Halifax-based DHX Media (DHX Media Stock Quote, Chart, News: TSX:DHX) may soon go from hunter to hunted, says Jacob Securities analyst Sameet Kanade.

Kanade says the DHX, which is now the largest supplier of children’s programming to Netflix, has transformed itself with the several recent acquisitions, including the pickup of privately held Cookie Jar Entertainment for $111 million.

The analyst says the company is now poised for strong earnings growth, driven by increased digital distribution of its considerable library. He says management’s demonstrated ability to manage highly accretive acquisitions presents investors with a unique opportunity to generate significant returns over at least the next eight to ten quarters.

Last Thursday, Kanade initiated coverage of DHX Media with a BUY recommendation and $3.50 target price. This target, he says, implies an EV/EBITDA multiple of 12x his estimate of DHX’s fiscal 2014 earnings.

But will DHX Media be around for investors to reap the benefits of its growth?

The Jacob Securities analyst says industry consolidation remains the dominant theme within the context of the larger market. This, he says, bodes well for continued growth through smaller tuck-in acquisitions for DHX. But Kanade says he expects that on the flip side of the same coin, DHX will soon be acquired by a larger US based competitor.

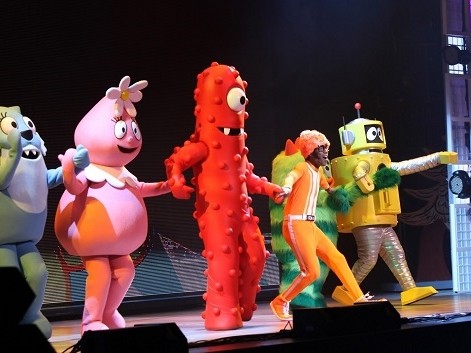

Kanade notes that with the Cookie Jar acquisition, DHX now owns more than 8,500 half-hours of premium programming, including franchises such as Rastamouse, Waybuloo, and Inspector Gadget. This provides a strong library of content that can be refreshed periodically and can enable generation of recurring revenue streams over a period of time. Kanade says that unlike most other genres, children’s programming is resold and refreshed across multiple generations before becoming obsolete. This results in recurring high-margin distribution revenue with a significant long-tail effect and minimal additional cost impact.

At press time, shares of DHX Media were even at $2.75.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment