Clarus initiates coverage of Urthecast with a $3.00 target

Newly public Urthecast (Urthecast Stock Quote, Chart, News: TSXV:UR) is not without risk, but the company has a significant first mover advantage in a potentially lucrative space, says Clarus Securities analyst Eyal Ofir.

Newly public Urthecast (Urthecast Stock Quote, Chart, News: TSXV:UR) is not without risk, but the company has a significant first mover advantage in a potentially lucrative space, says Clarus Securities analyst Eyal Ofir.

On Monday, Ofir initiated coverage of Urthecast with a Speculative Buy rating and a $3.00 one-year price target.

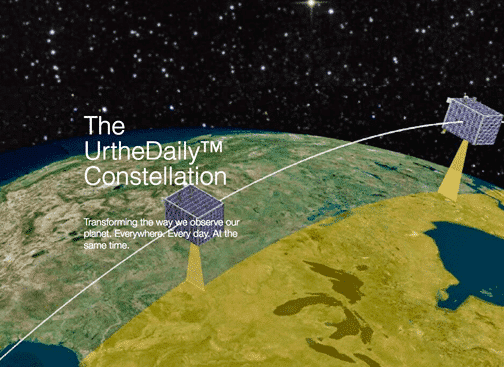

Urthecast recently signed a decade long agreement with Russian aerospace company RSC Energia to place two high-def cameras on the International Space Station. The company is an early entry into the Earth Observation market, a space Ofir says is already worth $2-billion and is set to double by 2020. Urthecast will provide the first-ever streaming HD video delivering live imagery of the planet. He says this opens the company up to business through what might be considered traditional channels, such as defense and government agencies, but also to “broader commercial” markets such as the news media, agriculture and environmental monitoring.

Vancouver-based Urthecast, which was founded in 2010, has already compiled an executive team comprised of senior space industry vets, about $40-million in funding, and letters of intent that will deliver a minimum of $19-million in annual revenue, notes Ofir. He points out that if fully penetrated and converted, the business from these seven distribution partners has the potential to deliver as much as $140-million in annual revenue.

The Clarus analyst says the earth observation business is characterized by its significant barriers to entry. DigitalGlobe (DGI-NYSE) currently holds about 60% of the markets, with a few smaller players sharing the rest. Urthecast’s solution, he says, should be instantly competitive as the company’s multi-frame capture technology will allow it to produce still images at best-in-class resolutions.

At press time, shares of Urthecast were down 2.5% to $1.95.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.