COM DEV’s soft Q3 is just a bump in the road, says Paradigm

A softer than expected Q3 is just a bump in the road for COM DEV (TSX:CDV), which is in the process of returning to its former glory, says Paradigm Capital analyst Daniel Kim.

Last Friday, COM DEV reported its Q3, 2014 results. The company earned $3.16-million on revenue of $50.8-million, a topline that was down 6.3% from last year’s third quarter.

“In the third quarter we had solid growth in revenue in our commercial satellite components business,” said CEO Michael Pley. “While revenues are still constrained by U.S. budget pressures, demand for commercial communication satellites remains strong, with 11 new satellite projects awarded in the third quarter. Com Dev has already won work on five of these satellite projects and is pursuing work on the remaining six. These will be potential sources of new revenue in future quarters.”

Kim says COM DEV’s Q3 fell below his expectations, and he points the finger at U.S. government budget sequestration for much of the weakness. He says the situation in the U.S. has hit the company’s gross margins and chewed through what was once a record backlog.

In a research update to clients this morning, Kim maintained his “Buy” rating but lowered his one-year price target on COM DEV from $6.75 to $6.25, implying a return of 68%, including dividend, at the time of publication. The analyst says he lowered his target to reflect the volatility that is evidenced by these third quarter results, but that he maintains a “positive bias” towards the company.

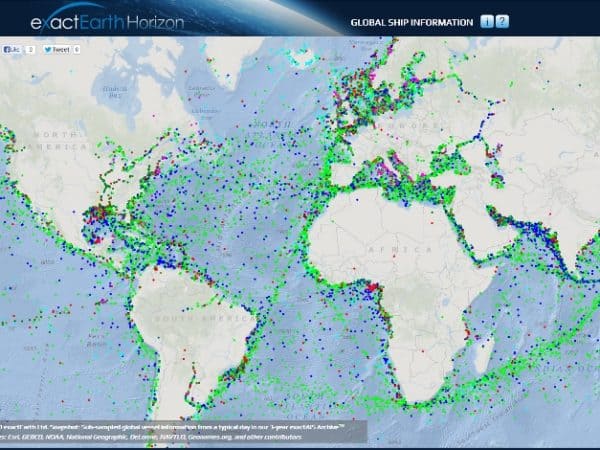

Kim thinks there is “significant” value in COM DEV’s shares that isn’t being recognized. He believes upside could come both from the company’s U.S. business returning to it normal run rate and from exactEarth, which he points out “…boasts a long customer list, impressive backlog and quickly ramping revenue”.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.