Expect another strong performance from Descartes Systems Group (Descartes Systems Group Stock Quote, Chart, News: TSX:DSG) tomorrow, says Cantor Fitzgerald analyst Justin Kew.

On Thursday, Descartes will report its Q2, 2014 numbers. The Waterloo-based logistics player is following on a Q1 in which it posted earnings of (U.S.) $2.8-million on revenue of of $34-million, which was a 14% bump from the $29.9-million the company posted in 2013’s first quarter.

Kew says Descartes continued growth is somewhat predictable because the company’s network effect is creating a stronger and stronger pipeline. He say this was illustrated last quarter when the company booked a large license revenue contract for a same-day delivery solution for a large U.S retailer, underscoring its position as a “highly strategic” vendor to world-class companies.

In a research update to clients this morning, Kew maintained his BUY rating and $13.00 one-year target price on Descartes Systems Group.

Kew’s expectations for Descartes’ Q2 are in line with the street’s. He think the company will generate EBITDA of $10.6-million on revenue of $37.4-milion.

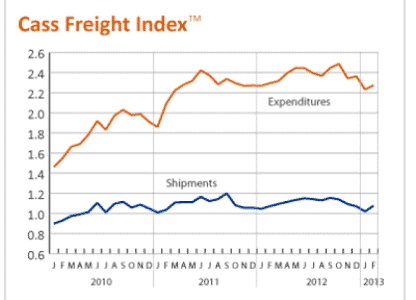

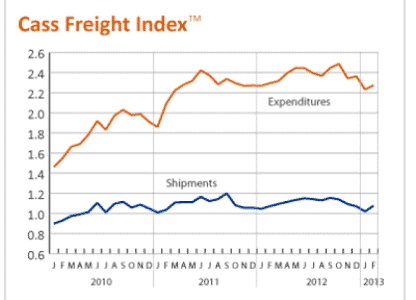

The Cantor Fitzgerald Canada analyst notes that Descartes is growing at at time when industry fundamentals are flat to slightly down. He points out that the Cass Freight Index, a measure of North American freight volumes and expenditures, is down 1.5% year-over-year. Kew says Descartes’s strong recurring revenue base insulates it against macro fluctuations.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment