The so-called “super-cycle” in commodities has been a hot topic, but contrary to a recent report from UBS, the cycle isn’t just over, it never existed, says one fund manager.

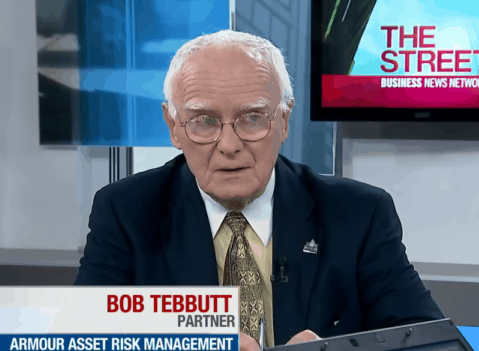

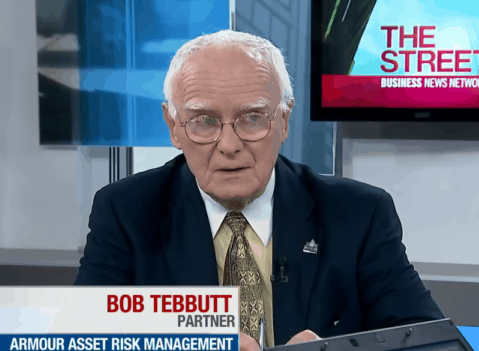

Bob Tebbutt, partner with Armour Asset Risk Management was on BNN’s “The Street” with hosts Saijal Patel and Paul Bagnell today to talk about the UBS report.

Tebbutt says he has been in the business for forty-five years and has seen some super-cycles, but doesn’t think this is one of them. He believes reports about such a phenomenon are inarticulate and simply don’t match what the market has been telling us.

“Take a look at the charts” says Tebbutt. “The market has been basically moving sideways, with a couple exceptions. Gold and silver are both sharply lower. Crude oil has moved sideways for three or four years. The copper market, with a wide range, has moved sideways”.

But Tebbutt says there are areas of commodities he does like.

He sees lumber continuing to rise due to the resurgence of the housing market in the United States. He also likes natural gas but he sees a boost in exports from the U.S. to the rest of the world.

The July 2nd report from London-based UBS strategist Stephane Deo recommended that investors reduce their exposure to commodities, particularly gold.

“Gold will continue to suffer,” said Deo. “After a stellar performance during the past decade, industrial metals have underperformed the stock market since the beginning of the current decade.”

Contrary to Deo’s report, however, Tebbutt says inflation is the next big “black cloud” on the horizon, and that gold and silver will end their “stunning” drop because of it. Tebbutt believes we will begin to see “heavy” inflation in the coming years.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment