A plan “B”.

A plan “B”.

When Chlormet Technologies (Chlormet Technologies Stock Quote, Chart, News: CSE:PUF) acquired AAA Heidelberg, a company in the process of applying for an Marihuana for Medical Purposes Regulations (MMPR) license with Heath Canada it already had a partially completed 8800 square foot marijuana cultivation facility in London, Ontario. Soon after, Chlormet added a facility for production and processing of marijuana in Washington State.

But CEO and co-founder Yari Nieken, while optimistic about the multi-billion dollar opportunity in the medical marijuana space, was also a realist. Nieken knew that the company had exposed itself to a tangle of bureaucracy it simply could not control. Under the Marijuana for Medical Purposes Regulations (MMPR), Health Canada no longer supplies marijuana to those with a proven medical need but instead has tasked licensed commercial producers to do so. Currently, 22 companies hold 26 licenses to produce marijuana in Canada. Many more are expected to be added, but the timeline is uncertain.

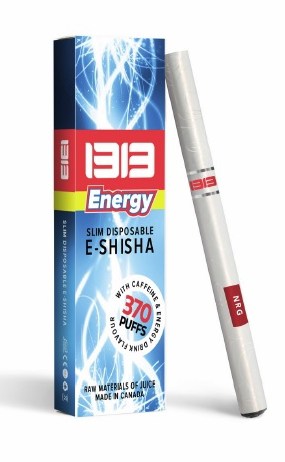

So Nieken set about looking for a Plan B that could compliment and perhaps supplant, Chlormet’s marijuana business. His answer was to acquire VapeTronix, a Canadian vaporizer and electronic cigarette company that owns the exclusive rights to the 1313 e-cig brand, medicinal marijuana mobile application technology, and several research and development projects within the vape and e-cig space. It’s a business Nieken says has high margins and can tuck in nicely with a licensed producer to create a diversified and vertically integrated player in the space.

Cantech Letter talked to Nieken about the company’s plans.

Yari, can you tell me about the history of Chlormet, how did it come together?

In November of 2013 management completed a consolidation of Chlormet on a 5:1 basis and began actively searching for a transaction of merit outside of the mining exploration and development sector. The types of businesses that we were assessing were revenue generating businesses or business that could be revenue producing in a relatively short period of time. This was largely the result of coming to the realization that recurring dilutive financings, which characterize the junior/venture market space, were being frowned upon by the investing public and quite frankly, by us (management) as well.

We are at an advantage in terms of time frame to production as we have a facility which is ready for Health Canada Inspection at this time.

When did you focus on the medical marijuana space?

Our attention shifted to medical marijuana as we started to see the proliferation of dispensaries in Vancouver and more and more media attention being placed on the sector in advance of the March 31, 2014 phase out of the MMAR (Marihuana Medical Access Regulation) and commercialization of the marijuana cultivation space by the replacement regulatory framework known as MMPR. We entered the Medical Marijuana landscape via a rolling takeover of AAA Heidelberg, which was (still is) in the process of applying for an MMPR license with Heath Canada and had a partially completed 8800 sq ft. marijuana cultivation facility in London, Ontario. We initially purchased a passive 16.5% interest in AAA in March of 2014 and over the next few months worked towards completing a share exchange agreement whereby we had the ability to acquire the remaining 83.5% in a staged manner. Subsequently, we spent in excess of $700,000 converting the existing building into a pharmaceutical grade, Health Canada guideline conforming, production and processing facility. The license is still pending and we are currently in the security clearance stage, where we have been for 12 months. Our file is still actively being worked on.

As a result of the delay in license issuances by Health Canada we have been actively looking for and have conducted two accretive transaction in related businesses: Acquisition of VapeTronix an electronic cigarette company and an additional facility for production and processing of marijuana in Washington State.

You are in the process of applying for a MMPR license, do you have a timeline for that?

We have been in the security clearance stage for just over 12 months and have been informed that our file is still active and being worked on. We have no definitive timeline and the forthcoming election could dictate timing, especially given that the Liberals, for example, favour decriminalization and development of recreational marijuana policies which would transform the whole industry (especially for those already producing but even for those companies in a similar position to ourselves). We are at an advantage in terms of time frame to production as we have a facility which is ready for Health Canada Inspection at this time.

You acquired VapeTronix in May, meaning you have and entered E-Cig and Vape industry. What do you think you can accomplish in this space?

We hope to continue to grab as much Canadian market share as possible as we continue to expand our product lines for our nicotine-free disposable e-cigs. We expect a change in ruling in the future that is similiar to the USA whereby E-cigs with nicotine will be allowed under new rules whereby we hope to have a presence where we can introduce our product into the already established distribution channels we have established at that time.

Depending on a variety of factors we may consider a spin-off of either or of the businesses if it means maximizing shareholder value. Additionally we are keen to move forwards with THC and CBD disposable cigarettes in both the Canadian and U.S. markets if and when we are able.

Will you continue to operate in the E-Cig space if and when you are granted an MMPR license?

Yes we will. Depending on a variety of factors we may consider a spin-off of either or of the businesses if it means maximizing shareholder value. Additionally we are keen to move forwards with THC and CBD disposable cigarettes in both the Canadian and U.S. markets if and when we are able. Weedbeacon also could be very useful in the context of medical marijuana (traceability etc).

How does your mobile app and physician portal, Weedbeacon, work?

It is a secondary product under-development from our main social technology we plan to unveil. The physician portal would connect to a mobile app that syncs with a vaporizer device and sends tracking data to the physician on cannabis usage.

If the worst happens and you are not granted an MMPR license, can your business go forward?

Yes, we have already pre-planned for that scenerio – hence the acquisition of VapeTronix to diversify our portfolio into other related sectors. Furthermore, our Washington acquisition has added more diversity into the recreational marijuana space that we have exposure across the border.

What will the medical marijuana part of the company look like, what kind of production do you expect?

Our initial application is for 600kg and we expect to increase this over time (potentially renovate the existing facility to double capacity, we are currently a single level facility but the surrounding buildings have all been given variance to add stories vertically and we would definitely entertain that idea and have already had our contractor demonstrate the feasibility of this being done with the current structure.

Our margins are currently over 50% cross our lines of disposable e-cigarettes and nicotine liquids.

Can you tell me about your new product, 1313 Energy?

Our new product is an energy-drink flavoured disposable slim unit. We have infused the product with taurine the chemical in Redbull for a small added boost. We unveiled a new product style called “SLIM” which is a very thin and sleek disposable e-cig unlike anything else on the market. Its compact and light weight nature makes it more appealing to certain demographics, like females who like to keep things tucked away in a clutch or purse.

What do you think the margins will look like on each side of your business?

Our margins are currently over 50% cross our lines of disposable e-cigarettes and nicotine liquids.

What does your balance sheet look like? Do you have enough cash to execute your business plan?

VapeTronix our wholly owned subsidiary is currently funded to execute all of the plans we have set out from its initial acquisition. We will have to do a raise to increase the canopy space in London as well as in Ferndale but these can be delayed until our share price is reflective of what management considers its fair value.

What do you want to accomplish in the next 12-18 months?

We plan to roll-out our new celebrity e-shisha line and some other products across the border that we are working on. We plan to continue our expansion across Canada and enhance our market-share. We hope to have a favourable ruling in that time period on our MMPR facility and we also hope to install our first tenant in our facility in Washington State. We also plan on enhancing our market awareness activities to bring more attention to our company and our product lines.

Disclosure: Chlormet is an annual sponsor of Cantech Letter

Comment

One thought on “Chlormet CEO Yari Nieken talks to Cantech Letter”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Great article. Very excited about PUF , one of the few CSE listed deals I know that actually have tangible things going on aside from the typical aspirations and fluff. I think this one is going to be a winner and happy to see you providing some coverage on it Nick. Thanks!