My 2014 Top Picks are TELUS and DHX Media.

My 2014 Top Picks are TELUS and DHX Media.

These Picks Reflect Bullish Views on Wireless and Content Plus Clear Record of Strong Execution and Shareholder Value Gains

We believe valuations are relatively attractive and forecasts relatively conservative. We are prudently not relying on either a declining yield curve or narrowing spreads to drive ahead equities. Our forecast returns are FCF driven with price targets largely reflecting current valuations rolled ahead one year with the benefit of debt repayment, share repurchases, and dividend yield returns. Looking at operating fundamentals, we see continued pricing discipline and intense new subscriber competition on wireline while we believe wireless expectations are modest across our telecom coverage. Turning to our content coverage, we see continued strong demand driven by the growth and competitive dynamics of OTTPs, network and premium channel broadcasters.

From a bottom up perspective, our overweight view is consistent with the challenge we had selecting our top picks. We elected to go with two proven outperformers where their risk/return profile put them marginally ahead of our top challengers. We actually forecast higher returns for both Cogeco Cable and Quebecor; however, we went with two lower risk and more broadly held stocks with TELUS and DHX Media.

Top Picks – Poised to Outperform

TELUS Corporation (TSX:T), $37.37, BUY, PT $43 ↑$1, TR 18.9%)

We believe that wireless forecasts and expectations are outdated based on subscriber forecasts and tough ARPU assumptions. We look for forecasts/expectations to be upwardly biased by a move to average revenue per account (ARPA) driven forecasts together with significantly higher wireless data forecasts updated for consideration of contributions from factors such as machine-to-machine (M2M) and sponsored data. We see our five-year wireless revenue/EBITDA CAGRs upgraded versus our current 5.7%/7.0% forecasts. Wireless represents 66% of our forecast 2014 EBITDA. While wireline prospects are maturing, competitive dynamics are improving and the Company’s relative consumer proposition is bolstered by its wireless bundling capabilities. Strong execution at the operating level has been married with equally strong shareholder focused moves, buying back $1B or 4.8% of shares in 2013, while advancing the dividend by 36% in the last three years. The Company’s objective of increasing its dividend rate by 10% and repurchasing $500M worth of its outstanding shares annually through 2016 adds to its defensive profile. Our baseline wireless forecasts support five-year EBITDA/FCF CAGRS at 5.1%/11.6%. Our PT reflects 7.3x 2015 EV/EBITDA, ahead modestly from the current 7.1x 2014 EV/EBITDA. Shareholder objectives and subsequent delivery warrant a modest premium.

DHX Media (TSX:DHX), $5.41, BUY, PT $6.25, TR 16.4%)

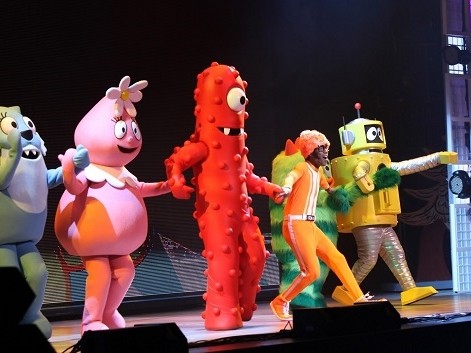

We are sticking with a longstanding favourite in DHX Media, recognizing its impressive 222% return during 2013. We remain bullish on content and children’s animation in particular. Notwithstanding the recent US Court ruling against net neutrality, we see sustained competition between legacy broadcasters and over-the-top-providers (OTTPs) driving ahead content prices with children’s animation leading the way with an extended cycle given its global appeal. Management has successfully completed three paradigm advancing acquisitions across Cookie Jar Entertainment (CJE) ($111M, FQ113), Ragdoll ($28M, FQ114), and most recently The Family Channel ($170M, FQ214). The scale, reach, and relationships acquired en-route leave the Company in an advantaged position where large content companies are better positioned to benefit from OTTP delivery and are empowered by improved acquisition economics (both revenue and cost synergies). We still struggle to find a better business model than the content model where advances pre-pay 90%+ of production costs in exchange for finite rights across a minority subset of the market (Canada, UK). The low net-cost content is then available for sale, distribution, and potentially, merchandising economics. Currently valued at 11.0x/10.6x F2014/15 EV/EBITDA, our $6.25 PT reflects 11.9x/10.0x F2015/16 EV/EBITDA.

Our Top Picks were Challenged by Strong Contenders!

Quebecor Inc. (TSX:QBR.B), $25.48, STRONG BUY, PT $32, TR 26.0%)

Quebecor Inc. (TSX:QBR.B), $25.48, STRONG BUY, PT $32, TR 26.0%)

We see clear value drivers in Wireless and SME where EBITDA contributions could add $8.00 and $3.15/share in equity value over the next three to five years. The track record speaks volumes for peer leading execution working with a compelling portfolio valued at 6.3x/5.8x 2013/14 EV/EBITDA including 1.0x multiple drag from wireless investments made to date. Our PT conservatively rolls valuations ahead one year while adding 0.5x would add $4.60/share or 19%. New entrant status in the spectrum auction could enable the Company to acquire both in-region and out-of-region spectrum at attractive levels. Additional spectrum could play an attractive role for both direct and wholesale initiatives.

Cogeco Cable Inc. (TSX:CCA), $50.00, STRONG BUY, PT $60, TR 22.4%)

We look for Cogeco Cable’s seemingly distinct assets to work together and in turn drive 20% annual FCF growth between F2013 and F2018. Cogeco Cable’s growth profile will be driven by its $18/share investment in Managed Services with another $9.80 in capex to the area forecast over the next five years. Execution to plan, deleveraging, and the ongoing business mix shift warrant positive revaluation considerations. Trading at 6.2x/5.9x C2013/14 EV/EBITDA, our PT rolls the valuation forward leaving room for positive moves considering a 0.5x move adds $9/share or 18%.

Rogers Communications Inc. (TSX:RCI.B), $47.40, BUY, PT $54 ↑$2, TR 17.6%)

Rogers Communications Inc. (TSX:RCI.B), $47.40, BUY, PT $54 ↑$2, TR 17.6%)

Our baseline wireless forecasts support five-year EBITDA/FCF CAGRs at 4.1%/7.9% with more aggressive wireless scenarios providing further upside. Post roaming headwinds, we see improved momentum. Our PT implies 6.9x 2015 EV/EBITDA, in line with the current forward multiple. While we see potentially greater room for positive revisions relative to TELUS and we support its content exposure, the balance tipped in TELUS’ favour considering its competitive balance and nearer-term wireless momentum. We could see Rogers significantly enhance its spectrum bank through the auction and indirectly through its efforts with Quebecor, Shaw (SJR.B-T, $24.78, HOLD, PT $25), and MTS (MBT-T, $30.13, HOLD, PT $30).

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment