DHX Media’s (DHX Media Stock Quote, Chart, News: TSX:DHX) revenue will double in fiscal 2015 and continue to best its industry peers in the years after that, says Jennings Capital analyst Dev Bhangui.

Last Thursday, DHX reported its fourth quarter and fiscal 2014 results. For the year, the company earned $7.81-million on revenue of $116.1-million, up 19% from 2013.

“This was a highly transformative year for DHX Media,” said CEO Dana Landry. “While we continued to grow our library both organically and through the acquisition of renowned assets, such as Degrassi, and the preschool series Teletubbies and In the Night Garden, we also became a fully integrated media company with the addition of DHX Television. For the year, we delivered strong growth across the key metrics of revenue, adjusted EDITDA, gross margin and net income, driven by significantly increased performance from production and distribution. Over the year ahead, we aim to continue to execute on our plan to focus on organic growth while also keeping an eye out for acquisitions that will further strengthen our position as a leading content company globally.”

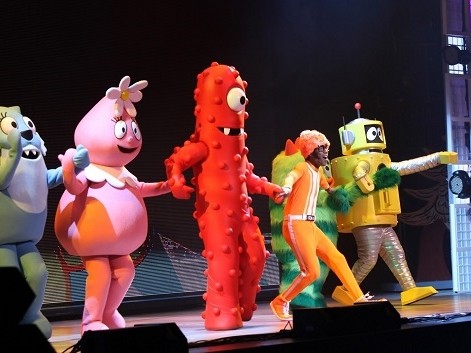

Bhangui says there are multiple drivers for DHX going into fiscal 2015. He notes that the company has signed recent distribution and M&L deals for brands like Teletubbies and Yo Gabba Gabba!, should experience proprietary production growth, still has cost synergies to be realized from its Bell Family Channel acquisition, and is seeing growth from unstructured YouTube content revenue, which he points out delivers cash that flows almost directly to the bottom line.

In a research update to clients following the results, Bhangui maintained his “Buy” rating on DHX Media, but raised his one-year target on the stock from $7.50 to $9.50. He thinks the company will post net earnings of $42.9-million on revenue of $247.5-million in fiscal 2015 and will continue to grow at a rate of more than 15% in the years that follow, a number he notes is more than double the growth of its peers.

Comment

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

what the hell is M&L

Merchandise & Licensing