Clarus launches coverage of ViXS with Buy rating, $3.30 target

The 4K TV market represents “a significant opportunity” and Toronto’s ViXs Systems (TSX:VXS) is poised to grab a meaningful share of it, says Clarus Securities analyst Eyal Ofir.

The 4K TV market represents “a significant opportunity” and Toronto’s ViXs Systems (TSX:VXS) is poised to grab a meaningful share of it, says Clarus Securities analyst Eyal Ofir.

In a research report to clients today, Ofir launched coverage of ViXS with a “Buy” rating and a one-year price target of $3.30, implying a return of 74.6% at the time of publication.

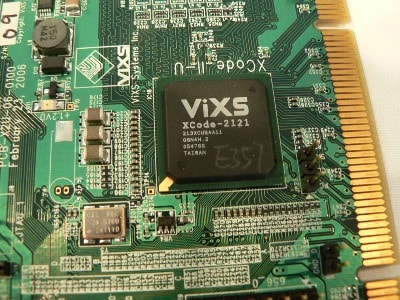

Ofir notes that the story of ViXS over the past few years has been all about its investment into next-gen broadcast technologies. He says the company’s aggressive positioning in next generation video and compression technologies has put it in a “unique leadership position in front of a burgeoning new market opportunity.”

Ultra HD, says Ofir, is the next upgrade cycle for television, and has been supported by the industry as such. ViXS’ System-on-Chip (SoC) solutions, he says, will become increasingly important in the marketplace as Ultra HD become more widespread. He sees a “meaningful level of consumer uptake” taking place soon, perhaps spurred by the upcoming holiday season.

The Clarus analyst thinks ViXS could ultimately own a 10-15% market share in the 4K TV market. Based on industry forecasts, he notes, this could translate into $55-80 million in revenue per year by 2016.

Ofir notes that since going public ViXS has declined more than 50%. While he acknowledges that the company has underperformed against financial expectations, he thinks the culprit is legacy revenues, which have declined at a faster rate than expected.

Ofir says his target price based on 12x his estimate of ViXS’ 2016 EPS.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.