North American cable operators facing steep customer declines will drive growth for Espial Group (Espial Group Stock Quote, Chart, News: TSX:ESP), says Global Maxfin Capital analyst Manish Grigo.

North American cable operators facing steep customer declines will drive growth for Espial Group (Espial Group Stock Quote, Chart, News: TSX:ESP), says Global Maxfin Capital analyst Manish Grigo.

In a research update to clients yesterday, Grigo initiated coverage of Espial with a “Buy” recommendation and a one year target price of $5.25 a share, implying a return of 37.4% at the time of publication.

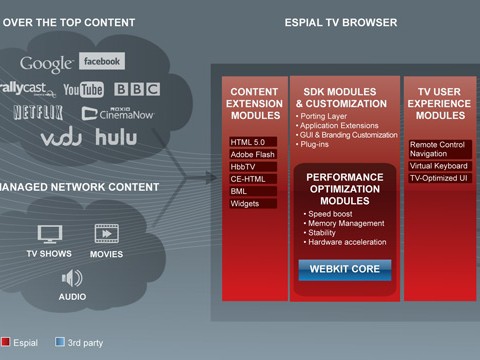

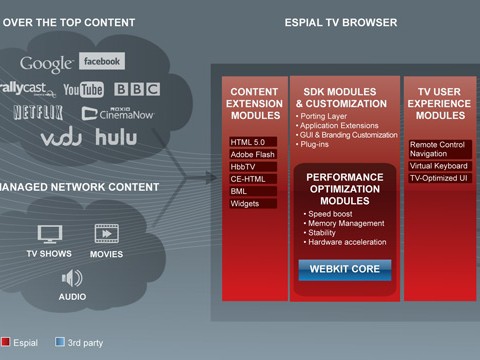

Pointing out that U.S. cable operators have lost more than four million subscribers, or ten percent of their base over the past three years, Grigo says these increasingly desperate incumbents will turn to Espial to battle over-the-top services like Amazon, Netflix and Hulu.

“Essentially, Espial’s software helps the TV retain its spot as the centre of video consumption in a household,” said Grigo. “We believe the Company’s addressable market is more than 20M subscribers in the US alone, which translates to $200M in one-time licensing revenue and $30M in recurring revenue. Considering the declining subscriber trend and Espial’s recent wins in Europe and North America, where operators went with its end-to-end RDK solution, we believe there is a strong likelihood that the Company will see wins come in at a faster pace than in the past.”

Shares of Espial have raced since March 30, when the company announced that an unnamed major European cable operator had selected its Reference Design Kit (RDK). The win represented the second major European operator to select Espial’s RDK and HTML5-based solution, and its third overall.

Grigo warns that Espial is still a company in its early stages of growth and that revenue may be lumpy for some time. But the analyst says he believes the company has “the right solution at the right time”, and enjoys high barriers to entry in its space.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment