Goldmoney is showing similar growth dynamic to PayPal, says Mackie

Mackie Research Capital analyst Nikhil Thadani compares the early success of Canada’s Goldmoney (Goldmoney Stock Quote, Chart, News: TSX:XAU) to one of the grandfathers of fintech, PayPal.

Mackie Research Capital analyst Nikhil Thadani compares the early success of Canada’s Goldmoney (Goldmoney Stock Quote, Chart, News: TSX:XAU) to one of the grandfathers of fintech, PayPal.

In a research update to clients today, Thadani maintained his “Buy” rating and one-year target of $7.00 on Goldmoney, implying a return of 43 per cent at the time of the publication. Commenting on information the company released this morning on the state of its business, the analyst said the company is showing a “similar dynamic” to that of PayPal more than a decade ago.

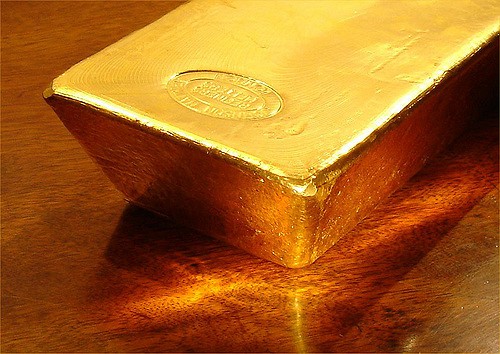

This morning, Goldmoney reported its key performance indicators for the period ending Feb. 29, 2016. The company’s user sign-ups climbed from 580,814 in December to 671,823 in January and then to 739,133 in February. The value of customer gold in vaults (gold grams) nearly doubled from December to February, and currently sits at $38,395,076.

Thadani says the numbers show Bitgold is off to a great start in 2016. He says growing traction and user trust in the platform could soon lead to even more success.

“While we believe recent market and macro volatility has no doubt helped XAU, we expect the platform to gain traction in the coming months driven by more relevant functionality, he says. “XAU could launch merchant functionality in a couple months. Growing traction with user transactions could enable XAU to offer a loyalty point and/or remittance program under a strategic partnership with established financial institutions as the company demonstrates filling a viable user need. We believe the company’s existing web services architecture should enable the platform to scale with relative ease. As the platform and users gain scale, we expect higher user monetization via transactions and fees.”

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.