Shares of Keek, which competes in the space and demographic occupied by Vine and SnapChat, have fallen in half since going public earlier this year.Social media player Keek (TSXV:KEK) hasn’t exactly lit it up since its public debut some months ago, but one insider clearly thinks current prices of the stock are a bargain.

Pinetree Capital CEO Sheldon Inwentash, personally and through his firm, have been buying up shares of Keek in the open market. On June 17th, both bought 564,500 shares at $0.136 and topped that on June 19th with the purchase 1.25-million shares each at $0.166. Other, smaller buys were dotted around those large purchases.

On June 12th, Keek made its third recent senior appointment in the form gaming veteran Jamie King, who will take on the role of Chief Product Officer. The company has cleaned house, with a new CEO, Alexandra Cameron, and CMO, Lin Dai. Keek went public through a reverse-merger in January with a company called Primary Petroleum. Shares of Keek, which competes in the space and demographic occupied by Vine and SnapChat, have been halved in the time since.

_____________

GUESS WHO?

This Vancouver-based company has developed patented technology that has caught the eye of food giants such as Kellogg, Hormel and Sun Maid. This Cantech sponsor is now entering full commercialization. Click here to find out who this is….

______________

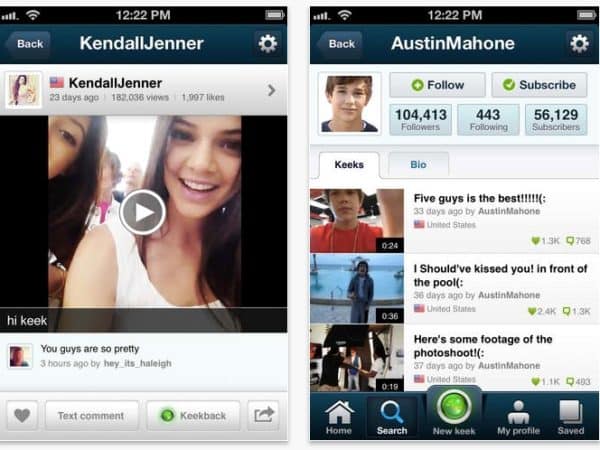

Keek, which was founded in 2011 and has been described as video version of Twitter, is best known among the teen-set and its most famous users include names best known to them, such as Kim Kardashian, singer Jesse McCartney, reality star Kendall Jenner and singer Austin Mahone. The company, which has raised more than $30-million to date, boast 66-million users worldwide.

At press time, shares of Keek were even at $0.15.

_

Comment

One thought on “Keek sees insider buying from Inwentash, Pinetree”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Someone already beat you to it:

http://seekingalpha.com/instablog/1107010-edward-vranic-cfa/3016133-keek-heavy-buying-from-pinetree-capital