AEterna Zentaris can still benefit from perifosine, says Byron’s Loe

Beware the Ides of…April and May?

Bad news for shareholders of AEterna Zentaris (TSX:AEZ) has lingered in the days since the company had its worst day ever, two months ago.

On April 2nd, the company announced that its lead offering, perifosine, failed to meet its primary endpoint. That day the stock fell from $2.14 to $.71 cents and has continued to fall, sparking a recent notification from the Nasdaq that its share price fallen below $1 for thirty consecutive business days and, therefore, was not in compliance with Nasdaq marketplace rule 5450(a)(1). The exchange has given the company has until November 12th to regain compliance with the minimum bid price requirement.

_________________________________________________________________________________________________________________________

This story is brought to you by Zecotek Photonics (TSXV:ZMS). As of November 16, 2011, Zecotek owned title to or controlled more than 55 patents and applications. Click here to learn more.

________________________________________________________________________________________________________________________

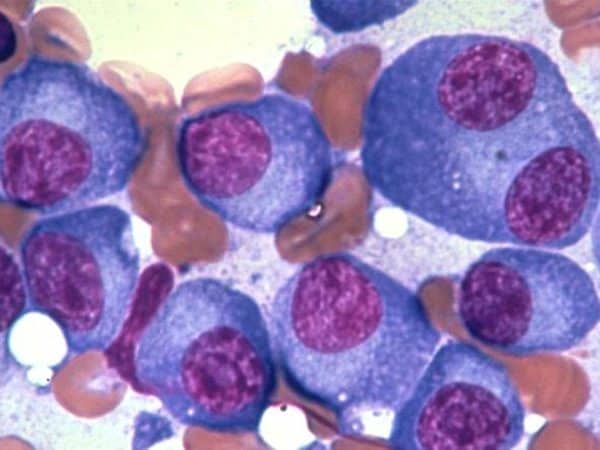

Byron Capital Healthcare analyst Douglas Loe, who slashed his one year target price on AEterna Zentaris to $.75 cents from $3.50 and reduced his rating from BUY to HOLD, says it is no surprise that partner Keryx returned the rights to perifosine, as they did on May 7th. But Loe says the door is not completely closed on the treatment. In a research update to clients recently, Loe said there are “credible mechanistic arguments for why perifosine could work well in combination with standard-of-care proteasome inhibitor drug bortezomib (Velcade) plus steroid dexamethasone.” While he says he doesn’t expect perifosine will be tested in human studies again, he does maintain some optimism for the treatment in an ongoing 450-patient Phase III advanced multiple myeloma study.

Loe says the myeloma data from the Phase Three trial is the next major milestone for AEterna Zentaris, and points out that it is not uncommon for experimental cancer therapies to show benefit in one area while having no effect in others. The Byron Healthcare analyst says he is still “…cautiously optimistic that perifosine could show medical benefit in advanced MM patients despite the recent clinical failure.” Loe notes, however, that while the company now has the exclusive rights to perifosine, the financial risk is much higher because it must now incur all clinical costs. In the research update, Loe maintained his $.75 cent target on AEterna Zentaris.

Share of AEterna Zentaris on the TSX closed Friday down 7.8% to $.48 cents.

_________________________________________________________________________________________________________________________

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.