A weakening economy driven by a plunging resource sector and a general talent shortage aren’t enough to dim an atmosphere of overall optimism in Canada’s tech sector, according to the 2015 BDO Technology RiskFactor Report.

A weakening economy driven by a plunging resource sector and a general talent shortage aren’t enough to dim an atmosphere of overall optimism in Canada’s tech sector, according to the 2015 BDO Technology RiskFactor Report.

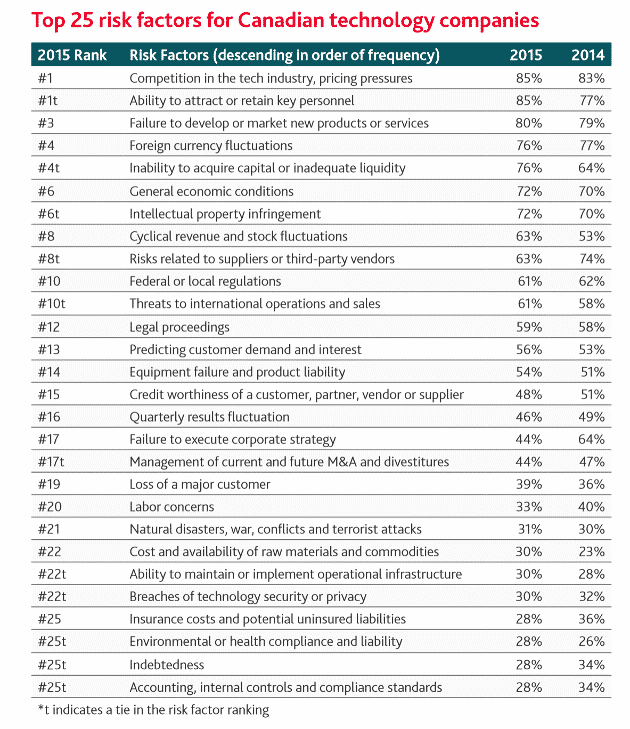

The report analyzes risk factors listed in the financial statements of Canada’s publicly traded technology companies.

While the overall economy continues to slump, the problems that the tech sector faces would be classified by other sectors of the economy as “nice to have”.

“Canada may be facing strong economic headwinds, but tech companies are seeking to use some of the negatives to their advantage,” said Scott Rodie of BDO’s Technology & Life Sciences practice. “As the Canadian technology sector looks to expand outside Canada, their exposure to slower-than-anticipated economic recovery may be mitigated by global growth opportunities.”

Indeed, this generation of tech leaders see themselves primarily as global companies, not so much restricted to satisfying Canadian markets first.

“Deal flow and investment interest in technology are strong, while the supply of talent, capital and innovation remains a major concern for public tech companies,” says the report.

While general economic conditions and foreign currency fluctuations were on the list of risks reported by Canadian tech companies, their main concerns were competition from lower-priced competitors and the ability to attract and retain talent.

Getting and keeping talent was a concern cited in the report for 85% of companies.

While the report mentions the strength Canada’s universities in cultivating tech talent, it also says that there’s a lag time between getting new talent up to speed and supplying skilled personnel for the tech sector’s labour pool.

And even though depressed oil prices and a shrinking dollar continued to drive overall markets down, the S&P/TSX Capped Information Technology Index grew by nearly 12% in Q1 2015.

The slumping dollar even provided a strong bump for companies whose client base mostly resides in the U.S. and pays in American dollars for SaaS recurring revenue subscription models.

The growth of the tech sector has also meant that despite the fact that the venture capital investment situation is far from perfect, it has grown 19% since 2012, with Canadian companies attracting investments from Silicon Valley heavy-hitters like Accel Partners, Sequoia Capital and Bessemer Venture Partners.

And the report is forecasting better days ahead on the investment front.

“There are signs that deal activity may accelerate as we near the end of 2015,” said Bruno Suppa, Transaction Advisory Services partner with BDO. “Economic conditions are creating a favourable climate for both strategic and financial buyers alike, which in turn may help technology companies on a number of levels—companies may be able to scale up through strategic acquisitions, use the proceeds of a transaction to make key business investments or even shed assets that may no longer be serving their needs. A promising deal environment could help foster continued agility in the sector.”

While 2015 got off to a slow start, with 82 transactions completed until the end of Q2 the in the technology, media and telecoms space, a drop of 24% from the same period last year.

But the Shopify IPO at the end of the second quarter sent a strong signal of optimism to other privately held Canadian tech companies and the sector as a whole.

Despite the optimism, 44% of companies reported anxiety related to M&A activity, or a failure to identify and act on acquisition targets or difficulty integrating businesses, as one of their more prominent risks.

Culturally interesting, too, is the fact that less than two-thirds of Canadian companies report government regulation as a threat to their enterprise, compared with all 100 companies surveyed for the American 2015 BDO Technology RiskFactor report, which is either an indication that the Canadian regulatory system is less onerous than in the U.S. or that Canadian entrepreneurs are more at ease with being regulated than their Silicon Valley man-god libertarian counterparts.

Similarly, 59% of Canadian companies reported litigation as a worry, compared with 93% of U.S. publicly traded tech companies, which tells you everything you need to know about Canada/U.S. cultural differences.

Comment

One thought on “Canada’s tech sector is bucking economic negativity trend, says BDO”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Don’t see how attracting people is a risk at all for Canada’s tech sector. As it stands, top grads in Canada find it incredibly difficult to find jobs, and the tech sector just needs to tap into this pool and start hiring.