Global Maxfin analyst Ralph Garcea says Espial Group (Espial Group Stock Quote, Chart, News: TSX:ESP) could deliver big returns to investors because its software solutions are in demand from both major TV service providers and Smart TV manufacturers worldwide.

Yesterday, in a research update to clients, Garcea initiated coverage of Espial with a STRONG BUY rating and a $1 target, implying a +156.4% return, based on yesterday’s price.

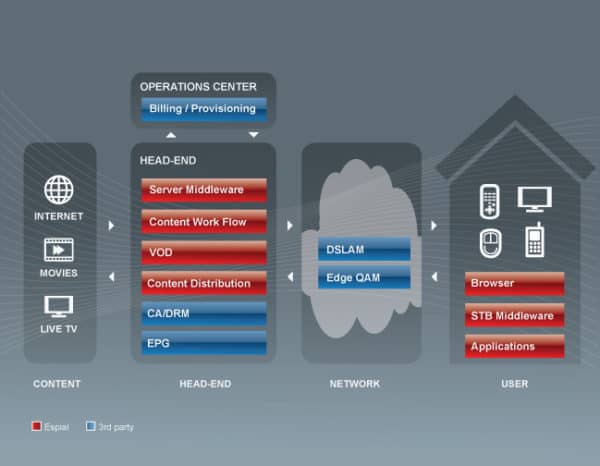

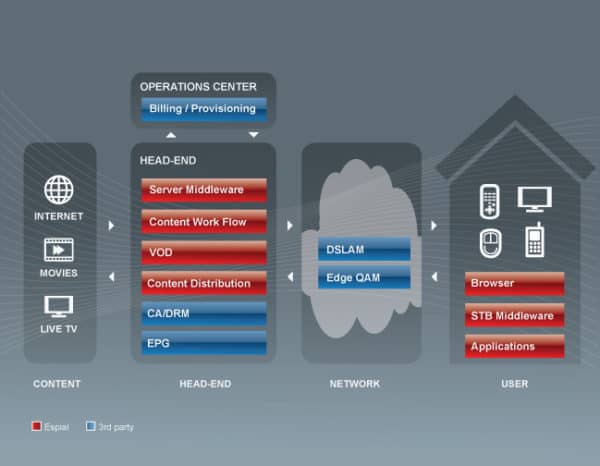

Garcea says Espial, whose platforms facilitate IPTV video services such as video-on-demand and TV web browsing, is starting to make real headway in penetrating the various markets it addresses. The driving force here, he says, is that incumbent cable and telecom companies are looking to save their existing TV businesses. Espial, he notes, has already integrated its software with ten tier-one service providers, and is in discussion with 25 of the 60 global cable and telco service providers.

The company’s business model is to generate revenue from license fees off the top, then book ongoing support and maintenance revenue. Garcea thinks Espial’s revenue will fall 23.7% to $10.13-million in fiscal 2013, but will rebound sharply after that. He thinks the company’s topline will grow 36.3% to $13.81-million in fiscal 2014, and tack on another 18% in the following year, to $16.30-million.

The most recent data available says the market for Espial’s services is growing rapidly, notes the Global Maxfin analyst. Broadband TV News, he points out, says the global IPTV market is expected to grow at a compound annual growth rate of 9.1%. Even more bullishly, Frost and Sullivan says the Smart TV market will grow at 23.2% per year.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment