Google satellite deal makes UrtheCast look cheap, says Clarus

A recent deal made by Alphabet makes Canada’s UrtheCast (UrtheCast Stock Quote, Chart, News: TSX:UR) look undervalued, says Clarus Securities analyst Noel Atkinson.

A recent deal made by Alphabet makes Canada’s UrtheCast (UrtheCast Stock Quote, Chart, News: TSX:UR) look undervalued, says Clarus Securities analyst Noel Atkinson.

On February 3, privately-held Planet Inc. announced it would acquire the Terra Bella satellite imagery division of Alphabet (Alphabet Stock Quote, Chart, News: NASDAQ:GOOG) and Alphabet would subsequently enter into a multi-year data purchase agreement.

Atkinson notes that media reports have pegged the price of the acquisition at $300-million, a figure he thinks makes what UrtheCast has attractive.

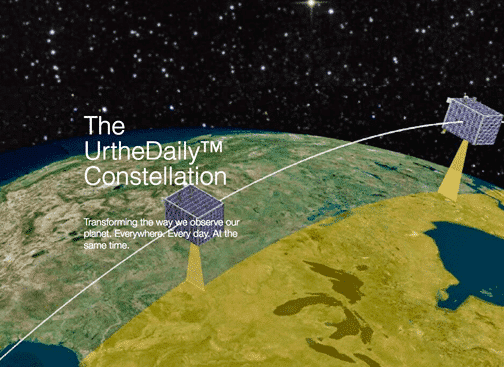

“Our takeaway is that UrtheCast remains very undervalued relative to its existing business, and even more so if you layer on the potential value creation of the OptiSAR and UrtheDaily constellations now under development,” says the analyst. “Planet is paying US$300MM for 7 satellites and a data contract, and presumably the goal is to initiate commercial sales of Terra Bella content. UrtheCast currently has a market cap of C$155MM (US$ 119MM) and we expect the Company’s existing business (Deimos + engineering services) alone to produce $91MM of revenue and nearly $27MM of Adj. EBITDA in 2017.”

In a research update to clients today, Atkinson maintained his “Buy” rating and one-year price target of $4.75 on UR, which closed Friday at $1.48.

Atkinson thinks UrtheCast will post an EBITDA loss of $1.0-million on revenue of $79-million in fiscal 2016. He expects these numbers will improve to positive EBITDA of $24.3-million on a topline of $91.2-million the following year.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.