Memex has huge upside, says Clarus

A quarter that met his expectations has Clarus Securities analyst Noel Atkinson feeling bullish about Memex (Memex Stock Quote, Chart, News: TSXV:OEE).

A quarter that met his expectations has Clarus Securities analyst Noel Atkinson feeling bullish about Memex (Memex Stock Quote, Chart, News: TSXV:OEE).

This morning, Memex reported its Q1, 2016 results. The company lost $641,000 on revenue of $614,000, a seven per cent topline bump over the same period last year.

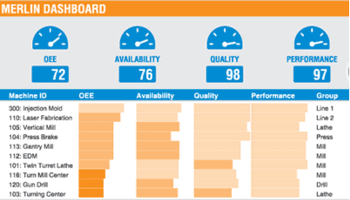

“The Industrial Internet of Things, or IIoT, represents the next industrial revolution, and Memex’s flagship software product Merlin is planted squarely in the middle of this manufacturing megatrend,” said CEO David McPhail. “Our latest quarterly results, representing our fourth consecutive quarter of growth, strongly indicate that manufacturers around the world see the value of our unique combination of industrial connectivity, and analytics to drive productivity and profit. I want to thank our customers for their trust and our employees for their hard work to achieve these results.”

Atkinson says he expects the Mazak SmartBox OEM plug-and-play factory tool monitoring solution, developed in conjunction with Cisco, to enter the market this summer. He notes that following Cisco’s featuring the MERLIN plaform at its Cisco IOT World Forum in Dubai in December, the relationship between the two continues to grow. The analyst says Memex is clearly ramping up.

“Product bookings in Q1 were a record $876k, up nearly +60% QoQ from Q4/FY2015,” he said. “The Company continues to expand its sales force to build its funnel and close more business in a timely fashion. Memex has added a VP of Marketing and three more U.S. sales reps. The Company continues to pursue several large ($1MM+) opportunities with global-scale manufacturing companies and hired a Director of Manufacturing Excellence to support sales and integration for these larger deals.”

In a research update to clients today, Atkinson maintained his “Buy” rating and one-year target price of $0.90 on Memex, implying a return of 592.3 per cent at the time of publication.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.