Three Things Canadian Tech CEOs Should be Doing Right Now

A version of this report was last published as the Caseridge TechSys DealBook in 2010. Since then we have been experiencing a very strange financial climate. Over the last five years, under the weight of stimulus and the imposition of previously unrivaled market intervention and regulation, markets have lost their allure as a mechanism for efficient price discovery.

The New York Times noted recently that the S&P 500 never once dropped below its December 31, 2011 closing price throughout all of 2012. This index also didn’t drop below its closing price on December 31, 2012 throughout all of 2013. This hasn’t happened since 1975-76 in the aftermath of the termination of the Bretton Woods Agreement in 1971. The recurrence of a similar phenomenon after a similar length of time following a monumental market event (the credit crisis in 2008) is certainly worth noting.

Will this period of good results continue into 2014? It is exceedingly difficult to predict the future direction of prices given the aggressiveness of national governments in using market intervention to influence prices. We do know however that the trend identified by the New York Times won’t be repeated in 2014. The S&P 500 was down in the first week of 2014 for the first time since 2008.

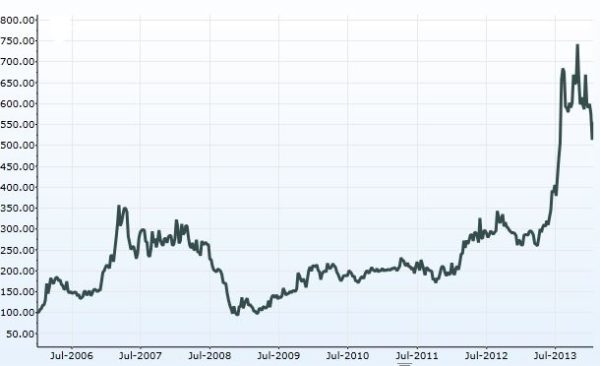

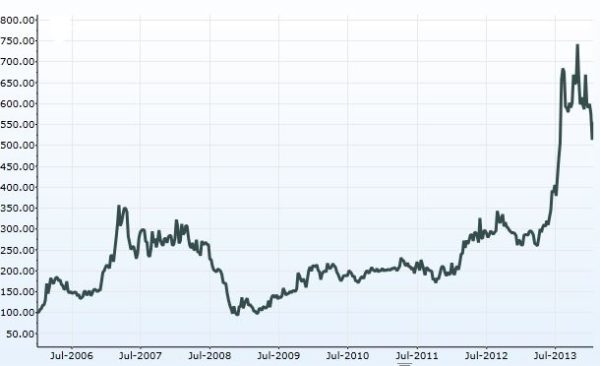

If the market is moving from a period of ‘lighter–than-air’ gains (as the New York Times put it) to a period of ‘more interesting times’ what does this mean for the corporate clients that are the primary constituency of this report? To track things from a Canadian perspective we developed the EPC Operating Company Index. This is a 250-company equal-weighted index of Canadian (or Canadian-listed) companies that we will use to track activity in the Knowledge, Innovation and Growth sectors. It is a Canadian mid-cap index with an equal-weighted average market capitalization of $275MM. The EPC Operating Company Index has gained 500% since January 2006. It has increased by over 130% over the last two years.

In the attached report I outline three things that I think executives and their boards should be doing right now. I will also introduce you to a new method of valuing growth stocks called the Gross Margin Model (“GMM”). We will apply this model to our broad 250-company Canadian Operating Company Index to see how it stacks up and to our GMM Company Index, a set of companies with attractive valuations under this model. We will also review the performance of the Canadian tech sector in 2013 and look forward to the outlook in 2014.

Here is the full report.

Adam Adamou

Writer