Merus Labs financing gets thumbs up at Laurentian

Merus Labs’ (Merus Lab Stock Quote, Chart, News: TSX:MSL, Nasdaq:MSLI) bought deal will put the company in a position to execute on acquisitions, says Laurentian Bank Securities analyst Joseph Walewicz.

Merus Labs’ (Merus Lab Stock Quote, Chart, News: TSX:MSL, Nasdaq:MSLI) bought deal will put the company in a position to execute on acquisitions, says Laurentian Bank Securities analyst Joseph Walewicz.

Yesterday, Merus Labs announced it had close a previously announced bought-deal financing. Merus issued 19,672,200 common shares at a price of $3.05 per share for gross proceeds of $60,000,210. A greenshoe clause means the deal could come in at just over $69-million.

Walewicz says the financing could be something of a game changer for the company.

“With the completion of this financing, Merus now has a very strong balance sheet available to execute on new deals,” he said. “By our estimates, using only cash and debt, the company could increase the size of the business by 50% and maintain its Net Debt/EBITDA below 2.0x, and it could more than double the size of the business while staying below 3.0x. We believe that the company is now very well positioned to execute on new transactions in 2015.”

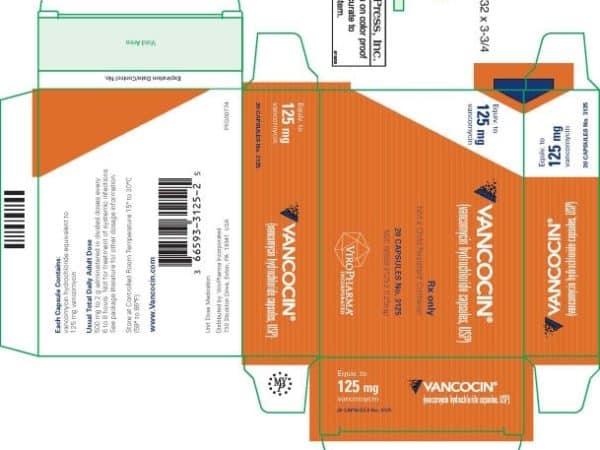

Founded in 2011, Toronto-based Merus Labs is a specialty pharma with a portfolio of three products, Sintrom, Enablex, and Vancocin, it markets in Canada.

Walewicz says he isn’t yet factoring any new deals into his outlook on Merus and says he prices the company at a discount to its peers, based on it current portfolio. But the analyst says he sees “considerable upside” if it can execute on new deals.

In a research update to clients yesterday, Walewicz maintained his “Buy” rating and one year target of $3.25 on Merus Labs, implying a return of 24.5% at the time of publication.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.