AEterna Zentaris’s Perifosine still has potential, says Byron analyst Loe

Fertility treatment Cetrotide is currently AEterna Zentaris’s only product on the market, but Byron Capital analyst Douglas Loe says the company’s pipeline is strong, even with a major setback for perifosine earlier this year. Last Tuesday, AEterna Zentaris (TSX:AEZ) reported its Q2, 2012 results. The company earned $4.54-million on revenue of $7.23-million.

AEterna CEO Juergen Engel characterized the quarter: “Unfortunately, the last quarter was marked by unexpected disappointing results for the perifosine phase 3 trial in colorectal cancer.” he said, adding: “Nevertheless, we pushed forward with a strategic plan aimed at refocusing the company’s activities and implementing cost-cutting measures in order to control our burn rate.”

AEterna’s cash and cash equivalents totaled $39.8-million as of June 30th, down from the $46.9-million the company had on December 31st of last year.

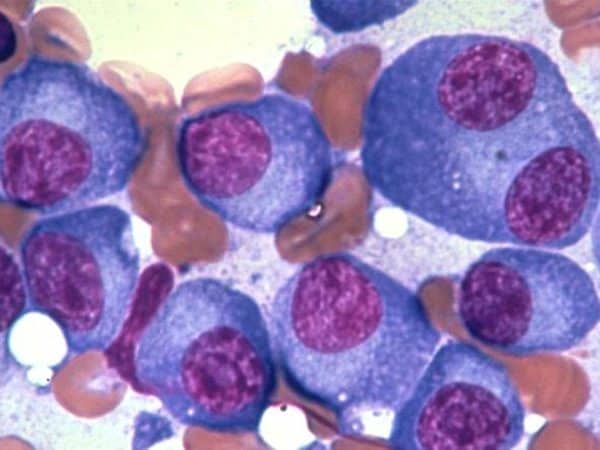

Byron Capital healthcare and biotech analyst Douglas Loe says there were no surprises in AEterna Zentaris’s Q2. Loe says he was, of course, disappointed to see perifosine underperform in the 468-patient advanced colorectal cancer trial X-PECT, in April of this year. However, he says, it isn’t uncommon for anticancer agents to show benefit in one cancer form and not others. And, he points out, medical evidence is available showing PFS benefit in perifosine-treated multiple myeloma patients. In a research update to clients last week, Loe maintained his HOLD rating and (US) $0.75 cent target price.

____________________________

This story is brought to you by Agrimarine (TSXV:FSH). Not all salmon farms are the same. Click here to learn how Agrimarine is meeting consumer demand for sustainable aquaculture.

____________________________

In 2010 and 2011, it looked like AEterna Zentaris was finally on the right track. The company’s stock perked up on the potential of perifosine. In July of 2011, nearly eight years after initially filing, the cancer therapy candidate was granted a patent by the European Patent Office. By the end of that month, the Quebec-based drug maker had completed recruiting 465 patients for its perifosine phase 3 trial for refractory advanced colorectal cancer. And by October, two articles reporting positive phase one and two results perifosine had been published in the October, 2011 on-line issue of the Journal of Clinical Oncology.

But on April 2nd, shareholders of the Quebec-based oncology/endocrinology drug maker had a very bad day. That morning, the company announced that perifosine failed to meet its primary endpoint. On May 7th, partner Keryx returned the rights to the treatment to AEterna Zentaris. Shares of the company fell from $2.14 on March 30th to recent lows under $.40 cents.

Loe says another positive for AEterna Zentaris is that its pipeline looks promising, including AEZS-108, which performed well in a recent 43-patient Phase II advanced endometrial cancer trial.

Shares of AEterna Zentaris on the TSx closed Friday down 5.6% to $.425.

____________________________

______________________________

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.