Data has always flowed through manufacturing facilities, but it is only in the IIoT revolution that manufacturers are starting to turn those ones and zeros into information. And more automation, communications networks, and stringent specifications entering the shops generates more data. This serves four functions: 1) Machines use the data in control processes; 2) Plants can quantify operations by measuring OEE, machine availability and functionality, measuring compliance, source data for enterprise resource planning systems, cost/price analysis, et cetera; 3) Networking with multiple factories across regions to coordinate internal inventories, quality control, and distribution; and, 4) Businesses can quantify inputs and outputs including: reliability of suppliers, supplier inventory levels, transportation metrics, and so on. Essentially, big data will help to optimize production schedules by recognizing supplier, customer, and machine availability. We believe that similar to other big data applications, manufacturers will require software architects specializing in algorithm creation for big data analysis.

Cloud Storage

Data, data, data. All of that data from those devices has to go somewhere. The data is real-time possibly running 24/7 and will come from possibly hundreds of machines. An unlikely scenario is storing raw data and extracting information from the data. Enterprise data systems will likely analyze the datasets and information. However, this is expensive storage that needs to scale, and not a realistic model. For many IIoT deployments, the storage is elastic: Data is filtered, analyzed, and possibly discarded. Whether it is stored or discarded, what’s left over will be a multiple smaller than what was extracted from the machines. The other thing to consider is that enterprise applications like CRM and ERP will likely perform their own analysis on the information and require their own storage.

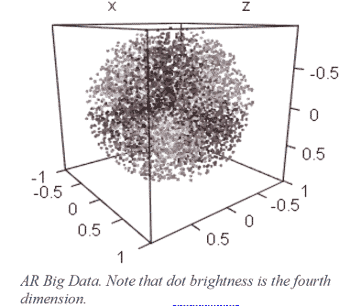

Augmented Reality – Making Sense of Big Data

Big data is not only a problem for machines to analyze – humans have difficulty making sense of the data. The problem is the volume of data. There’s so much that we can’t possibly look at it and know what to look for. Computers are making sense of it, yet the issue for us is how to get computers to display big data analytics results for humans to conceptualize. Enter augmented reality (AR).

Augmented reality is the immersion of computer generated images and text into our world. We are spatially-oriented creatures; you can probably recall the location of one thousand objects in your home. However, can you recall the last 15 numbers that you used? This suggests that big data is best presented in a visual format, since this is something humans understand and easily process. AR presents a medium that is perfect for achieving this via smart glasses such as Microsoft’s (NASDAQ:MSFT) HoloLens and Vuzix’s (NASDAQ:VUZI) M-100.

One day, many workers will wear augmented reality glasses for training, maintenance, and manufacturing. Augmented reality applications will likely replace written instructions. For example, rather than have workers upgrade their skills with a textbook, enterprises could develop AR instruction applications where a worker with augmented reality glasses could walk through a manufacturing procedure.

For an in depth look at the AR industry see our report “AUGMENTED REALITY: GLASSES GETTING CLOSER TO REALITY” published on June 15, 2015.

Network Security – Guarding the Digital Assets

Target (NYSE:TGT) was vilified for an information breach of 70 million customers, a breach the Company estimated cost $148 million and agreed to pay $10 million in a related class-action lawsuit. Dating website Ashley Madison was hacked, compromising the profiles of 37 million users. This followed the data breach of about 3.5 million users of Adult FriendFinder.

Globally, one billion data records were compromised in 2014. Internet security is a theme that is going to last for a while because corporations, governments, and individuals are going to invest in securing their networks, data, and devices. Research and market intelligence firm Gartner estimated that global spending on information security will be a $76.9 billion market in 2015. MarketsandMarkets believes the total cyber security market could grow from $106.32 billion in 2015 to $170.21 billion by 2020. This does not seem unreasonable when you consider the scale of malware (software used to damage or disable computers and computer systems) in existence. In 2014, coders created 317 million new pieces of malware – almost 1 million pieces per day – bringing the total number of malware programs in existence to about 1.7 billion.

With big data circulating around the organization, employees and customers accessing corporate information, enterprises need to protect their networks from attacks. Major technology companies have positioned themselves to take advantage of this trend. Some of the more prominent transactions include:

⦁ October 27, 2015: Cisco buys Lancope (private) for $452.5 million, and;

⦁ May 29, 2015: Raytheon (NYSE:RTN) completes its $1.9 billion acquisition of Websense (private).

MEMEX: An Investment Connecting Machines to Management

Little known to investors but with a growing industry reputation, MEMEX (TSXV:OEE), a Sophic Capital client, is disrupting the industrial sector with software and related hardware adapters that network machines to produce real-time data collection and analytics. The Company’s MERLIN IIoT communications platform, its core product, is machine monitoring software used in manufacturing environments. Validated in over 100 manufacturing environments, MERLIN essentially makes every shop floor machine a node on the enterprise network. By monitoring production as it happens in real-time, companies can increase their productivity by reducing downtime between jobs. There are over 100 MERLIN installations, connecting 1000s of machines, spread across three continents with an average IRR of over 300% and 4-month payback. If these customers were to fully deploy this would represent a ~$30 million revenue opportunity for MEMEX.

On October 15, 2015, Mazak USA (private), one of the world’s largest machine tool and systems OEMs, announced an IIoT platform called SmartBox that incorporates MEMEX’s MERLIN MTConnect compliant hardware adapter, dashboard and analytical software and Cisco’s Industrial Ethernet IE4K switch.* SmartBox provides real-time visibility and insights into factory floor data, process control, and operation monitoring. It builds upon Mazak’s iSMART Factory concept which uses advanced manufacturing cells and systems, MTConnect, and full digital integration.

The industry-first SmartBox collaboration arose after Mazak implemented MEMEX’s MERLIN IIoT software among seven competitive vendors and gained a 42% improvement in machine utilization, a 100-hour reduction in operator overtime per month, and 400 hours per month decrease in previously outsourced work – all within the first 5 months. Mazak is a global leader and the largest machine tool vendor in the world offering innovative and productive manufacturing solutions. The Company’s 800,000 square foot Florence, KY plant produces industrial machine tools at a rate of 200 units per month and proactively explores manufacturing processes and continuous improvement methodologies that can be implemented in other Mazak manufacturing plants to improve productivity and efficiency.

The industry-first SmartBox collaboration arose after Mazak implemented MEMEX’s MERLIN IIoT software among seven competitive vendors and gained a 42% improvement in machine utilization, a 100-hour reduction in operator overtime per month, and 400 hours per month decrease in previously outsourced work – all within the first 5 months. Mazak is a global leader and the largest machine tool vendor in the world offering innovative and productive manufacturing solutions. The Company’s 800,000 square foot Florence, KY plant produces industrial machine tools at a rate of 200 units per month and proactively explores manufacturing processes and continuous improvement methodologies that can be implemented in other Mazak manufacturing plants to improve productivity and efficiency.

The team at Mazak understood that in order to maintain their title as a world class leader in OEM machine tools, they needed to improve production across the shop floor, particularly in regards to machine availability and associated downtime. Moreover, any technological advantage Mazak incorporates into its manufacturing stream is also offered to its customers. MERLIN collects data via MTConnect software adapters on older machines and through it’s Universal Machine Interface MTConnect compliant hardware adapters for legacy machines resulting in the aforementioned benefits, plus:

• An immediate 6% increase in machine utilization after MERLIN’s real-time dashboards were displayed on the Mazak plant floor;

• Enhanced visibility of production, with over 75 standard MERLIN reports automatically sent out daily via email;

• Instantaneous, automatic and timed pro-active email and text alerts to increase situational awareness and minimize downtime;

• Detailed analyses of downtime root causes, pointing to areas requiring more operators training, and;

• Identification and removal of unnecessary optional stops, recovering lost production time.

MEMEX – Unlocking Hidden Factories on the Shop Floor

Case studies illustrate the lack of knowledge the top floor has about the shop floor and how MERLIN not only pays for itself within four months on average but also generates operational and financial returns going forward.

Magellan Aerospace: Raising OEE from 36% to 85%

Magellan Aerospace: Raising OEE from 36% to 85%

Magellan Aerospace, a developer and manufacturer of sophisticated supersonic jet fighter components, found that stand-alone machines weren’t achieving production targets. Downtime events were frequent, and the Company considered purchasing another machine to compensate for missed targets. Instead, Magellan Aerospace installed MEMEX’s MERLIN platform on several machines, and the result was a reduction in downtime from 400 hours per month to 100 hours per month. One machine’s machining time doubled, resulting in a 100% efficiency gain.

Rose Integration: Plant-wide MERLIN Deployment Improves OEE from 40%-82%

Rose Integration, a major supplier of precision machined components and complex mechanical assemblies to the defense and aerospace markets, had little visibility on what each of their 30 machines were doing. Rose Integration installed MEMEX’s MERLIN on six machines and saw a 20% efficiency gain within a week. The Company scaled plant-wide, adding MERLIN to each machine, and saw OEE increase from 40% to 82%, a more than 100% increase in this key manufacturing metric.

Héroux-Devtek

Héroux-Devtek

Héroux-Devtek, a leading provider of aircraft landing gear, sought to increase plant productivity and track real-time performance of its machines. After evaluating several OEE vendors, the Company installed MEMEX OEE and direct numerical control systems on 130 machines across six manufacturing plants. MERLIN increased productivity due to the visibility of production with real-time status, OEE increased 30% (now at 90%) saving the purchase of new machines, and higher revenues coupled with decreased costs which provide a competitive advantage in the marketplace.

MEMEX – Management Team are Experts in IIoT

MEMEX’s CTO Dave Edstrom, who joined MEMEX in 2014, was the co-founder of the MTConnect standard and the former President and Chairman of the MTConnect Institute. Mr. Edstrom is not the only expert at MEMEX with MTConnect expertise: President and Chief Executive Officer Dave McPhail co-chaired the MTConnect Legacy machine tool connectivity working group. He also developed and released the “Getting Started With MTConnect: Connectivity Guide” to specifically address the real-world questions raised when considering the implementation of MTConnect in shops or plants. Management and insiders are also aligned with shareholders as they collectively own ~35% of the Company.

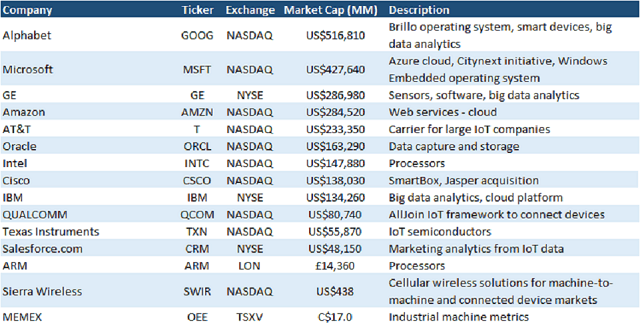

Several non-Pure Plays Are Focusing on IoT and IIoT

We believe that MEMEX is the best pure-play, public company for investors to participate in the IIoT sector. Several large cap companies (Exhibit 12) are also targeting the IoT an IIoT spaces but don’t disclose the significance these industries have to their top and bottom lines. If anything, Exhibit 12 demonstrates that some of the largest technology companies view IoT and IIoT as key growth markets.

Conclusion

The Industrial Internet of Things represents a trillion-dollar market opportunity. Most machine shops have not caught up to the connectivity of IIoT to optimize machine operations. But Sophic Capital client MEMEX has changed that. And through its collaboration with Cisco Systems and Mazak, MEMEX could be a major benefactor of the trend to monitor machine availability, performance, and output quality.

*The U.S. government has detected a rise in cyber-attacks on industrial control systems. Just as in the enterprise, no manufacturing facility wants its data compromised. SmartBox’s Cisco switch embeds network-level security to prevent unauthorized access to machines on the IIoT network.

Acronyms Used in this Report

AR augmented reality

CAD computer aided drawing

CAGR compound annual growth rate

CNC computer numerical control

CRM customer relationship management

ERP enterprise resource planning

IoE Internet of Everything

IIoT Industrial Internet of Things

IoT Internet of Things

OEE Overall Equipment Effectiveness

Disclaimers

The information and recommendations made available here through our emails, newsletters, website, press releases, collectively considered as (“Material”) by Sophic Capital Inc. (“Sophic” or “Company”) is for informational purposes only and shall not be used or construed as an offer to sell or be used as a solicitation of an offer to buy any services or securities. You hereby acknowledge that any reliance upon any Materials shall be at your sole risk. In particular, none of the information provided in our monthly newsletter and emails or any other Material should be viewed as an invite, and/or induce or encourage any person to make any kind of investment decision. The recommendations and information provided in our Material are not tailored to the needs of particular persons and may not be appropriate for you depending on your financial position or investment goals or needs. You should apply your own judgment in making any use of the information provided in the Company’s Material, especially as the basis for any investment decisions. Securities or other investments referred to in the Materials may not be suitable for you and you should not make any kind of investment decision in relation to them without first obtaining independent investment advice from a qualified and registered investment advisor. You further agree that neither Sophic, its employees, affiliates consultants, and/or clients will be liable for any losses or liabilities that may be occasioned as a result of the information provided in any of the Company’s Material. By accessing Sophic’s website and signing up to receive the Company’s monthly newsletter or any other Material, you accept and agree to be bound by and comply with the terms and conditions set out herein. If you do not accept and agree to the terms, you should not use the Company’s website or accept the terms and conditions associated to the newsletter signup. Sophic is not registered as an adviser under the securities legislation of any jurisdiction of Canada and provides Material on behalf of its clients pursuant to an exemption from the registration requirements that is available in respect of generic advice. In no event will Sophic be responsible or liable to you or any other party for any damages of any kind arising out of or relating to the use of, misuse of and/or inability to use the Company’s website or Material. The information is directed only at persons resident in Canada. The Company’s Material or the information provided in the Material shall not in any form constitute as an offer or solicitation to anyone in the United States of America or any jurisdiction where such offer or solicitation is not authorized or to any person to whom it is unlawful to make such a solicitation. If you choose to access Sophic’s website and/or have signed up to receive the Company’s monthly newsletter or any other Material, you acknowledge that the information in the Material is intended for use by persons resident in Canada only. Sophic is not an investment advisory, and Material provided by Sophic shall not be used to make investment decisions. Information provided in the Company’s Material is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. Sophic and/or its principals and employees may have positions in the stocks mentioned in the Company’s Material, and may trade in the stocks mentioned in the Material. Do not consider buying or selling any stock without conducting your own due diligence and/or without obtaining independent investment advice from a qualified and registered investment advisor.

Comment

One thought on “How the Industrial Internet of Things is Revolutionizing Manufacturing”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

The fact that 17% of manufacturers don’t know what IIoT is and 7% say its irrelevant is troubling. In order to stay competitive and attract top talent, manufacturers must not only understand it but be taking steps to utilize it in their facility.