This report was adapted by Cantech Letter from a piece prepared by the Virtus Advisory Group, Inc.

This report was adapted by Cantech Letter from a piece prepared by the Virtus Advisory Group, Inc.

The New Age of Advertising

An emerging marketplace for companies to strategically communicate with their consumer base through the use of real-time data is poised to be the next big theme in a wave of change in the advertising industry. We are in the advanced stages of a transition from traditional paper-based advertising to a complete digital landscape that has wide reaching implications for the everyday consumer, small business owner, and large multinationals. Traditionally, advertising has been a costly and time consuming process that involved mass marketing techniques, such as newspaper, television and radio advertisements, with little or no adoption rates from the end user. Firms that use television ads to connect with consumers have had to reassess their strategy as a result of changes in consumer patterns such as cord cutting – where consumers elect to use other media platforms such as Netflix, Hulu and other online streaming platforms to watch their favourite shows and movies. As a result of this shift, traditional methods of advertising have become limited in effectiveness. Traditional advertising methods, while still implemented by many companies, are difficult to assess and analyse, making it difficult to build a strong marketing program around. This inefficiency has left companies with limited resources when attempting to evaluate the size of their target market, and more importantly the success rate of their advertising efforts. The inability to actively monitor and engage the consumer’s feedback and response to a particular advertisement has opened up a huge market opportunity in this new age of digital advertising.

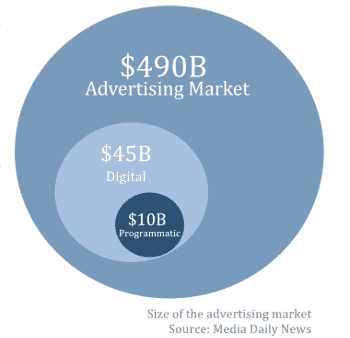

Digital advertising includes websites, mobile applications, and anything else that connects users with an online presence. This market currently makes up $45B of the overall $450B dollar advertising market place, and is projected to grow at a faster rate than traditional advertising methods. Recent figures suggest that by 2018 digital advertising will account for 33% of all media spending. There are a number of reasons for the continued shift away from traditional advertising to digital. The more prevalent of which is the consumer’s preference for having all of their information needs delivered online and on demand.

Digital advertising includes websites, mobile applications, and anything else that connects users with an online presence. This market currently makes up $45B of the overall $450B dollar advertising market place, and is projected to grow at a faster rate than traditional advertising methods. Recent figures suggest that by 2018 digital advertising will account for 33% of all media spending. There are a number of reasons for the continued shift away from traditional advertising to digital. The more prevalent of which is the consumer’s preference for having all of their information needs delivered online and on demand.

Users continue to spend more time online, through the use of their laptops, mobile devices or tablets, combing through their favourite websites and applications. Having access to such a large and diverse user base digitally has given companies the incentive to market and advertise their products directly to thousands of users at a fraction of what it would cost through mass marketing efforts with paper and other forms of traditional advertising platforms. This trend can be seen in both younger generations as well as older generations who are typically associated with long-established advertising methods.

The next logical step is to take this large online presence and collection of big data and turn it into uniquely designed and intelligently placed media (ads) in order to directly target users who would most benefit from the product or service, based on their specific interests, spending and shopping patterns, known as Programmatic Advertising. Companies are already taking advantage of this by targeting ads on newer platforms such as YouTube and Facebook. This opportunity is the next phase of digital advertising and it is well on its way to taking over the entire advertising industry.

Rise of Programmatic Advertising

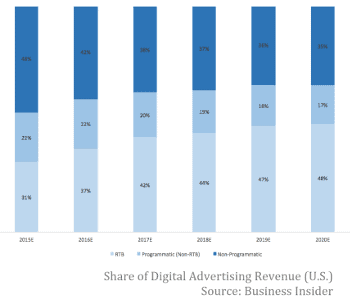

Programmatic advertising maintains its position as the fastest growing sub sector of the digital advertising market with a 71% increase in spending in 2014, accounting for 20% of all online marketing in the U.S. that year. Programmatic advertising via video spending reached about $3B in 2015 accounting for 39% of U.S. video ad spending. It is anticipated that 83% of all display buys will be programmatic by 2017. It is a term and industry in its infancy, both in terms of investor familiarity, and growth potential.

Programmatic advertising maintains its position as the fastest growing sub sector of the digital advertising market with a 71% increase in spending in 2014, accounting for 20% of all online marketing in the U.S. that year. Programmatic advertising via video spending reached about $3B in 2015 accounting for 39% of U.S. video ad spending. It is anticipated that 83% of all display buys will be programmatic by 2017. It is a term and industry in its infancy, both in terms of investor familiarity, and growth potential.

Programmatic refers to software designed to eliminate the need for humans to purchase and sell media (ads) physically. Programmatic marketers are able to accomplish this by building intelligent algorithms designed to identify an online user’s tastes and preferences and placing ads that are relevant to that user. The algorithm is designed to buy ads at each impression level, resulting in millions of purchases every minute. This process of acquiring space (which often is a banner space on websites such as CNN, CNBC, TSX etc.) and placing relevant ads in a rapid manner is done through a process called real-time bidding (RTB).

Real-time bidding (RTB) is an auction-based platform allowing media buyers (programmatic marketers) to bid on advertising space at the impression level, as the ad impression takes place. RTB enables a media buyer to specify exactly what their goals or outcomes are and look only for ad inventory that matches against those goals. Real-time bidding revenue reached approximately $9B in 2015 and is expected to grow substantially to $26B by 2020. RTB essentially leads programmatic advertising platforms as it targets both the most efficient cost and clearly targets appropriate ad placements for the desired consumer.

The Real-Time Bidding Ecosystem

In order to tie everything we have learned together, it is essential to break down the programmatic advertising ecosystem. A typical transaction would involve the following participants:

⦁ Publisher: They provide the source of ad inventory (i.e. the digital spaces in which ads are placed into). Some publishers may use Supply Side Platforms, or SSPs, to help better manage and sell their inventory. The process of supplying the programmatic marketer with a steady stream of available inventory not only allows the publisher to maximize revenue on their limited inventory, but also assists advertisers by providing details about the user the ad will be placed in front of.

⦁ Ad Exchanges: This is advertising’s version of the stock market. It is designed to connect the publishers (eg. CNN or CNBC websites) with programmatic marketers (eg. Honda, McDonalds) in order to facilitate the supply and demand of available ad inventory.

⦁ Demand Side Platforms (DSP): DSPs enable buyers (i.e. advertisers) to connect directly to multiple sources of inventory supply and provide such benefits as workflow simplification, integrated reporting, algorithmic buying optimization and the ability to make impression-level bid.

We expect programmatic advertising to continue to grow rapidly not only because of the ROI maximization for the advertiser and publisher, but the value that is created for the individual consumer viewing the advertisements. By identifying the needs of an individual consumer based on algorithms put in place by the marketer, each consumer can now expect to view ads that are relevant to their specific needs and life circumstances. This eliminates the need to spend countless hours searching for products and services when the same time could be spent viewing additional products tailored to each consumer’s needs.

From the publisher perspective, the old methods of selling ad space is outdated and time consuming. According to a study done by the Boston Consulting Group (BCG), publishers spend upwards of 80% on administrative tasks (i.e. monitoring data, billing, etc.) and organizing advertisement arrangements, which while important, is an inefficient use of time. With the use of programmatic advertising, publishers can now focus on producing better content and in turn increasing the value of the ad space sold to buyers.

The Canadian Players

The Canadian market remains nascent in comparison with the American marketplace in terms of market acceptance and education around programmatic advertising. Despite the slow start north of the border, M&A activity has begun to pick up with the recent acquisition of Chango, a private Canadian player, by Rubicon Project out of the U.S. for $122M.

We don’t have to look far for an example of how successful a programmatic advertising company can be. DoubleClick, a U.S. based programmatic advertising agency, was purchased in March of 2008 by Google for $3.1B. With companies such as L’Oréal, General Motors and Apple directly using their services, it is clear that this form of media is not simply a fad.

We believe this is a signal of things to come based on our assessment of the direction digital advertising is moving towards. The adoption rate will continue to rise as all stakeholders involved begin to see the ROI potential of programmatic advertising. As can be seen below, programmatic advertising is becoming a more dominant force in the advertising industry. While there will always be a place for traditional methods such as television, newspaper and radio, this new method is going to have a major impact on how advertisers reach their audiences.

Direct and indirect competitors in the programmatic supply chain have begun to see the software developed by programmatic marketers as a vital source of information on customer spending habits. The big data that is collected by the marketer serves as a major catalyst for publishers looking to increase their own ROI by selling limited inventory for the highest price available.

This leads us to believe that companies focused on the supply side market (publishers) could see this as an opportunity to acquire a demand side platform, Chango in this case, with the hopes of integrating the software into their own platform.

The second major theme we see contributing to continued M&A activity is the limited number of players in the Canadian marketplace. We have highlighted two of the more prominent Canadian figures in the programmatic advertising space below.

⦁ AcuityAds Inc. (TSXV:AT): AcuityAds, is now the largest public Canadian company in the programmatic advertising industry based on market capitalization. Recently named a finalist in the Cantech TSX Venture Tech Stock of the Year, AcuityAds is clearly being recognized as an industry leader in this field. The company has developed a programmatic advertising platform that allows their clients to manage their purchases of ad space through the use of real-time bidding. Acuity’s clients are primarily large national brands and ad agencies that run their digital advertising campaigns on a set budget through Acuity’s Managed Services offering, or license Acuity’s technology to run their own ad campaigns under the Company’s Self-Service offering, which has created a Software as a Service (SaaS) based revenue model for the Company.

⦁ UpSnap (CSE:UP): UpSnap is the smallest of the three companies we have highlighted, but certainly not any less worthy of noting. Similar to Acuity, the company delivers targeted ads to brands in need of exposure. UpSnap, however, has chosen to focus their attention on the Small and Medium Size Enterprises (SMEs) that have little to no advertising presence on the internet. SMEs remain an underserved market with plenty of opportunity to capture market share quickly. The revenue model in place requires the customer to pay a monthly subscription fee in order to use the service. Under this approach, UpSnap has a predictable cash flow stream that is not contingent on the number of impressions, leaving the SME in a healthier financial position to make payments.

As the Canadian community becomes more educated on this matter, we will begin to see market multiples expand from their current levels. The transaction multiple in the Chango acquisition serves as a leading indicator of potential premiums that could be attached to acquisitions down the road. Regardless of an investor’s understanding of this industry, we view the slow investor adoption in Canada as a positive for those that are looking to get in early on an explosive and dynamic industry. It is clear that programmatic advertising is going to revolutionize the advertising industry and companies that wish to stay in touch with their customer base will continue to adapt to this new age digital advertising model.

Disclaimers

The information and recommendations made available here by The Virtus Advisory Group Inc. (“Virtus Advisory”) and/or all affiliates is for information purposes only. The opinions expressed in this article are based upon our analysis and interpretation of widely available market and company information, and not to be used or construed as an offer to sell or solicitation of an offer to buy any services or securities. Virtus Advisory nor its principals, officers, directors, representatives, and associates will be liable for the accuracy of the information included in this article nor shall be liable for any losses or liabilities that may be occasioned as a result of the information or commentary provided in this article. Virtus Advisory may act as capital markets advisor for certain or all of the companies mentioned in this article, and may receive remuneration for its services. Virtus Advisory and/or its principals, officers, directors, representatives, and associates may have a position in the securities mentioned in this article and may make purchases and/or sales of these securities from time to time in the open market or otherwise. Do not consider buying or selling any stock without conducting your own due diligence. Prior to making any investment decision, it is recommended that you seek outside advice from a qualified or registered investment advisor.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment